Podcast

Questions and Answers

What is the range of FICO credit scores?

What is the range of FICO credit scores?

- 400 to 950

- 200 to 850 (correct)

- 100 to 800

- 300 to 900

Which factor accounts for the largest percentage of a FICO score?

Which factor accounts for the largest percentage of a FICO score?

- Amounts owed

- Length of credit history

- Credit mix

- Payment history (correct)

When was the FICO score developed?

When was the FICO score developed?

- 1995

- 2001

- 1967

- 1989 (correct)

Which category of the FICO score evaluates how long you've had credit accounts?

Which category of the FICO score evaluates how long you've had credit accounts?

Who collaborated with Fair Isaac in developing the FICO score?

Who collaborated with Fair Isaac in developing the FICO score?

Which category of the FICO score assesses how much debt you have relative to your credit limits?

Which category of the FICO score assesses how much debt you have relative to your credit limits?

What percentage of the FICO score does 'new credit' category account for?

What percentage of the FICO score does 'new credit' category account for?

How can closing old credit card accounts impact your FICO score?

How can closing old credit card accounts impact your FICO score?

What action can significantly lower your FICO score?

What action can significantly lower your FICO score?

How can having a diverse mix of credit accounts help improve your FICO score?

How can having a diverse mix of credit accounts help improve your FICO score?

What is the significance of paying bills on time in relation to your FICO score?

What is the significance of paying bills on time in relation to your FICO score?

How do excessive new credit applications affect your FICO score?

How do excessive new credit applications affect your FICO score?

Flashcards are hidden until you start studying

Study Notes

FICO: Understanding Credit Scores and Their Impact

FICO, short for Fair Isaac Corporation, is a well-known name when it comes to assessing an individual's creditworthiness. Their credit scores play a vital role in our financial lives, shaping our access to loans, mortgages, and insurance premiums. To help you better understand FICO and its significance, let's delve into the history and key aspects of FICO credit scores.

Origins of FICO Credit Scores

Fair Isaac Corporation, founded in 1956, revolutionized the credit scoring industry with the development of the FICO score in 1989. The FICO score was born from a collaboration between Fair Isaac and the three major credit reporting agencies: Equifax, Experian, and TransUnion.

How FICO Scores Work

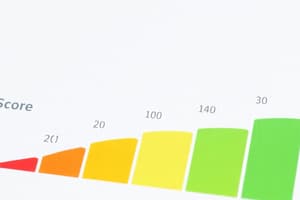

FICO credit scores range from 300 to 850, with higher scores indicating lower credit risk. FICO scores are calculated using the following five categories:

- Payment history: This category accounts for 35% of your FICO score. It reflects how consistently you've paid your bills, including credit cards, loans, and mortgages.

- Amounts owed: This category accounts for 30% of your FICO score. It assesses how much debt you have relative to your credit limits.

- Length of credit history: This category accounts for 15% of your FICO score. It evaluates how long you've had credit accounts and if you've maintained a good payment history over time.

- Credit mix: This category accounts for 10% of your FICO score. It evaluates the types of credit accounts you have, including credit cards, mortgages, and auto loans.

- New credit: This category accounts for 10% of your FICO score. It reflects how many new credit accounts you've opened and when you opened them.

Why FICO Scores Matter

FICO scores are used by lenders and financial institutions to determine the risk of loaning money to an individual. A higher FICO score typically indicates a lower risk and might result in lower interest rates and better loan terms. On the other hand, a lower FICO score could lead to higher interest rates and less favorable loan terms.

Common Misconceptions

- Closing old credit card accounts: While closing old credit card accounts might seem like a good way to improve your credit score, it can negatively impact your FICO score in the long run. The length of credit history is a significant factor in your FICO score, and closing old accounts reduces the average age of your credit accounts.

- Checking your credit report: Checking your own credit report does not negatively impact your FICO score. Pulling your credit report does not trigger the same hard inquiry that a lender's review of your credit report would.

Keeping Your FICO Score Healthy

- Pay bills on time: Make sure you consistently pay your bills on time. Late payments can significantly lower your FICO score.

- Reduce your credit utilization ratio: Aim to use less than 30% of your total available credit on credit cards.

- Maintain a good credit history: Keep your credit accounts open and active, and make sure you've paid them on time.

- Mix your credit types: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can help improve your FICO score.

- Limit new credit applications: Apply for new credit sparingly, as excessive new credit applications can negatively impact your FICO score.

Conclusion

FICO scores play a pivotal role in our financial lives, opening doors to loans, mortgages, and insurance premiums. Understanding the components of a FICO score and how to maintain a healthy one can improve your access to credit and save you money in the long run. By taking a proactive approach to managing your credit, you can build a strong credit score and lay a solid foundation for your financial future.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.