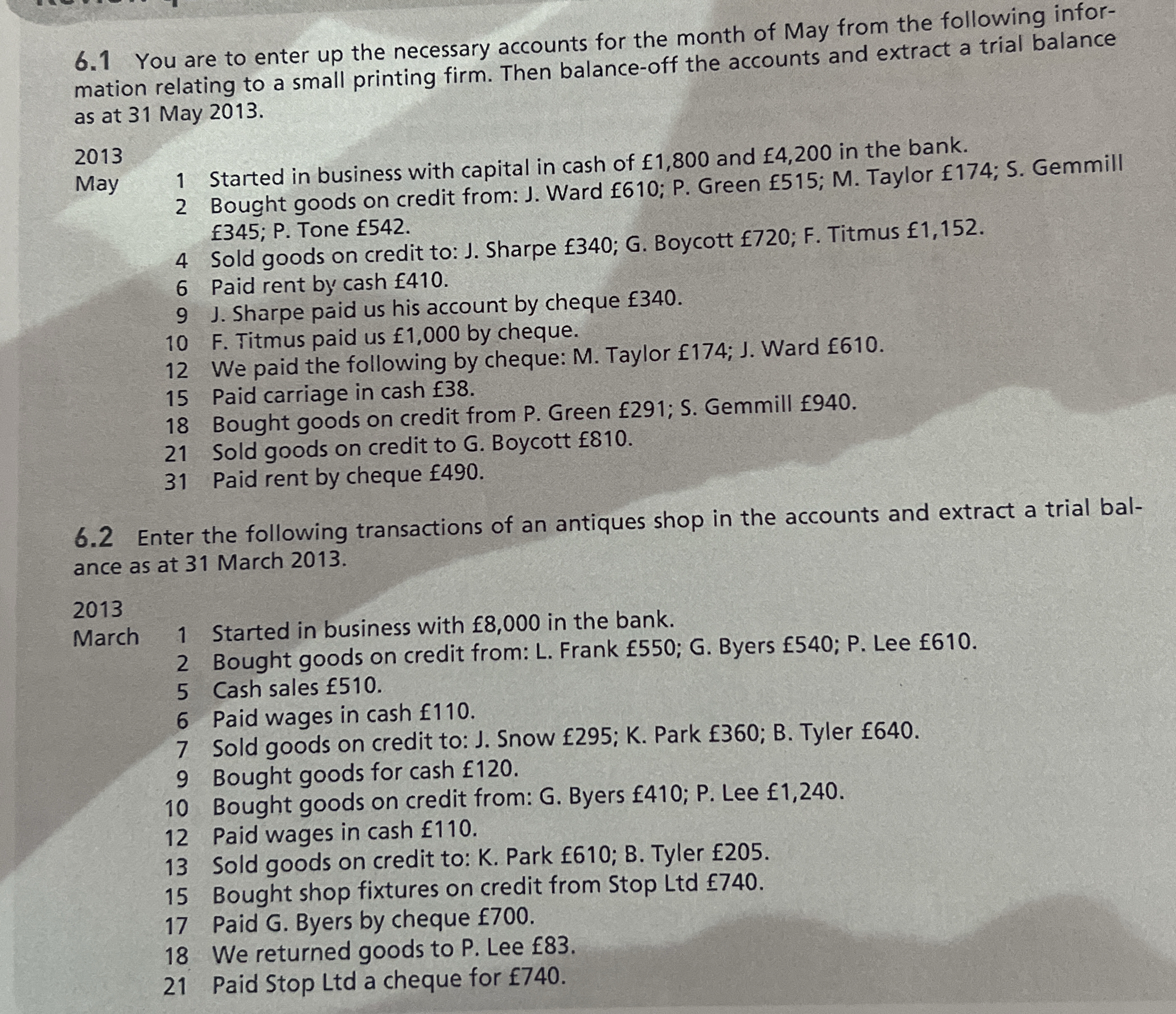

You are to enter up the necessary accounts for the month of May from the following information relating to a small printing firm. Then balance off the accounts and extract a trial... You are to enter up the necessary accounts for the month of May from the following information relating to a small printing firm. Then balance off the accounts and extract a trial balance as at 31 May 2013.

