Podcast

Questions and Answers

What is the main focus of job order costing?

What is the main focus of job order costing?

- General employee salaries

- Individual jobs (correct)

- Production process

- Factory overhead

Which of the following is an example of a direct expense in job order costing?

Which of the following is an example of a direct expense in job order costing?

- General employee salaries

- Design costs (correct)

- Rent

- Utilities

What section of the income statement typically lists direct expenses?

What section of the income statement typically lists direct expenses?

- Operating Expenses

- Cost of Goods Sold (correct)

- Revenue

- Net Income

Which of the following is considered an indirect expense in job order costing?

Which of the following is considered an indirect expense in job order costing?

How are indirect expenses typically treated in job order costing?

How are indirect expenses typically treated in job order costing?

What is the first step in calculating job order costs?

What is the first step in calculating job order costs?

Which cost is specifically tied to a job in job order costing?

Which cost is specifically tied to a job in job order costing?

Where are direct costs typically listed in the financial statements?

Where are direct costs typically listed in the financial statements?

What distinguishes direct costs from indirect costs in job order costing?

What distinguishes direct costs from indirect costs in job order costing?

Where do indirect expenses like salaries for general employees typically fall in terms of cost allocation?

Where do indirect expenses like salaries for general employees typically fall in terms of cost allocation?

Flashcards are hidden until you start studying

Study Notes

What is Job Order Costing?

Job order costing is a method used in manufacturing and service businesses to allocate resources and expenses to individual jobs. Unlike process costing, where the focus is on the production process itself, job order costing focuses on each unique job produced. This method is particularly useful for companies that produce a wide variety of products or offer customized services.

Direct Expenses

Direct expenses are costs that can be directly attributed to a specific department or job. Examples of direct expenses include design costs, tool maintenance, and equipment purchases. These costs are typically listed under the COGS (Cost of Goods Sold) section in the income statement.

Indirect Expenses

Indirect expenses are those that cannot be directly linked to a specific job or department. Examples of indirect expenses include rent, utilities, and salaries for general employees. These costs are often considered part of the factory overhead and are spread across all jobs.

Calculating Job Order Costs

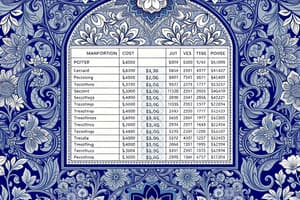

To calculate job order costs, follow these six steps:

-

Identifying the job: Determine the job requirements, such as the type of work, materials needed, labor hours, and estimated completion time.

-

Calculating the costs: Break down the costs into direct and indirect expenses. Direct costs are those that can be specifically tied to the job, while indirect costs are shared among multiple jobs.

-

Choosing the allocation base: Decide how to divide indirect costs among jobs. Common methods include labor hours, machine hours, or direct materials consumed.

-

Receiving the order: Record the actual costs incurred during the execution of the job.

-

During manufacturing: Continuously monitor and record job costs throughout the production process.

-

After manufacturing: Review and revise the cost sheets to finalize the costs for each job.

By following these steps, businesses using the job order costing method can accurately track and allocate their costs, providing valuable insights into the true costs of each job and helping them better manage their resources and pricing strategies.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.