Podcast

Questions and Answers

What is the main assumption of the Arbitrage Pricing Theory (APT)?

What is the main assumption of the Arbitrage Pricing Theory (APT)?

- Firm size and book-to-market ratio are the only relevant risk factors.

- The market portfolio is the only relevant risk factor.

- Investors are risk-averse and aim to maximize expected return.

- There are no arbitrage opportunities among well-diversified portfolios. (correct)

Which of the following is NOT a type of factor included in multi-factor models used in APT?

Which of the following is NOT a type of factor included in multi-factor models used in APT?

- Firm's market capitalization and book-to-market ratio. (correct)

- Macro factors like inflation and interest rates.

- Fundamental factors like company size and dividend yield.

- Factors derived from machine learning algorithms.

How does APT enable the hedging of systematic risk?

How does APT enable the hedging of systematic risk?

- By creating zero beta portfolios with opposite positions to specific factor risks. (correct)

- By using the CAPM to calculate the expected return on a portfolio.

- By diversifying the portfolio across a large number of securities.

- By investing solely in the market portfolio to eliminate idiosyncratic risk.

What is the main reason why small firms and low book-to-market firms tend to outperform according to the Fama-French three-factor model?

What is the main reason why small firms and low book-to-market firms tend to outperform according to the Fama-French three-factor model?

What is the primary reason why portfolio managers have increasingly focused on factor-based investing after the 2008 financial crisis?

What is the primary reason why portfolio managers have increasingly focused on factor-based investing after the 2008 financial crisis?

What year was the Arbitrage Pricing Theory (APT) model developed?

What year was the Arbitrage Pricing Theory (APT) model developed?

Which model did the APT model build upon?

Which model did the APT model build upon?

What was the primary purpose of the APT model?

What was the primary purpose of the APT model?

How did the APT model differ from the CAPM?

How did the APT model differ from the CAPM?

What were the systematic risk factors captured in the APT model?

What were the systematic risk factors captured in the APT model?

Study Notes

- Stephen Ross developed the Arbitrage Pricing Theory (APT) model in 1976, building on the work of Harry Markowitz in 1952 and William Sharpe in 1964 with the Capital Asset Pricing Model (CAPM).

- The CAPM was developed based on a set of limiting assumptions, creating a restricted framework similar to the KePM world in the first Star Wars movie where Luke Skywalker was in a confined space.

- Despite the limitations, the CAPM provided a significant amount of knowledge and wisdom in 1964, laying a strong foundation for future developments in the field of risk management.

- Ross' APT model expanded on the ideas of CAPM, offering a more flexible framework that allowed for a deeper understanding of risk and return dynamics in financial markets.

- The evolution from CAPM to APT marked a significant advancement in risk management theory, providing valuable insights for investors and financial professionals.- The text discusses the concept of Asset Pricing Theory (APT) as an extension of the Capital Asset Pricing Model (CAPM).

- APT aims to determine a reasonable required rate of return on a share of stock based on a linear relationship and systematic risk factors.

- Systematic risks are captured by variables like inflation, exchange rates, and GDP, leading to the development of multi-factor models.

- APT was developed as an alternative pricing theory to CAPM, offering a natural extension rather than a replacement.

- APT founders, like Stephen Ross, had backgrounds in economics, relying on economic training for financial models.

- APT assumes no arbitrage opportunities among well-diversified portfolios and aims to eliminate idiosyncratic risks through diversification.

- Multi-factor models in APT can include macro factors (like inflation, interest rates) and fundamental factors (such as company size, dividend yield).

- Statistical factor models use machine learning to uncover unique factors but require economic validation.

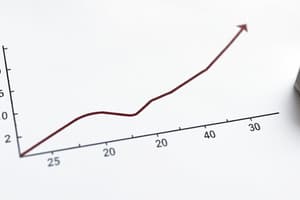

- APT equations calculate revised expected returns based on weighted averages of expected and actual factor sensitivities.

- Factors like GDP growth, interest rates, and inflation can impact portfolio returns based on their beta loadings.

- APT enables the hedging of systematic risk by creating zero beta portfolios with opposite positions to specific factor risks.

- By employing APT, investors can adjust their exposure to different systematic risk factors and potentially enhance portfolio performance.- Hedging against risk allows for retaining, lessening, or increasing exposure to systematic risks like inflation or GDP fluctuations.

- Combining original portfolio with short positions in factor portfolios can create a zero beta portfolio, replicating the return on a treasury security.

- Hedging is not cost-free; the marginal benefit of hedging must exceed the marginal cost, requiring continuous monitoring and adjustment.

- Fama and French introduced a three-factor model considering size, book to market ratios, and market portfolio in addition to CAPM.

- Small firms and low book to market firms tend to outperform due to inherent riskiness and potential for private information not fully reflected in stock prices.

- The expected return on a portfolio is calculated using the risk-free rate, factor betas, and risk premiums, with any excess return considered alpha.

- Portfolio managers have increasingly focused on factor-based investing post-2008 financial crisis to understand the impact of various factors on stock performance.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Description

Test your knowledge on the differences between Asset Pricing Theory (APT) and Capital Asset Pricing Model (CAPM), their assumptions, applications, and implications in financial markets. Explore how APT extends and improves upon the concepts introduced in CAPM, offering valuable insights for investors and portfolio managers.