Podcast

Questions and Answers

Which of the following is not a factor in determining a FICO score?

Which of the following is not a factor in determining a FICO score?

- Taking out a mortgage on the house

- Using credit cards

- Getting a personal loan from a bank

- Paying cash for all purchases (correct)

Which of the following is not a good idea for getting out of debt?

Which of the following is not a good idea for getting out of debt?

- Quit borrowing money

- Get a part-time job or work overtime

- Sell something

- Borrow money from your parents to pay for debt (correct)

Which of the following things cannot be done with a debit card but can be done with a credit card?

Which of the following things cannot be done with a debit card but can be done with a credit card?

- Go into debt (correct)

- Purchase an airline ticket

- Purchase something online

- Rent a car

What factors affect a credit score?

What factors affect a credit score?

Which of the following statements is false?

Which of the following statements is false?

Which of the following is not a recommended step in the Drive Free method of purchasing a car?

Which of the following is not a recommended step in the Drive Free method of purchasing a car?

Which of the following is the most cost-effective option for purchasing a home?

Which of the following is the most cost-effective option for purchasing a home?

Which of the following is not recommended in the debt snowball method of getting out of debt?

Which of the following is not recommended in the debt snowball method of getting out of debt?

What is paycheck garnishment?

What is paycheck garnishment?

Which of the following best summarizes how the use of a credit card for purchases instead of cash can change one's spending behavior?

Which of the following best summarizes how the use of a credit card for purchases instead of cash can change one's spending behavior?

Which of the following is not a credit myth?

Which of the following is not a credit myth?

If you do not have a FICO score, what factors will determine whether or not you qualify for a mortgage?

If you do not have a FICO score, what factors will determine whether or not you qualify for a mortgage?

A credit score is intended to measure...

A credit score is intended to measure...

Which of the following is a sign that your identity may have been stolen?

Which of the following is a sign that your identity may have been stolen?

Individual account information is removed from your credit report seven years after the last activity on the account, except Chapter 7 bankruptcy, which stays on your credit report for...

Individual account information is removed from your credit report seven years after the last activity on the account, except Chapter 7 bankruptcy, which stays on your credit report for...

You must establish credit in order to buy a house.

You must establish credit in order to buy a house.

If you are a victim of identity theft, you are only responsible for paying back half of the debt.

If you are a victim of identity theft, you are only responsible for paying back half of the debt.

There are three credit bureaus: Experian, TransUnion, and Equifax.

There are three credit bureaus: Experian, TransUnion, and Equifax.

You can and should obtain a free copy of your credit report annually to check for any suspicious activity.

You can and should obtain a free copy of your credit report annually to check for any suspicious activity.

You need to have a credit card to rent a car or check in to a hotel.

You need to have a credit card to rent a car or check in to a hotel.

It is okay to use a credit card if you pay it off every month.

It is okay to use a credit card if you pay it off every month.

The Federal Trade Commission is one of many U.S. federal agencies that regulate the consumer credit system and enforce the laws related to it.

The Federal Trade Commission is one of many U.S. federal agencies that regulate the consumer credit system and enforce the laws related to it.

Under the Fair Credit Reporting Act, any person or organization may check a person's credit information without having a legitimate need.

Under the Fair Credit Reporting Act, any person or organization may check a person's credit information without having a legitimate need.

Teens are a huge target of credit card companies today.

Teens are a huge target of credit card companies today.

Co-signing a loan is a good way to help a friend or relative.

Co-signing a loan is a good way to help a friend or relative.

Preferred method of debt repayment includes a list of all debts organized from smallest to largest balance; minimum payments are made to all debts except for the smallest, which is attacked with the largest possible payments.

Preferred method of debt repayment includes a list of all debts organized from smallest to largest balance; minimum payments are made to all debts except for the smallest, which is attacked with the largest possible payments.

A detailed report of an individual's credit history is known as a...

A detailed report of an individual's credit history is known as a...

Time frame that a loan agreement is in force, and before or at the end of which the loan should either be repaid or renegotiated is known as what?

Time frame that a loan agreement is in force, and before or at the end of which the loan should either be repaid or renegotiated is known as what?

Cost of borrowing money on an annual basis; takes into account the interest rate and other related fees on a loan is referred to as...

Cost of borrowing money on an annual basis; takes into account the interest rate and other related fees on a loan is referred to as...

A decrease or loss in value is known as...

A decrease or loss in value is known as...

A yearly fee charged by the credit card company for the convenience of the credit card is called...

A yearly fee charged by the credit card company for the convenience of the credit card is called...

An interest rate charged to a customer during the early stages of a loan, often increasing after a specified period of time is called...

