Podcast

Questions and Answers

Which action would NOT directly improve your credit score?

Which action would NOT directly improve your credit score?

- Negotiating with creditors to address late payments.

- Consistently making payments at the beginning of the month.

- Requesting a higher credit limit on existing credit cards without increasing spending. (correct)

- Checking credit reports annually for inaccuracies and disputing them.

A person has a credit card with a $5,000 limit and a current balance of $2,000. To optimize their credit score, what should they do?

A person has a credit card with a $5,000 limit and a current balance of $2,000. To optimize their credit score, what should they do?

- Transfer the balance to another credit card with a lower interest rate, regardless of the limit.

- Charge an additional \$2,500 to maximize rewards before paying it off.

- Wait for the billing cycle to end and then pay the minimum payment.

- Make several small payments throughout the billing cycle to keep the balance low. (correct)

What is the primary difference between using a credit card and a debit card for purchases?

What is the primary difference between using a credit card and a debit card for purchases?

- Debit cards offer better fraud protection than credit cards.

- Debit cards typically have higher interest rates compared to credit cards.

- Credit cards use the cardholder's own funds directly from their checking account.

- Credit cards provide a line of credit from the credit card company, while debit cards use the cardholder's own funds. (correct)

Which of the following is the most significant consequence of only paying the minimum payment on a credit card each month?

Which of the following is the most significant consequence of only paying the minimum payment on a credit card each month?

Which scenario would have the most negative impact on your credit score?

Which scenario would have the most negative impact on your credit score?

How do 'hard' and 'soft' inquiries differ in their impact on your credit score?

How do 'hard' and 'soft' inquiries differ in their impact on your credit score?

An individual has the following debts: Credit Card A ($500 balance, 18% APR), Credit Card B ($1,000 balance, 22% APR), and a personal loan ($2,000 balance, 12% APR). Using the 'avalanche' method, which debt should they prioritize paying off first?

An individual has the following debts: Credit Card A ($500 balance, 18% APR), Credit Card B ($1,000 balance, 22% APR), and a personal loan ($2,000 balance, 12% APR). Using the 'avalanche' method, which debt should they prioritize paying off first?

An individual is pre-approved for a $300,000 mortgage. What does this pre-approval signify?

An individual is pre-approved for a $300,000 mortgage. What does this pre-approval signify?

When buying a home, who typically pays the buyer's agent's commission?

When buying a home, who typically pays the buyer's agent's commission?

What is the purpose of an escalation clause in a home offer?

What is the purpose of an escalation clause in a home offer?

During the home buying due diligence phase, what is the primary purpose of an appraisal?

During the home buying due diligence phase, what is the primary purpose of an appraisal?

What is the Loan to Value (LTV) ratio and how is it calculated?

What is the Loan to Value (LTV) ratio and how is it calculated?

What is the primary function of an escrow account in the context of homeownership?

What is the primary function of an escrow account in the context of homeownership?

What is Private Mortgage Insurance (PMI), and when is it typically required?

What is Private Mortgage Insurance (PMI), and when is it typically required?

What is the main purpose of first-time home buyer programs?

What is the main purpose of first-time home buyer programs?

Why might a homeowner consider refinancing their mortgage?

Why might a homeowner consider refinancing their mortgage?

What is the purpose of tax withholding from your paycheck?

What is the purpose of tax withholding from your paycheck?

What taxes are included within FICA (Federal Insurance Contributions Act)?

What taxes are included within FICA (Federal Insurance Contributions Act)?

Approximately what percentage of your income do both the employer AND employee pay towards FICA taxes?

Approximately what percentage of your income do both the employer AND employee pay towards FICA taxes?

Will contributing to a Traditional 401(k) reduce FICA taxes?

Will contributing to a Traditional 401(k) reduce FICA taxes?

What age is considered the Full Retirement Age (FRA) for Social Security for many individuals?

What age is considered the Full Retirement Age (FRA) for Social Security for many individuals?

An individual passes away. Which social security benefit could their family receive?

An individual passes away. Which social security benefit could their family receive?

Generally, which income group receives a larger portion of their taxed Social Security income back when they are receiving benefits?

Generally, which income group receives a larger portion of their taxed Social Security income back when they are receiving benefits?

What is the minimum number of quarters of work needed to be considered to have 'Full Coverage' under Social Security?

What is the minimum number of quarters of work needed to be considered to have 'Full Coverage' under Social Security?

According to the 'Benefit Breakeven' rule of thumb, if you believe you will live until at least age 80, what age should you consider beginning to receive social security?

According to the 'Benefit Breakeven' rule of thumb, if you believe you will live until at least age 80, what age should you consider beginning to receive social security?

Flashcards

Credit reporting agencies

Credit reporting agencies

Equifax, TransUnion, and Experian.

