Podcast

Questions and Answers

Hawala banking is known for its slow money transactions due to extensive verification procedures.

Hawala banking is known for its slow money transactions due to extensive verification procedures.

False (B)

In Hawala banking, a lot of paperwork is typically generated for each transaction.

In Hawala banking, a lot of paperwork is typically generated for each transaction.

False (B)

Hawaladars primarily rely on formal financial institutions for transferring funds.

Hawaladars primarily rely on formal financial institutions for transferring funds.

False (B)

The use of informal communication methods like telephone and email can slow down transaction processes in Hawala banking.

The use of informal communication methods like telephone and email can slow down transaction processes in Hawala banking.

Hawala transactions are limited to big cities and do not occur in smaller villages.

Hawala transactions are limited to big cities and do not occur in smaller villages.

Trust and long-term relationships among hawalandars play a crucial role in enabling fast money transactions in Hawala banking.

Trust and long-term relationships among hawalandars play a crucial role in enabling fast money transactions in Hawala banking.

Hawala banking is regulated and requires formal documentation for all transactions.

Hawala banking is regulated and requires formal documentation for all transactions.

Hawalandars can be held accountable if they fail to fulfill their obligations in a hawala transaction.

Hawalandars can be held accountable if they fail to fulfill their obligations in a hawala transaction.

Unregulated hawala systems are not prone to being misused for illegal activities like money laundering.

Unregulated hawala systems are not prone to being misused for illegal activities like money laundering.

The value of money transferred via hawala is not affected by market conditions.

The value of money transferred via hawala is not affected by market conditions.

The 2019 hawala case discussed in the text involved cash payments for exporting agricultural products to West Africa.

The 2019 hawala case discussed in the text involved cash payments for exporting agricultural products to West Africa.

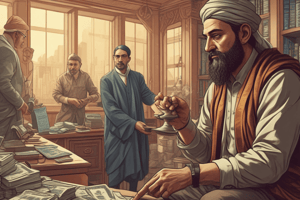

The criminal investigation revealed that Dutch potato and onion traders accepted nearly 200 million euros in cash between 2014 and early 2019.

The criminal investigation revealed that Dutch potato and onion traders accepted nearly 200 million euros in cash between 2014 and early 2019.

The anti-money laundering legislation does not require reporting cash payments above 10,000 euros.

The anti-money laundering legislation does not require reporting cash payments above 10,000 euros.

The investigation showed that money launderers were NOT channeling criminal funds to the Dutch potato and onion sector.

The investigation showed that money launderers were NOT channeling criminal funds to the Dutch potato and onion sector.

Underground banking involves third-party payments that are not related to the actual parties involved in the transaction.

Underground banking involves third-party payments that are not related to the actual parties involved in the transaction.

The drug trafficker in the example could get the money back from the trader in Mauritania through regular banking channels.

The drug trafficker in the example could get the money back from the trader in Mauritania through regular banking channels.