Podcast

Questions and Answers

What does the Income Statement represent in comparison to a Balance Sheet?

What does the Income Statement represent in comparison to a Balance Sheet?

- A timeline of financial activities with a beginning and an end. (correct)

- A snapshot of a business at one point in time.

- A representation of financial growth over a long term.

- A detailed analysis of assets and liabilities.

What is the first element that contributes to generating income in a business as mentioned?

What is the first element that contributes to generating income in a business as mentioned?

- Cost of Goods Sold.

- Sales. (correct)

- Gross Profit.

- Expenses incurred.

What does the term 'Cost of Goods Sold' specifically relate to?

What does the term 'Cost of Goods Sold' specifically relate to?

- All expenses of doing business.

- The cost involved in producing and selling a product. (correct)

- The overall profit made by a company.

- The total income generated from sales.

What is the formula for calculating Gross Profit?

What is the formula for calculating Gross Profit?

Why is it called Gross Profit?

Why is it called Gross Profit?

What is the relation between Sales and Cost of Goods Sold in determining profit?

What is the relation between Sales and Cost of Goods Sold in determining profit?

What does the 'gross' in Gross Profit imply regarding its calculation?

What does the 'gross' in Gross Profit imply regarding its calculation?

What is the purpose of the General Ledger in a business?

What is the purpose of the General Ledger in a business?

What was the total sales amount for the week from the lemonade stand?

What was the total sales amount for the week from the lemonade stand?

How is the available for sale calculated during the week?

How is the available for sale calculated during the week?

When calculating the Cost of Goods Sold, what is subtracted?

When calculating the Cost of Goods Sold, what is subtracted?

What is the mathematical formula to derive the Cost of Goods Sold?

What is the mathematical formula to derive the Cost of Goods Sold?

What do you do with the Cost of Goods Sold amount after calculating it?

What do you do with the Cost of Goods Sold amount after calculating it?

What is the first figure obtained in the income statement before subtracting expenses?

What is the first figure obtained in the income statement before subtracting expenses?

What does the Income Statement primarily provide a detailed breakdown of?

What does the Income Statement primarily provide a detailed breakdown of?

How is Net Profit calculated in relation to Gross Profit?

How is Net Profit calculated in relation to Gross Profit?

What type of statement provides a larger picture of financial performance, including specific details on sales and expenses?

What type of statement provides a larger picture of financial performance, including specific details on sales and expenses?

Why does the principal of a loan not appear on the Income Statement?

Why does the principal of a loan not appear on the Income Statement?

Which financial statement tracks the effect of a loan on cash transactions?

Which financial statement tracks the effect of a loan on cash transactions?

What expense related to a loan would appear on the Income Statement?

What expense related to a loan would appear on the Income Statement?

What is required to present a complete financial picture?

What is required to present a complete financial picture?

Which financial statement reflects the profits made during a specific period of time?

Which financial statement reflects the profits made during a specific period of time?

What is considered Ending Inventory?

What is considered Ending Inventory?

What connects the Beginning and Ending Balance Sheets?

What connects the Beginning and Ending Balance Sheets?

Why does Ending Inventory have value on the Balance Sheet?

Why does Ending Inventory have value on the Balance Sheet?

What does a Beginning Balance Sheet represent?

What does a Beginning Balance Sheet represent?

What must be done with Ending Inventory before calculating Cost of Goods Sold?

What must be done with Ending Inventory before calculating Cost of Goods Sold?

Flashcards are hidden until you start studying

Study Notes

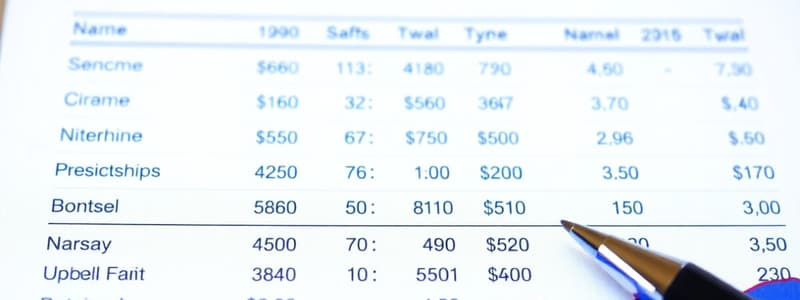

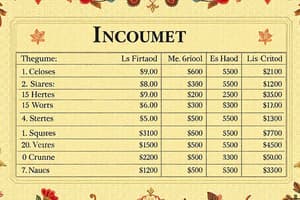

Income Statement

- The Income Statement shows the profit generated by a business over a specific period of time.

- Revenue is represented by sales.

- Expenses are categorized as Cost of Goods Sold (COGS) and other operating expenses.

- COGS represents the direct cost of producing the goods sold.

- The Income Statement starts with sales revenue and then subtracts COGS to arrive at Gross Profit.

- Gross Profit is sales revenue minus COGS.

- Operating expenses are subtracted from Gross Profit to arrive at Net Profit.

- Operating expenses include expenses such as rent, advertising, and utilities.

Relating the Balance Sheet and Income Statement

- The Balance Sheet is like a snapshot in time, showing the financial position of a company at a particular moment.

- The Income Statement is like a movie, tracking the changes in a company's financial position over a period of time.

- The Income Statement helps to explain the changes in Earnings shown on the Balance Sheet.

The Importance of Inventory

- Inventory is goods available for sale.

- Inventory is recorded on both the Balance Sheet and the Income Statement.

- Inventory is recorded as Ending Inventory on the Balance Sheet, which indicates goods that were not sold during the accounting period.

- Cost of Goods Sold on the Income Statement represents the value of goods that were sold during the accounting period.

Cash Flow

- Cash flow is the movement of cash into and out of a business.

- Cash flow is not reflected on either the Balance Sheet or the Income Statement.

- It is important for businesses to track cash flow to ensure they have sufficient funds to meet their financial obligations.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.