Podcast

Questions and Answers

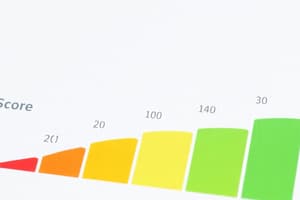

What is the range of FICO credit scores?

What is the range of FICO credit scores?

- $200$ to $900$

- $100$ to $1000$

- $0$ to $800$

- $300$ to $850$ (correct)

What factors are considered in determining a credit score?

What factors are considered in determining a credit score?

- Geographic location, marital status, race

- Political affiliation, criminal record, social media activity

- Number of accounts, total debt levels, repayment history (correct)

- Employment history, income level, age

What do lenders use credit scores for?

What do lenders use credit scores for?

- To assess an individual's net worth

- To evaluate creditworthiness and likelihood of loan repayment (correct)

- To verify an individual's identity

- To determine eligibility for employment

Which of the following is NOT one of the three major credit bureaus in the U.S.?

Which of the following is NOT one of the three major credit bureaus in the U.S.?

What do the three major credit bureaus primarily do?

What do the three major credit bureaus primarily do?

What percentage of a credit score is based on payment history?

What percentage of a credit score is based on payment history?

Which of the following can help you get a lower interest rate on a loan?

Which of the following can help you get a lower interest rate on a loan?

What is the main purpose of credit scores for lenders?

What is the main purpose of credit scores for lenders?

Which of the following credit score ranges is considered excellent?

Which of the following credit score ranges is considered excellent?

What percentage of a credit score is based on the amount of credit used compared to the available credit?

What percentage of a credit score is based on the amount of credit used compared to the available credit?

What is the primary function of the three major credit bureaus in the U.S.?

What is the primary function of the three major credit bureaus in the U.S.?

What is the main advantage of having a longer credit history?

What is the main advantage of having a longer credit history?

Which of the following credit types can contribute to a better credit mix?

Which of the following credit types can contribute to a better credit mix?

What does a lender typically view as a potential sign of credit desperation?

What does a lender typically view as a potential sign of credit desperation?

If you have multiple credit cards that you don't use, what is the recommended approach?

If you have multiple credit cards that you don't use, what is the recommended approach?

What is the primary difference between VantageScore and FICO Score?

What is the primary difference between VantageScore and FICO Score?

What is the recommended approach for checking on unused credit cards to prevent fraud?

What is the recommended approach for checking on unused credit cards to prevent fraud?

Flashcards are hidden until you start studying