Podcast

Questions and Answers

What do you obtain by subtracting the Cost of Goods Sold from Total Sales?

What do you obtain by subtracting the Cost of Goods Sold from Total Sales?

- Gross Profit (correct)

- Operating Income

- Net Profit

- Total Income

When analyzing financial statements, the term Gross Profit reflects what?

When analyzing financial statements, the term Gross Profit reflects what?

- Total Expenses subtracted from Total Sales

- Total Assets minus Liabilities

- Net Profit after all deductions

- Sales minus Cost of Goods Sold (correct)

What outcome occurs after subtracting total Expenses from Gross Profit?

What outcome occurs after subtracting total Expenses from Gross Profit?

- Cost of Goods Sold

- Net Profit (correct)

- Total Revenue

- Operating Margin

What is the primary difference between a Balance Sheet and an Income Statement?

What is the primary difference between a Balance Sheet and an Income Statement?

What does 'Cost of Goods Sold' (COGS) primarily reflect?

What does 'Cost of Goods Sold' (COGS) primarily reflect?

Which term best describes the profits before other business expenses are deducted?

Which term best describes the profits before other business expenses are deducted?

Which of the following best describes the 'sales' line in an Income Statement?

Which of the following best describes the 'sales' line in an Income Statement?

What is represented by the abbreviation COGS in an income statement?

What is represented by the abbreviation COGS in an income statement?

What kind of expenses should be deducted from gross profit to determine net profit?

What kind of expenses should be deducted from gross profit to determine net profit?

Which statement about the Income Statement is correct?

Which statement about the Income Statement is correct?

What is calculated by subtracting Expenses from Gross Profit?

What is calculated by subtracting Expenses from Gross Profit?

Which term is often used interchangeably with Net Profit?

Which term is often used interchangeably with Net Profit?

What formula correctly reflects the relationship between Sales, COGS, Gross Profit, Expenses, and Net Profit?

What formula correctly reflects the relationship between Sales, COGS, Gross Profit, Expenses, and Net Profit?

What is the primary purpose of an Income Statement?

What is the primary purpose of an Income Statement?

Flashcards are hidden until you start studying

Study Notes

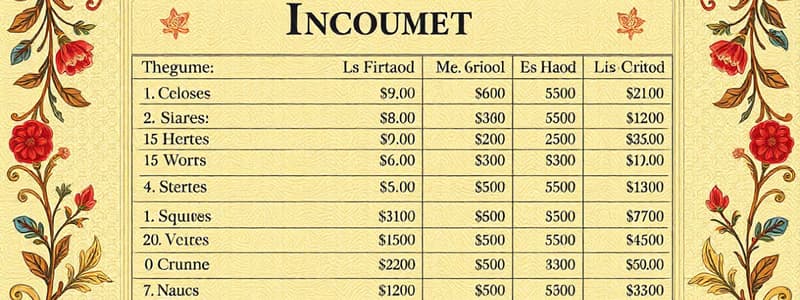

Income Statement - Introduction

- The Income Statement is like a "movie" showing how a business's finances evolve over time.

- It shows income generation from sales.

- Costs are categorized into Cost of Goods Sold (COGS) and Expenses.

Cost of Goods Sold (COGS)

- COGS represents the direct costs associated with creating or obtaining the products sold.

- It only includes costs related to goods produced or acquired for sale.

Gross Profit

- Gross Profit is calculated by subtracting COGS from Sales.

- The word "gross" emphasizes that this profit doesn't include other business expenses.

Expenses

- Expenses are all the costs of running a business other than COGS.

- They include things like rent, advertising, utilities, and salaries.

Net Profit

- Net Profit is the bottom line of the Income Statement.

- It's calculated by subtracting all expenses from Gross Profit.

- Net Profit is also known as Net Income.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.