Podcast

Questions and Answers

What is Cash Flow From Assets?

What is Cash Flow From Assets?

(Cash Flow to Creditors + Cash Flow to Stockholders)

What is Cash Flow To Creditors?

What is Cash Flow To Creditors?

(Interest Expense - Net New Borrowings from Creditors)

What is Cash Flow To Stockholders?

What is Cash Flow To Stockholders?

(Dividends - Net new borrowings from Owners)

What is one formula for Cash Flow From Assets?

What is one formula for Cash Flow From Assets?

What is Operating Cash Flow?

What is Operating Cash Flow?

What is Net Capital Spending?

What is Net Capital Spending?

What is Change In Net Working Capital?

What is Change In Net Working Capital?

What is Net Working Capital?

What is Net Working Capital?

Flashcards are hidden until you start studying

Study Notes

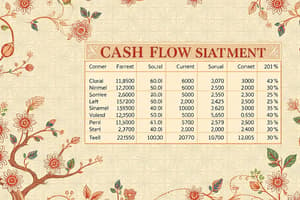

Cash Flow From Assets Overview

- Cash Flow From Assets represents the total cash available to stakeholders, calculated as Cash Flow to Creditors plus Cash Flow to Stockholders.

Cash Flow To Creditors

- Cash Flow To Creditors is determined by subtracting Net New Borrowings from Interest Expense, reflecting the net outflow to lenders.

Cash Flow To Stockholders

- Cash Flow To Stockholders accounts for the cash paid as dividends minus any new equity raised, indicating net cash distribution to owners.

Components of Cash Flow From Assets

- Cash Flow From Assets can be calculated using the formula: Operating Cash Flow minus Net Capital Spending minus Change in Net Working Capital.

Operating Cash Flow

- Operating Cash Flow is derived from EBIT (Earnings Before Interest and Taxes), adding depreciation, and subtracting taxes, representing cash generated from operations.

Net Capital Spending

- Net Capital Spending reflects investment in fixed assets and is calculated as the change in Net Fixed Assets over a period plus depreciation.

Change In Net Working Capital

- Change in Net Working Capital indicates the difference between Ending and Beginning Net Working Capital, affecting liquidity.

Net Working Capital

- Net Working Capital is calculated by subtracting Current Liabilities from Current Assets, emphasizing the operational liquidity available.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.