Podcast

Questions and Answers

Match the following terms with their definitions:

Match the following terms with their definitions:

Assets = Resources owned by an entity Liabilities = Obligations owed to other parties Equity = Ownership interest in an asset Depreciation = Reduction in value of an asset over time

Match the following financial statements with their purposes:

Match the following financial statements with their purposes:

Balance Sheet = Shows financial position at a specific time Cash Flow Statement = Displays how cash flows in and out over a period Income Statement = Provides information on profit or loss over a period Statement of Financial Position = Another term for Balance Sheet

Match the following types of assets with their categories:

Match the following types of assets with their categories:

Current Assets = Assets expected to be converted to cash within a year Long-term Assets = Assets held for more than one year Human Assets = Value derived from employee capabilities Marketable Investments = Financial assets that can be quickly sold

Match the following cash flow activities with their descriptions:

Match the following cash flow activities with their descriptions:

Match the following financial metrics with their calculations:

Match the following financial metrics with their calculations:

Flashcards are hidden until you start studying

Study Notes

Financial Concepts and Statements

- Assets: Resources owned by a business or household that have economic value.

- Balance Sheet: A financial statement showing a company's assets, liabilities, and equity at a specific point in time.

- Capital Expenditures (CapEx): Investments in long-term assets such as property, equipment, or technology to enhance future earning capacity.

- Cash Flow: The net amount of cash being transferred into and out of a business, crucial for maintaining liquidity.

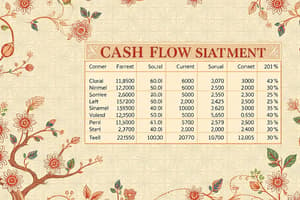

- Cash Flow Statement: A financial statement that outlines the cash inflow and outflow over a specific period, categorized into operating, investing, and financing activities.

- Current Assets: Assets expected to be converted to cash or used up within one year, such as cash, inventory, and accounts receivable.

Asset Management and Depreciation

- Depreciation: The systematic allocation of the cost of a tangible asset over its useful life, reflecting wear and tear.

- Financing Activities: Cash flows related to changes in equity and borrowings, including dividends and loan repayments.

- Functional Cash Flow Statement: Organized cash flow statement differentiating cash flows by function, often used in more detailed analysis.

- Household Assets: Total economic resources owned by a household that contribute to wealth, including properties and investments.

- Household Equity: The net worth of a household, calculated as total assets minus total liabilities, indicating financial health.

Financial Metrics and Cash Flow Types

- Household Net Worth: A comprehensive measure of an individual or family’s financial position, reflecting all assets and liabilities.

- Human Assets: Skills, knowledge, and experience possessed by individuals, contributing to earning potential and economic output.

- Liabilities: Financial obligations or debts that a company or household needs to settle, impacting overall net worth.

- Long-Term Assets: Assets not expected to be liquidated within a year, including property, machinery, and intangible assets.

- Marketable Investments: Financial securities that can be easily sold in the market, providing liquidity.

Cash Flow and Capital Management

- Net Cash Flow: The difference between cash inflows and outflows over a given period, vital for understanding liquidity.

- Net Working Capital: A measure of a company's efficiency and short-term financial health, calculated as current assets minus current liabilities.

- Operating Activities: Cash flows generated from day-to-day business operations, critical for assessing primary revenue-generating activities.

- Pro Forma Statements: Financial statements based on hypothetical scenarios or projections used for planning and decision-making.

- Savings: Funds that are set aside, often in accounts or investments, to be utilized for future purchases or investments.

Types of Cash Flow Statements

- Statement of Cash Flow: Organized report showing how changes in balance sheet accounts and income affect cash and cash equivalents.

- Statement of Financial Position: Another term for a balance sheet, representing financial condition at a specific date.

- Traditional Cash Flow Statement: Standard presentation of cash flow, typically following GAAP guidelines, encompassing operating, investing, and financing activities.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.