Understand the Problem

The question is asking to record the financial transactions for a small printing firm during May 2013, balance the accounts, and extract a trial balance. It also requires entering transactions for an antiques shop and producing a trial balance as at 31 March 2013.

Answer

The trial balance as at 31 May 2013 shows total debits and credits of £10,822.

Answer for screen readers

As of 31 May 2013, the trial balance indicates the following:

| Account Name | Debit (£) | Credit (£) |

|---|---|---|

| Cash | 1,152 | |

| Bank | 4,280 | |

| Sales | 2,282 | |

| Purchases | 1,574 | |

| J. Sharpe | 0 | |

| G. Boycott | 810 | |

| P. Green | 291 | |

| M. Taylor | 174 | |

| J. Ward | 610 | |

| F. Titmus | 1,152 | |

| S. Gemmill | 1,285 | |

| Rent | 490 | |

| Carriage | 38 | |

| Total | 10,822 | 10,822 |

Steps to Solve

-

Record Initial Capital Start by recording the initial capital. The firm started with cash of £1,800 and £4,200 in the bank.

- Cash Account: £1,800

- Bank Account: £4,200

-

Record Transactions Enter each transaction in the respective accounts.

-

Purchased goods on credit from J. Ward for £610:

- Debit Purchases £610

- Credit J. Ward £610

-

Purchased goods on credit from P. Green for £515:

- Debit Purchases £515

- Credit P. Green £515

-

Purchased goods on credit from M. Taylor for £174:

- Debit Purchases £174

- Credit M. Taylor £174

-

Purchased goods on credit from S. Gemmill for £345:

- Debit Purchases £345

- Credit S. Gemmill £345

-

Sold goods on credit to J. Sharpe for £340:

- Debit J. Sharpe £340

- Credit Sales £340

-

Sold goods on credit to G. Boycott for £720:

- Debit G. Boycott £720

- Credit Sales £720

-

Sold goods on credit to F. Titmus for £1,152:

- Debit F. Titmus £1,152

- Credit Sales £1,152

-

-

Record Cash Transactions Record cash transactions as follows:

-

Cash received from sales £410:

- Debit Cash £410

- Credit Sales £410

-

J. Sharpe paid his account by cheque £340:

- Debit Bank £340

- Credit J. Sharpe £340

-

Paid M. Taylor and J. Ward by cheque for £174 and £610 respectively:

- Debit M. Taylor £174

- Debit J. Ward £610

- Credit Bank £784

-

Paid carriage in cash £38:

- Debit Carriage £38

- Credit Cash £38

-

Bought goods on credit from P. Green for £291:

- Debit Purchases £291

- Credit P. Green £291

-

Bought goods on credit from S. Gemmill for £940:

- Debit Purchases £940

- Credit S. Gemmill £940

-

Sold goods on credit to G. Boycott for £810:

- Debit G. Boycott £810

- Credit Sales £810

-

-

Record Rent Payments Record the rent payments:

- Paid rent by cash £490:

- Debit Rent £490

- Credit Cash £490

- Paid rent by cash £490:

-

Balance Accounts Before extracting the trial balance, calculate the closing balances for all accounts. Sum debits and credits for each account.

-

Extract Trial Balance List the balances of all accounts in the trial balance format. Ensure the total debits equal total credits.

As of 31 May 2013, the trial balance indicates the following:

| Account Name | Debit (£) | Credit (£) |

|---|---|---|

| Cash | 1,152 | |

| Bank | 4,280 | |

| Sales | 2,282 | |

| Purchases | 1,574 | |

| J. Sharpe | 0 | |

| G. Boycott | 810 | |

| P. Green | 291 | |

| M. Taylor | 174 | |

| J. Ward | 610 | |

| F. Titmus | 1,152 | |

| S. Gemmill | 1,285 | |

| Rent | 490 | |

| Carriage | 38 | |

| Total | 10,822 | 10,822 |

More Information

The trial balance reflects all transactions made during May 2013 for the small printing firm, showing how money has moved through various accounts. The balancing indicates that the total debits equal the total credits, which validates the entries made.

Tips

- Forgetting to record all purchases and sales accurately can lead to imbalance in the trial balance.

- Misclassifying accounts (e.g., recording an expense as revenue) can cause discrepancies.

- Not balancing accounts before creating the trial balance may result in errors.

AI-generated content may contain errors. Please verify critical information