FICO Score

FICO Score

A numerical representation of your creditworthiness, used by lenders to assess risk.

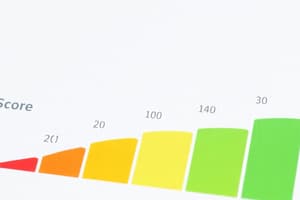

Good FICO Score

Good FICO Score

A FICO score ranging from 700 to 850.

Bad FICO Score

Bad FICO Score

Signup and view all the flashcards

Payment History

Payment History

Signup and view all the flashcards

Credit Utilization

Credit Utilization

Signup and view all the flashcards

Hard Inquiry

Hard Inquiry

Signup and view all the flashcards

Soft Inquiry

Soft Inquiry

Signup and view all the flashcards

Improve Credit Score

Improve Credit Score

Signup and view all the flashcards

Grace Period

Grace Period

Signup and view all the flashcards

Credit Utilization Target

Credit Utilization Target

Signup and view all the flashcards

Credit card late fees

Credit card late fees

Signup and view all the flashcards

Impact of Late Payments

Impact of Late Payments

Signup and view all the flashcards

Minimum Payment

Minimum Payment

Signup and view all the flashcards

Worse Late Payment

Worse Late Payment

Signup and view all the flashcards

Debit Card

Debit Card

Signup and view all the flashcards

Credit Card Funds

Credit Card Funds

Signup and view all the flashcards

Credit Card Advantage

Credit Card Advantage

Signup and view all the flashcards

Credit Card Points

Credit Card Points

Signup and view all the flashcards

Lower Lifetime Interest

Lower Lifetime Interest

Signup and view all the flashcards

Mortgage Principal

Mortgage Principal

Signup and view all the flashcards

Variable Rate (Mortgage)

Variable Rate (Mortgage)

Signup and view all the flashcards

Debt Snowball Method

Debt Snowball Method

Signup and view all the flashcards

Pre-approval

Pre-approval

Signup and view all the flashcards

Buying Agent

Buying Agent

Signup and view all the flashcards

Study Notes

Credit Scores

- Credit scores are determined by agencies like Equifax, TransUnion, and Experian.

- Lenders use FICO scores because they are less subjective than other evaluation methods.

- A good FICO score ranges from 700 to 850, while a bad score ranges from 300 to 650.

FICO Score Breakdown

- Payment history is the largest factor in determining your FICO score.

- Credit utilization is calculated by dividing the amount of credit used by the total credit limit on all revolving credit accounts.

- A hard inquiry occurs when applying for credit (e.g., buying a home) and can negatively affect your credit score.

- A soft inquiry occurs when checking your own credit score or during a background check and does not affect your credit score.

Improving Credit Score

- Potential ways to improve your credit score include communicating with creditors to negotiate late payments.

- Have payments reported to credit agencies and regularly check credit reports for accuracy.

- Making payments at the beginning of the month or when you get paid can help improve your score.

- There is no substitute for disciplined financial behavior when it comes to maintaining a good credit score.

- You are entitled to one free credit report per year, but it may not include your FICO score.

- Some credit card companies provide FICO score information to their customers.

Credit Cards

- Each purchase made with a credit card results in a small debt.

- The billing cycle is important for understanding when balances are reported to credit agencies, which occurs at the end of the billing cycle before the grace period.

- The grace period is typically 21-25 days after the billing cycle ends, during which no interest is charged if the balance is paid in full.

- To improve your credit score, aim to keep credit utilization under 29% and make payments throughout the billing cycle.

Consequences of Not Paying in Full

- Late fees can range from $20 to $50.

- Interest rates on unpaid balances can be 15-30% annualized.

- Not paying in full can decrease your credit score, with credit card companies typically reporting after 30 days.

Minimum Payment

- Making the minimum payment avoids late fees and prevents a decrease in credit score.

- A 90-day late payment has a greater negative impact on your credit score than a 30-day late payment.

Credit Card vs. Debit Card

- Debit cards are linked directly to your checking account, while credit cards involve borrowing the credit card company's money.

- With debit cards, you are using your own money, while with credit cards, you are using the credit card company's money.

- Credit cards offer fraud protection, ensuring money won't leave your account, while debit cards typically don't have the same level of protection.

Credit Card Points/Rewards

- Understand the conversion rates from money spent to rewards given.

- Two main types: rewards based on spending and sign-on bonuses.

- Some cards offer more points/rewards for spending in certain categories.

Debt

- Common types of debt include home loans, personal loans, auto loans, credit cards, and student loans.

Home Mortgage

- For mortgage loan terms (15 vs. 30 year): the 15 year has a higher interest rate and less interest over the life of the loan than the 30 year, but higher monthly payments.

Loan Amortization

- Focus on the interest portion of loan amortization, specifically understanding how much you would pay in interest in a given month based on interest rate, balance, and payment amount.

