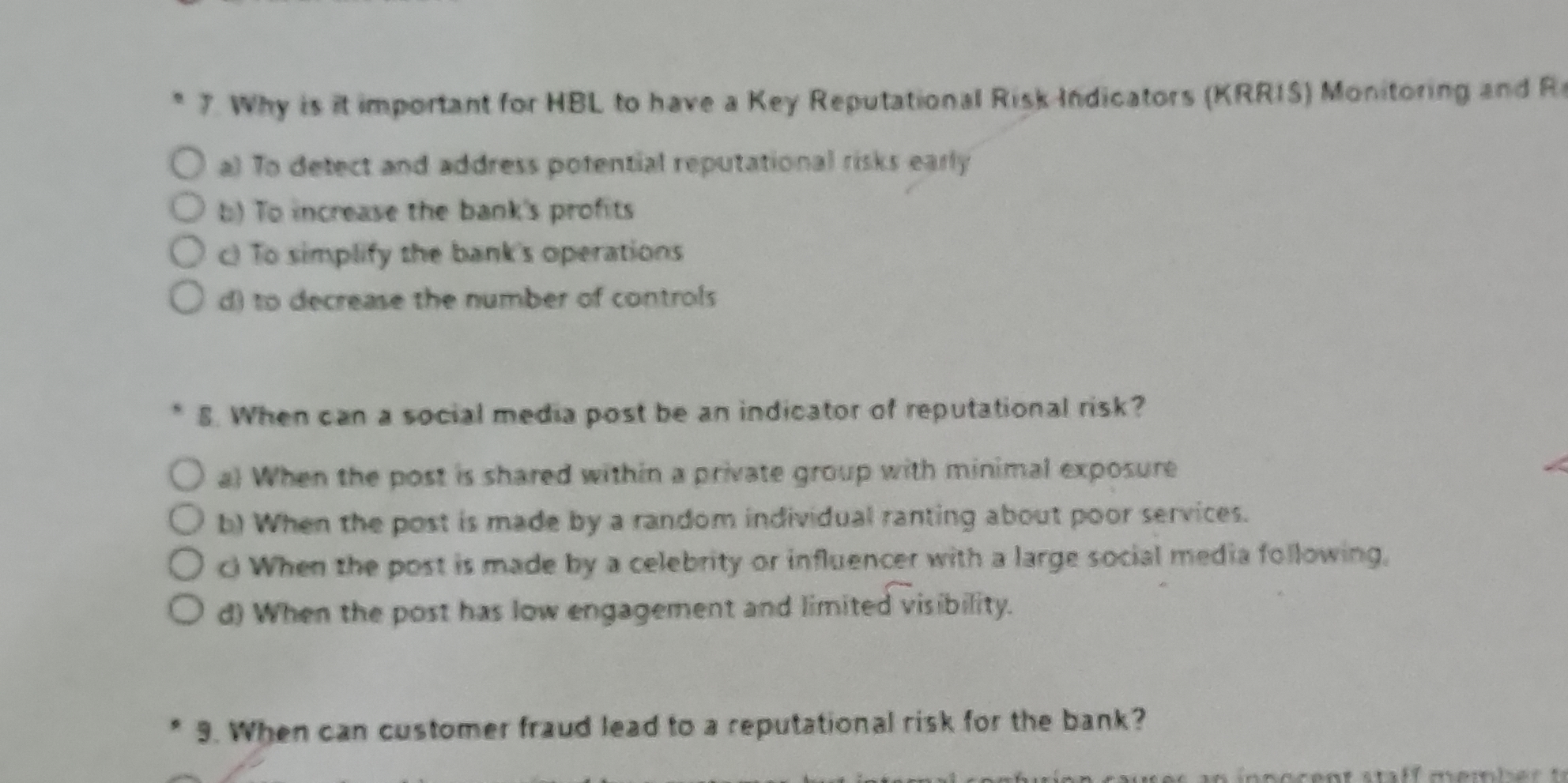

Why is it important for HBL to have a Key Reputational Risk Indicators (KRRI) Monitoring and Reporting System? When can a social media post be an indicator of reputational risk? Wh... Why is it important for HBL to have a Key Reputational Risk Indicators (KRRI) Monitoring and Reporting System? When can a social media post be an indicator of reputational risk? When can customer fraud lead to a reputational risk for the bank?

Understand the Problem

The question is asking about the importance of having Key Reputational Risk Indicators for a bank, specifically relating to monitoring and addressing reputational risks. It also queries the implications of social media posts in determining reputational risks and how customer fraud can lead to such risks.

Answer

1. Early risk detection (a). 2. Influencer post risk (c). 3. Customer fraud affects integrity.

- It's important for HBL to have a KRRI system to detect and address potential reputational risks early (a). 2. A social media post can indicate reputational risk when made by a celebrity or influencer with a large following (c). 3. Customer fraud leads to reputational risk if it causes harm or loss to innocent customers or affects the bank's integrity.

Answer for screen readers

- It's important for HBL to have a KRRI system to detect and address potential reputational risks early (a). 2. A social media post can indicate reputational risk when made by a celebrity or influencer with a large following (c). 3. Customer fraud leads to reputational risk if it causes harm or loss to innocent customers or affects the bank's integrity.

More Information

Effective monitoring helps prevent reputational damages that could lead to financial and credibility losses for the bank.

Tips

Ignoring early warnings on social media can exacerbate reputational risks.

Sources

- Reputation Risk Management - vendasta.com

- How social media affects bank reputation - financialit.net

AI-generated content may contain errors. Please verify critical information