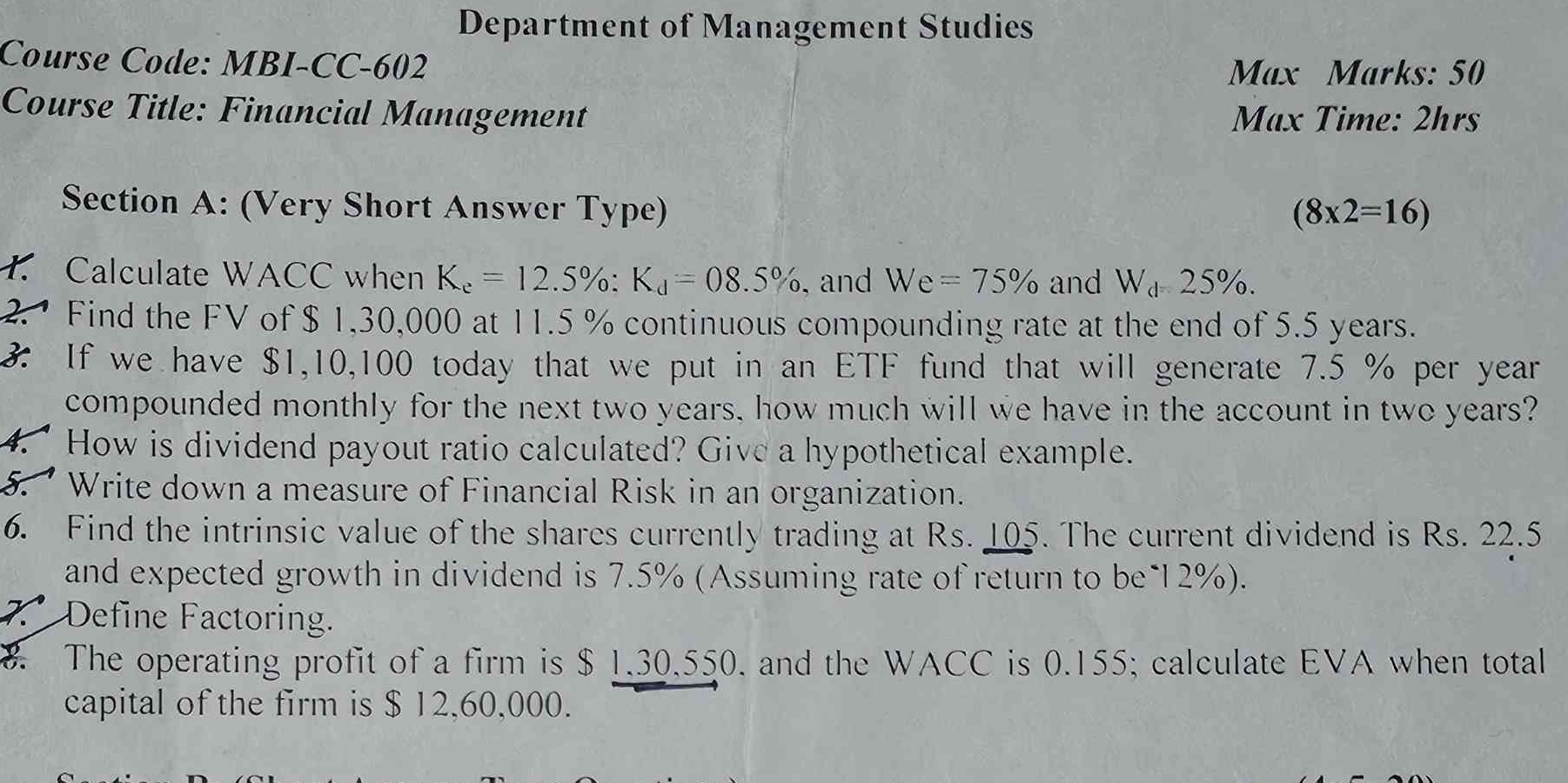

1. Calculate WACC when K_e = 12.5%; K_d = 08.5%; W_e = 75% and W_d = 25%. 2. Find the FV of $130,000 at 11.5% continuous compounding rate at the end of 5.5 years. 3. If we have $11... 1. Calculate WACC when K_e = 12.5%; K_d = 08.5%; W_e = 75% and W_d = 25%. 2. Find the FV of $130,000 at 11.5% continuous compounding rate at the end of 5.5 years. 3. If we have $110,100 today that we put in an ETF fund that will generate 7.5% per year compounded monthly for the next two years, how much will we have in the account in two years? 4. How is dividend payout ratio calculated? Give a hypothetical example. 5. Write down a measure of Financial Risk in an organization. 6. Find the intrinsic value of the shares currently trading at Rs. 105. The current dividend is Rs. 22.5 and expected growth in dividend is 7.5%. (Assuming rate of return to be 12%). 7. Define Factoring. 8. The operating profit of a firm is $130,550, and the WACC is 0.155; calculate EVA when total capital of the firm is $1,260,000.

