Podcast

Questions and Answers

Match the following financial terms with their definitions:

Match the following financial terms with their definitions:

Assets = Resources owned by a company Liabilities = Obligations or debts owed by a company Equity = Ownership interest in a company Cash Flow = Movement of money in and out of a business

Match the following statements to their respective cash flow categories:

Match the following statements to their respective cash flow categories:

Operating Activities = Cash flows from everyday operations Financing Activities = Cash flows related to borrowing and repaying debts Investing Activities = Cash flows from the acquisition and sale of assets Functional Cash Flow = Cash flow categorized by its function within the business

Match the following types of assets with their descriptions:

Match the following types of assets with their descriptions:

Current Assets = Assets expected to be converted into cash within one year Long-term Assets = Assets intended to be held for more than a year Marketable Investments = Investments that can be quickly converted to cash Household Assets = Assets owned by individuals or families

Match the following financial statements with their purposes:

Match the following financial statements with their purposes:

Match the following terms related to household finance:

Match the following terms related to household finance:

Match the following types of cash flow statements with their characteristics:

Match the following types of cash flow statements with their characteristics:

Match the following asset types with their definitions:

Match the following asset types with their definitions:

Match the following terms with their financial concepts:

Match the following terms with their financial concepts:

Match the following household finance terms with their meanings:

Match the following household finance terms with their meanings:

Match the following statements with the relevant financial statements:

Match the following statements with the relevant financial statements:

Match the following terms related to cash flow with their corresponding definitions:

Match the following terms related to cash flow with their corresponding definitions:

Match the following asset types with their characteristics:

Match the following asset types with their characteristics:

Match the following financial concepts with their explanations:

Match the following financial concepts with their explanations:

Match the following statements about financial reports with their purposes:

Match the following statements about financial reports with their purposes:

Match the following terms with their related financial activities:

Match the following terms with their related financial activities:

Flashcards are hidden until you start studying

Study Notes

Financial Fundamentals

- Assets: Resources owned by an entity that are expected to provide future economic benefits.

- Liabilities: Obligations or debts an entity owes to others, representing claims against its assets.

- Equity: Represents the owner's interest in the assets after deducting liabilities; critical in assessing financial strength.

Financial Statements

- Balance Sheet: A snapshot of a company’s financial position at a specific point, detailing assets, liabilities, and equity.

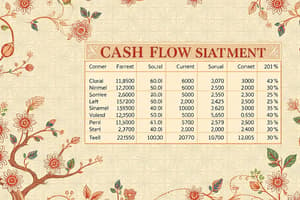

- Statement of Cash Flow: Provides information on cash inflow and outflow from operating, investing, and financing activities over a period, crucial for understanding liquidity.

- Statement of Financial Position: Another term for balance sheet, emphasizing its role in reflecting financial health.

Cash Flows

- Cash Flow: Movement of money into and out of a business, essential for maintaining operations and growth.

- Net Cash Flow: The difference between total cash inflows and outflows, indicating whether a company is generating or losing cash.

- Operating Activities: Cash movements related to the core business operations, including revenue from sales and expenses.

- Investing Activities: Cash transactions linked to the acquisition and disposal of long-term assets, important for business expansion.

- Financing Activities: Cash transactions involved in the raising and repaying of capital, including loans and equity financing.

Asset Categories

- Current Assets: Assets expected to be liquidated or used within one year, including cash, accounts receivable, and inventory.

- Long-term Assets: Assets held for more than one year, such as property, equipment, and intangible assets, affecting long-term financial stability.

- Marketable Investments: Financial assets that can easily be converted into cash, crucial for liquidity management.

- Household Assets: Personal resources owned by individuals or families, contributing to their overall net worth.

- Human Assets: Skills, knowledge, and other attributes of employees that contribute to a company's success.

Financial Metrics

- Cash Flow Statement: Comprehensive view of cash movements, divided into operating, investing, and financing sections.

- Pro Forma Statements: Projected financial statements based on hypothetical scenarios, useful for planning and forecasting.

- Net Working Capital: Difference between current assets and current liabilities, indicating short-term financial health.

- Household Net Worth: Total assets owned by a household minus liabilities, an essential measure of personal financial health.

- Household Equity: Value of owned assets minus debts, influencing decisions regarding investments and expenditures.

Depreciation and Savings

- Depreciation: Systematic reduction in value of an asset over time, impacting profitability and tax calculations.

- Savings: Accumulated funds set aside for future use, vital for financial security and investment opportunities.

Cash Flow Types

- Functional Cash Flow: A specific approach to analyzing cash flow that focuses on little-used segments within the broader categories.

- Traditional Cash Flow Statement: Conventional method emphasizing cash inflows and outflows from business activities, foundational for financial analysis.

Financial Fundamentals

- Assets: Resources owned by an entity that are expected to provide future economic benefits.

- Liabilities: Obligations or debts an entity owes to others, representing claims against its assets.