An interest rate charged to a customer during the early stages of a loan, often increasing after a specified period of time is called...

A long-term rental agreement on a car; a form of secured long-term debt is known as a...

A long-term rental agreement on a car; a form of secured long-term debt is known as a...

When a person owes more on an item than it is worth, the person is said to be...

When a person owes more on an item than it is worth, the person is said to be...

A card issued by a bank that allows users to finance a purchase is called a...

A card issued by a bank that allows users to finance a purchase is called a...

Flashcards are hidden until you start studying

Study Notes

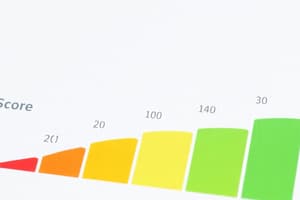

FICO Score and Factors

- FICO score is influenced by multiple factors including payment history, credit utilization, and length of credit history.

- Paying cash for purchases does not contribute to building a FICO score.

Debt Management Strategies

- Effective strategies for getting out of debt include quitting borrowing, seeking additional income, and selling personal items.

- Borrowing money from family to pay off debt is not a recommended practice.

Debit Cards vs. Credit Cards

- Credit cards allow users to incur debt, whereas debit cards do not.

- Renting a car or purchasing items typically requires a credit card rather than a debit card.

Credit Score Factors

- Credit scores are impacted by types of debt, new debt, and the duration of debt.

- All mentioned factors collectively influence the overall credit score.

Fair Credit Reporting Act (FCRA)

- Prior to the FCRA, consumers faced challenges contesting credit report errors.

- The FCRA allows consumers one free credit report annually, contrary to the misconception of every five years.

Car Purchase Strategies

- The Drive Free method advocates for planning car purchases in advance and starting with an affordable car.

- Exploring new car dealerships is not part of the recommended strategies.

Home Financing Options

- The most cost-effective way to purchase a home is through a 15-year fixed-rate mortgage with at least a 10% down payment.

- Options involving a 30-year mortgage generally lead to higher costs.

Debt Snowball Method

- The debt snowball method encourages paying off the smallest debts first and applying those payments to larger debts.

- Prioritizing the largest debt first is not a part of this method.

Paycheck Garnishment

- Paycheck garnishment is a legal mechanism where lenders can collect owed amounts directly from a borrower’s wages.

Spending Behavior with Credit Cards

- Research indicates that consumers tend to spend more when using credit cards instead of cash due to perceived ease and rewards.

Common Credit Myths

- Myths include the idea that gaining a credit card signifies financial success or that debt can be a tool for prosperity.

- Recognizing the serious consequences of borrowing is vital for wealth building.

Alternatives for Mortgage Qualification

- Without a FICO score, mortgage eligibility may rely on rental and utility payment history and the size of the down payment.

Signs of Identity Theft

- Indicators of potential identity theft include receiving debt collection calls for unfamiliar debts and unexpected changes in credit reports.

Reporting Timelines

- Most account information falls off a credit report after seven years, whereas Chapter 7 bankruptcy stays for ten years.

Credit Establishment Misconceptions

- Establishing credit is not mandatory for purchasing a home.

Identity Theft Accountability

- Victims of identity theft are typically responsible for the entirety of the incurred debt.

Existence of Credit Bureaus

- There are three major credit bureaus: Experian, TransUnion, and Equifax.

Annual Credit Report Access

- Consumers are entitled to one free credit report per year to monitor their credit health for potential issues.

Credit Requirements for Rentals and Hotels

- A credit card is not a necessary prerequisite for renting a car or booking a hotel.

Credit Usage

- Using a credit card responsibly can be acceptable if the balance is paid off each month.

Federal Regulation of Credit

- The Federal Trade Commission plays a crucial role in regulating consumer credit laws.

Credit Information Access

- Access to an individual's credit information is restricted to those with legitimate needs only.

Targeting of Teenagers by Credit Companies

- Teenagers represent a significant target market for credit card companies.

Co-signing Loans Risks

- Co-signing loans can have negative financial repercussions for the co-signer.

Definitions

- Debt Snowball: A repayment strategy prioritizing smaller debts first.

- Credit Report: A comprehensive document detailing an individual's credit history.

- Loan Term: The specified duration for a loan agreement.

- Annual Percentage Rate (APR): A combined measure of borrowing costs, including interest and fees.

- Depreciation: A reduction in the value of an asset over time.

- Annual Fee: A recurring charge by credit card companies for card usage.

- Introductory Rate: A temporarily low interest rate for new customers.

- Lease: A long-term agreement for renting an asset, such as a car.

- Upside Down on Loan: A situation where an individual owes more on an item than its current value.

- Credit Card: A financial tool permitting users to borrow money for purchases.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.