- The amount going towards the principal is the payment amount minus the interest (Payment – Interest = Amount that pays down debt or principle).

Fixed vs. Variable Rate

- Variable interest rates are typically lower due to the risk involved, while fixed rates offer security against rate increases.

- Adjustable Rate Mortgage (ARM) involves paying a fixed rate for a set period, after which the rate adjusts annually.

Auto Loans

- Auto loans typically range from 3-7 years.

- Cars depreciate quickly and have higher interest rates compared to mortgages.

- Auto loans can be obtained from banks, credit unions, or dealerships with "financing available."

Student Loans

- Student loans offer a 6-month grace period after graduation, dropping below half-time enrollment, or dropout before payments begin.

- Federal loan amortization is typically 10 years, while private loans range from 5 to 20 years.

- Consider student loans as an investment and evaluate the return on investment, especially for graduate school.

- Repayment options include standard repayment, public service loan forgiveness, and income-based repayment.

- Forbearance is available upon request from your provider.

Personal Loans

- Personal loans are not backed by collateral and are used for various purposes like moving, weddings, or emergencies.

- Personal loan interest rates are generally higher than those of secured loans.

Debt Repayment Strategies

- Snowball method focuses on paying off the smallest balance first and then working up to larger balances.

- Avalanche method prioritizes paying off the debt with the highest interest rate first, resulting in less overall interest paid.

Buying a Home

- "Pre-approval" involves a bank analyzing your assets, income, and debt to determine a maximum home purchase amount.

- Pre-approval does not guarantee loan approval.

- The pre-approved amount may not always align with your budget.

Buying Agent

- Buyers typically do not pay a buying agent; the seller pays 3% to both their own agent and the buyer's agent.

- Buying agents assist in finding homes, negotiating offers, and writing offers.

- The seller of the home pays the buying agent.

Factors to Consider When Looking for a Home

- Factors to consider include size, schools nearby, price, and location.

Offer

- An escalation clause is a provision in an offer that automatically increases the offer by a set amount (e.g., $500) when a higher offer is made, up to a specified maximum (e.g., $625,000).

Due Diligence

- An inspection involves a non-invasive examination of the home by an independent party to identify issues.

- An appraisal is a valuation of the home by an independent third party.

Loan to Value

- Understand the relationship between appraisal, purchase price, and loan amount, and how much you have to pay out of pocket.

Closing

- Closing costs typically range from 3-5% of the home's value.

Escrow

- Escrow involves making monthly payments that are used to cover property taxes and insurance premiums when they are due.

- Property tax payments are typically due semi-annually.

- Escrow manages these payments on your behalf using your monthly payments.

Down Payment

- The down payment is the amount you pay at the closing of the home purchase.

- Down payments are typically around 5-20% of the home's value, depending on the loan amount.

Private Mortgage Insurance (PMI)

- PMI is a monthly fee paid if the loan is 80% or more of the home's value, typically 0.5-1% extra percentage interest on your loan.

- Once the loan value reaches 80% of the original value, you can request to stop PMI payments.

First-Time Home Buyer Programs

- These programs can assist with down payments, closing costs, loan acceptance, and grants.

Home Warranty

- A home warranty involves paying a monthly premium to cover certain home repairs, often with a one-time fee for the initial service call.

Refinancing

- If interest rates decrease, refinancing your home loan may be an option, but consider the associated costs to determine if it's worthwhile.

Paystubs and Social Security

- Tax withholding is the amount of money the government keeps from your income until you file your taxes.

- Tax withholding started during World War II.

- It is possible to adjust your withholding amount, subject to a minimum amount determined during onboarding.

FICA Taxes

- FICA taxes are also known as payroll taxes.

- FICA taxes consist of Social Security (6.2% paid by both employer and employee) and Medicare (1.45% paid by both employer and employee).

- The employee and employer each pay 7.65% in FICA taxes.

- Deductible retirement savings (Traditional IRA/401(k)) do not reduce FICA taxes.

Social Security

- Women generally have a longer life expectancy than men.

- President Franklin D. Roosevelt signed Social Security into law.

- Key ages for Social Security: 67 is the Full Retirement Age (FRA), 62 is the earliest age to receive benefits, and 70 is the latest age to wait to receive benefits.

- Social Security benefits are progressive.

- Low-income individuals receive a larger portion of their taxed Social Security income back when receiving benefits compared to high-income individuals.

- "Full Coverage" requires 40 quarters of work history.

- "Currently Insured" requires 6 of the last 13 quarters.

- Other Social Security benefits include disability, survivor's benefits (if a family member dies, you may receive a portion of their benefit), and a death benefit (a lump sum to spouse or kids).

- If you think you’ll die before 80 consider taking it at 62, round 80 consider 67, longer than 80 wait till 70

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.