- Equity: Represents the owner's interest in the assets after deducting liabilities; critical in assessing financial strength.

Financial Statements

- Balance Sheet: A snapshot of a company’s financial position at a specific point, detailing assets, liabilities, and equity.

- Statement of Cash Flow: Provides information on cash inflow and outflow from operating, investing, and financing activities over a period, crucial for understanding liquidity.

- Statement of Financial Position: Another term for balance sheet, emphasizing its role in reflecting financial health.

Cash Flows

- Cash Flow: Movement of money into and out of a business, essential for maintaining operations and growth.

- Net Cash Flow: The difference between total cash inflows and outflows, indicating whether a company is generating or losing cash.

- Operating Activities: Cash movements related to the core business operations, including revenue from sales and expenses.

- Investing Activities: Cash transactions linked to the acquisition and disposal of long-term assets, important for business expansion.

- Financing Activities: Cash transactions involved in the raising and repaying of capital, including loans and equity financing.

Asset Categories

- Current Assets: Assets expected to be liquidated or used within one year, including cash, accounts receivable, and inventory.

- Long-term Assets: Assets held for more than one year, such as property, equipment, and intangible assets, affecting long-term financial stability.

- Marketable Investments: Financial assets that can easily be converted into cash, crucial for liquidity management.

- Household Assets: Personal resources owned by individuals or families, contributing to their overall net worth.

- Human Assets: Skills, knowledge, and other attributes of employees that contribute to a company's success.

Financial Metrics

- Cash Flow Statement: Comprehensive view of cash movements, divided into operating, investing, and financing sections.

- Pro Forma Statements: Projected financial statements based on hypothetical scenarios, useful for planning and forecasting.

- Net Working Capital: Difference between current assets and current liabilities, indicating short-term financial health.

- Household Net Worth: Total assets owned by a household minus liabilities, an essential measure of personal financial health.

- Household Equity: Value of owned assets minus debts, influencing decisions regarding investments and expenditures.

Depreciation and Savings

- Depreciation: Systematic reduction in value of an asset over time, impacting profitability and tax calculations.

- Savings: Accumulated funds set aside for future use, vital for financial security and investment opportunities.

Cash Flow Types

- Functional Cash Flow: A specific approach to analyzing cash flow that focuses on little-used segments within the broader categories.

- Traditional Cash Flow Statement: Conventional method emphasizing cash inflows and outflows from business activities, foundational for financial analysis.

Financial Fundamentals

- Assets: Resources owned by an entity that are expected to provide future economic benefits.

- Liabilities: Obligations or debts an entity owes to others, representing claims against its assets.

- Equity: Represents the owner's interest in the assets after deducting liabilities; critical in assessing financial strength.

Financial Statements

- Balance Sheet: A snapshot of a company’s financial position at a specific point, detailing assets, liabilities, and equity.

- Statement of Cash Flow: Provides information on cash inflow and outflow from operating, investing, and financing activities over a period, crucial for understanding liquidity.

- Statement of Financial Position: Another term for balance sheet, emphasizing its role in reflecting financial health.

Cash Flows

- Cash Flow: Movement of money into and out of a business, essential for maintaining operations and growth.

- Net Cash Flow: The difference between total cash inflows and outflows, indicating whether a company is generating or losing cash.

- Operating Activities: Cash movements related to the core business operations, including revenue from sales and expenses.

- Investing Activities: Cash transactions linked to the acquisition and disposal of long-term assets, important for business expansion.

- Financing Activities: Cash transactions involved in the raising and repaying of capital, including loans and equity financing.

Asset Categories

- Current Assets: Assets expected to be liquidated or used within one year, including cash, accounts receivable, and inventory.

- Long-term Assets: Assets held for more than one year, such as property, equipment, and intangible assets, affecting long-term financial stability.

- Marketable Investments: Financial assets that can easily be converted into cash, crucial for liquidity management.

- Household Assets: Personal resources owned by individuals or families, contributing to their overall net worth.

- Human Assets: Skills, knowledge, and other attributes of employees that contribute to a company's success.

Financial Metrics

- Cash Flow Statement: Comprehensive view of cash movements, divided into operating, investing, and financing sections.

- Pro Forma Statements: Projected financial statements based on hypothetical scenarios, useful for planning and forecasting.

- Net Working Capital: Difference between current assets and current liabilities, indicating short-term financial health.

- Household Net Worth: Total assets owned by a household minus liabilities, an essential measure of personal financial health.

- Household Equity: Value of owned assets minus debts, influencing decisions regarding investments and expenditures.

Depreciation and Savings

- Depreciation: Systematic reduction in value of an asset over time, impacting profitability and tax calculations.

- Savings: Accumulated funds set aside for future use, vital for financial security and investment opportunities.

Cash Flow Types

- Functional Cash Flow: A specific approach to analyzing cash flow that focuses on little-used segments within the broader categories.

- Traditional Cash Flow Statement: Conventional method emphasizing cash inflows and outflows from business activities, foundational for financial analysis.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.