Podcast

Questions and Answers

You only have one credit score called your FICO.

You only have one credit score called your FICO.

False (B)

FICO stands for Federal Insurance and Credit Operations.

FICO stands for Federal Insurance and Credit Operations.

False (B)

Types of credit used accounts for 10% of your credit score.

Types of credit used accounts for 10% of your credit score.

True (A)

800 is the highest FICO score.

800 is the highest FICO score.

Having better credit should save you money on the principal of loans.

Having better credit should save you money on the principal of loans.

Defaulting on child support payments can impact your credit.

Defaulting on child support payments can impact your credit.

The lower your score, the lower the risk is to lenders.

The lower your score, the lower the risk is to lenders.

Your FICO score determines whether or not you are a 'good' customer.

Your FICO score determines whether or not you are a 'good' customer.

Barry is married; this will impact his credit score.

Barry is married; this will impact his credit score.

Your FICO score changes over time.

Your FICO score changes over time.

Credit Bureau scores are the only scores used.

Credit Bureau scores are the only scores used.

Being unemployed impacts your credit score at all three agencies.

Being unemployed impacts your credit score at all three agencies.

Your score is the same at the three credit reporting agencies.

Your score is the same at the three credit reporting agencies.

Bob is 18; this will impact his credit score.

Bob is 18; this will impact his credit score.

Barbie lives in South Central Los Angeles; this will impact her credit score.

Barbie lives in South Central Los Angeles; this will impact her credit score.

There are four main credit reporting agencies; one of them is Beacon.

There are four main credit reporting agencies; one of them is Beacon.

The higher your credit score, the less you can expect to pay for your loan.

The higher your credit score, the less you can expect to pay for your loan.

Consumer-related inquiries do not impact your credit score.

Consumer-related inquiries do not impact your credit score.

The severity of delinquency, how long past due, matters.

The severity of delinquency, how long past due, matters.

Adverse public records can impact your credit score.

Adverse public records can impact your credit score.

Amounts owed makes up the largest percentage of your credit score.

Amounts owed makes up the largest percentage of your credit score.

Promotional inquiries do not impact your credit score.

Promotional inquiries do not impact your credit score.

Payment history makes up a majority of your credit score.

Payment history makes up a majority of your credit score.

The lowest your credit score can be is 300.

The lowest your credit score can be is 300.

One part of your credit score includes nude credit.

One part of your credit score includes nude credit.

Nigel is purple; this will not impact his credit score.

Nigel is purple; this will not impact his credit score.

Equifax is a credit reporting agency.

Equifax is a credit reporting agency.

Number of past items due does not impact your credit score.

Number of past items due does not impact your credit score.

No one piece of information or factor will determine your credit score.

No one piece of information or factor will determine your credit score.

Leslie is a Chinese Jew; this will impact her credit.

Leslie is a Chinese Jew; this will impact her credit.

Because of credit scores, people can get loans faster and credit decisions are more fair.

Because of credit scores, people can get loans faster and credit decisions are more fair.

One piece of information can hurt your credit score.

One piece of information can hurt your credit score.

Child support payments (ordered by a judge) are part of your credit score.

Child support payments (ordered by a judge) are part of your credit score.

FICO stands for Fair Isaac and Company.

FICO stands for Fair Isaac and Company.

No one has a FICO score over 800 or below 350.

No one has a FICO score over 800 or below 350.

No one has a FICO score over 850 or below 200.

No one has a FICO score over 850 or below 200.

The amount of money you owe and the number of accounts with balances affect your score.

The amount of money you owe and the number of accounts with balances affect your score.

The three main credit reporting agencies are Equifax, Experian, and TransUnion.

The three main credit reporting agencies are Equifax, Experian, and TransUnion.

FICO scores are the only credit bureau scores when it comes to credit.

FICO scores are the only credit bureau scores when it comes to credit.

Credit scores have no impact on how fast you get a loan.

Credit scores have no impact on how fast you get a loan.

No one piece of information or factor alone will determine your score.

No one piece of information or factor alone will determine your score.

You have one FICO score where the report must contain at least one account that updated in the past six months.

You have one FICO score where the report must contain at least one account that updated in the past six months.

The severity of delinquency (how much owed) matters.

The severity of delinquency (how much owed) matters.

Bob is 18; this might impact his ability to get a loan.

Bob is 18; this might impact his ability to get a loan.

Payment history and length of credit history make up a majority of your credit score.

Payment history and length of credit history make up a majority of your credit score.

Flashcards are hidden until you start studying

Study Notes

Credit Score Myths and Facts

- Individuals have multiple credit scores, not just a single FICO score.

- FICO refers to Fair Isaac and Company, not Federal insurance and Credit Operations.

Credit Score Components

- The types of credit used contribute to 10% of your FICO score.

- Payment history is crucial for determining credit scores but does not exclusively dominate the score.

- Amounts owed do not make up the largest percentage of a credit score.

Financial Behavior Impact

- Defaulting on child support payments can negatively impact credit.

- Consumer-related inquiries, such as checking your own credit, do not affect scores.

- The number of past due items influences your credit score.

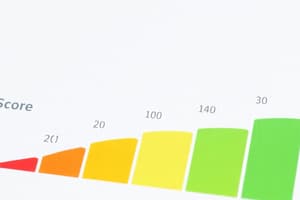

Score Ranges and Changes

- FICO scores range from 300 to 850, contrary to the belief that the maximum is 800 or the minimum is 350.

- The lowest possible credit score is 300, while scores can reach up to 850.

- FICO scores can fluctuate over time based on individual financial behaviors.

Reporting Agencies

- The three main credit reporting agencies are Equifax, Experian, and TransUnion; there are not four major agencies.

- Equifax is confirmed as a credit reporting agency.

Characteristics of Scoring

- No single piece of information determines credit scores; it's a combination of factors.

- The severity and duration of delinquency, along with past due amounts, impact scores.

Miscellaneous Facts

- Personal attributes such as marital status, job occupation, or race do not impact credit scores.

- Child support payments ordered by a judge are not used to calculate credit scores.

- Under government laws, naming a dog "FICO" could misrepresent credit-related services.

General Understanding of Credit

- Better credit should theoretically lead to savings on interest for loans, though it does not lower the principal owed.

- Credit scores influence the speed at which loans can be obtained and aim to promote fairness in lending decisions.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.