Understand the Problem

The question consists of multiple short answer type problems related to financial management concepts such as calculating WACC, FV, dividend payout ratio, financial risk, and EVA. Each question requires specific financial calculations or definitions.

Answer

1. WACC = 11.5% 2. FV = $230,356 3. FV = $127,062 4. Dividend Payout Ratio = 25% 5. Financial Risk Measure = Debt-to-Equity Ratio 6. Intrinsic Value = Rs. 537.5 7. Factoring = Selling receivables for cash 8. EVA = -$64,850

Answer for screen readers

- WACC = 11.5%

- FV = $230,356

- FV = $127,062

- Dividend Payout Ratio = 25%

- Financial Risk Measure = Debt-to-Equity Ratio

- Intrinsic Value = Rs. 537.5

- Factoring = Selling receivables for cash

- EVA = -$64,850

Steps to Solve

- Calculate WACC To find the Weighted Average Cost of Capital (WACC), use the formula: $$ WACC = (E/V) \times K_e + (D/V) \times K_d \times (1 - T) $$ Where:

- ( K_e ) = Cost of equity = 12.5%

- ( K_d ) = Cost of debt = 8.5%

- ( E ) = Market value of equity = 75% of total capital

- ( D ) = Market value of debt = 25% of total capital

- ( T ) = Tax rate (not given, assume 0% for simplicity)

Calculating: $$ WACC = (0.75 \times 0.125) + (0.25 \times 0.085) $$ $$ WACC = 0.09375 + 0.02125 = 0.115 $$ or 11.5%

- Find FV using Continuous Compounding To find the future value (FV) with continuous compounding, use the formula: $$ FV = PV \times e^{rt} $$ Where:

- ( PV ) = Present value = $130,000

- ( r ) = interest rate = 11.5% = 0.115

- ( t ) = time in years (noted as 5 years)

Calculating: $$ FV = 130000 \times e^{0.115 \times 5} $$ Using ( e^{0.575} \approx 1.772 $: $$ FV \approx 130000 \times 1.772 = 230356 $$

- Calculate Future Value for ETF fund Using the formula for future value compounded monthly: $$ FV = PV \times (1 + r/n)^{nt} $$ Where:

- ( PV ) = $110100

- ( r ) = 7.5% = 0.075

- ( n ) = number of times the interest is compounded per year = 12

- ( t ) = 2 years

Calculating: $$ FV = 110100 \times (1 + \frac{0.075}{12})^{12 \times 2} $$ Approximate ( FV ) becomes: $$ FV \approx 110100 \times (1.00625)^{24} $$ Using calculator: $$ FV \approx 110100 \times 1.1616 \approx 127,062 $$

-

Calculate Dividend Payout Ratio The dividend payout ratio is calculated as follows: $$ Dividend ; Payout ; Ratio = \frac{Dividends ; Paid}{Net ; Income} $$ Hypothetical example: If a company pays $50,000 in dividends with a net income of $200,000, then: $$ Dividend ; Payout ; Ratio = \frac{50000}{200000} = 0.25 $$ or 25%

-

Measure of Financial Risk A measure of financial risk could be the Debt-to-Equity Ratio: $$ Debt-to-Equity ; Ratio = \frac{Total ; Debt}{Total ; Equity} $$ This indicates the proportion of debt and equity financing used in a company's capital structure.

-

Find Intrinsic Value of Shares Using the formula for intrinsic value of the shares: $$ Intrinsic ; Value = \frac{D_0 \times (1 + g)}{r - g} $$ Where:

- ( D_0 ) = current dividend = 22.5

- ( g ) = growth rate = 7.5% or 0.075

- ( r ) = required return = 12% or 0.12

Calculating: $$ Intrinsic ; Value = \frac{22.5 \times (1 + 0.075)}{0.12 - 0.075} $$ $$ \approx \frac{24.1875}{0.045} \approx 537.5 $$

-

Define Factoring Factoring refers to the process of breaking down an expression into a product of simpler expressions. In finance, it often refers to obtaining cash by selling receivables to a third party (factor) at a discount.

-

Calculate EVA To find the Economic Value Added (EVA): $$ EVA = NOPAT - (WACC \times Capital) $$ Where:

- Operating profit (assumed to be NOPAT) = $130,550

- Capital = $12,60,000

- WACC = 0.155

Calculating: $$ EVA = 130550 - (0.155 \times 1260000) $$ $$ EVA = 130550 - 195300 = -64850 $$

- WACC = 11.5%

- FV = $230,356

- FV = $127,062

- Dividend Payout Ratio = 25%

- Financial Risk Measure = Debt-to-Equity Ratio

- Intrinsic Value = Rs. 537.5

- Factoring = Selling receivables for cash

- EVA = -$64,850

More Information

The calculations provided cover fundamental financial management topics such as WACC, future value with continuous compounding, and economic value added (EVA). Understanding these concepts is crucial for assessing investment opportunities and financial health.

Tips

- Misapplying formulas, especially WACC without considering the tax rate.

- Not converting interest rates into decimal form.

- Forgetting to use the correct time period when calculating future value with monthly compounding.

AI-generated content may contain errors. Please verify critical information