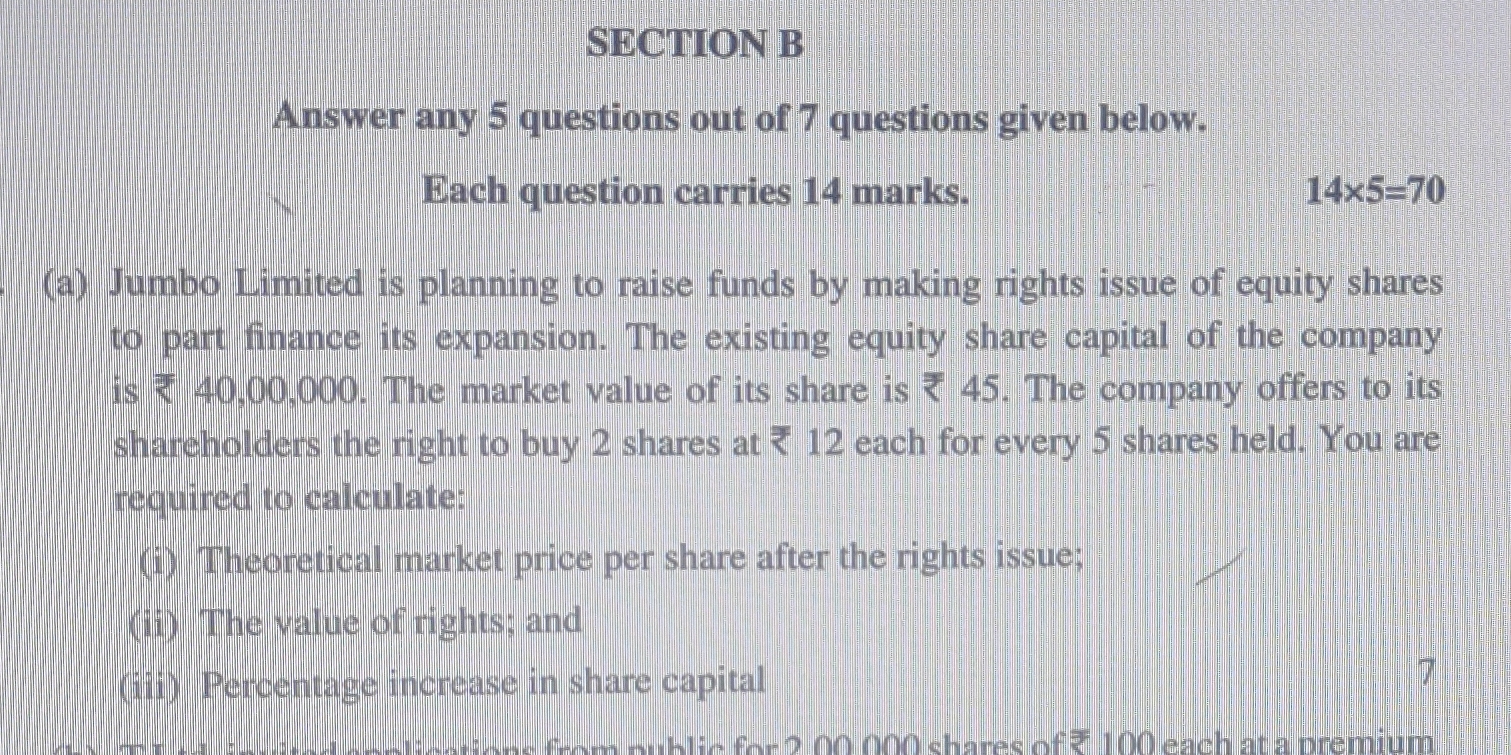

Jumbo Limited is planning to raise funds by making a rights issue of equity shares to finance its expansion. The existing equity share capital of the company is ₹ 40,00,000. The ma... Jumbo Limited is planning to raise funds by making a rights issue of equity shares to finance its expansion. The existing equity share capital of the company is ₹ 40,00,000. The market value of its share is ₹ 45. The company offers its shareholders the right to buy 2 shares at ₹ 12 each for every 5 shares held. Calculate: (i) Theoretical market price per share after the rights issue; (ii) The value of rights; and (iii) Percentage increase in share capital.

Understand the Problem

The question is asking to compute several financial metrics related to a rights issue made by Jumbo Limited. Specifically, it asks us to calculate the theoretical market price per share after the rights issue, the value of the rights themselves, and the percentage increase in the share of capital. We are given information on the existing equity share capital, the market value of the shares, and the terms of the rights issue (number of shares offered and the price).

Answer

(i) ₹35.57 (ii) ₹13.2 (iii) 10.67%

Answer for screen readers

(i) Theoretical market price per share after the rights issue: ₹35.57 (ii) The value of rights: ₹13.2 (iii) Percentage increase in share capital: 10.67%

Steps to Solve

- Calculate the number of existing shares

To find the number of existing shares, divide the existing equity share capital by the market value per share. $$ \text{Number of existing shares} = \frac{\text{Existing equity share capital}}{\text{Market value per share}} $$ $$ \text{Number of existing shares} = \frac{40,00,000}{45} = 88,888.89 \approx 88,889 \text{ shares} $$

- Calculate the number of new shares issued

The company offers 2 new shares for every 5 shares held.

$$ \text{Number of new shares} = \frac{2}{5} \times \text{Number of existing shares} $$ $$ \text{Number of new shares} = \frac{2}{5} \times 88,889 = 35,555.6 \approx 35,556 \text{ shares} $$

-

Calculate the total market value before the rights issue $$ \text{Total market value before rights issue} = \text{Number of existing shares} \times \text{Market value per share} $$ $$ \text{Total market value before rights issue} = 88,889 \times 45 = 40,00,005 \text{ ₹} $$

-

Calculate the total amount received from the rights issue

The company offers the new shares at ₹12 each.

$$ \text{Total amount from rights issue} = \text{Number of new shares} \times \text{Issue price per share} $$ $$ \text{Total amount from rights issue} = 35,556 \times 12 = 4,26,672 \text{ ₹} $$

- Calculate the aggregate market value Sum of the total market value before the rights issue and the funds raised from the rights issue.

$$ \text{Aggregate market value} = \text{Total market value before rights issue} + \text{Total amount from rights issue} $$ $$ \text{Aggregate market value} = 40,00,005 + 4,26,672 = 44,26,677 \text{ ₹} $$

-

Calculate the total number of shares after the rights issue $$ \text{Total number of shares after rights issue} = \text{Number of existing shares} + \text{Number of new shares} $$ $$ \text{Total number of shares after rights issue} = 88,889 + 35,556 = 1,24,445 \text{ shares} $$

-

Calculate the theoretical market price per share after the rights issue

Divide the aggregate market value by the total number of shares after the rights issue. $$ \text{Theoretical market price per share} = \frac{\text{Aggregate market value}}{\text{Total number of shares after rights issue}} $$ $$ \text{Theoretical market price per share} = \frac{44,26,677}{1,24,445} = 35.57 \text{ ₹} $$

- Calculate the value of the right

$$ \text{Value of right} = \frac{\text{Market price before rights issue} - \text{Issue price}}{\text{Number of rights required to purchase a new share}} $$

Since 5 old shares allow you to buy 2 new shares, then $5/2 = 2.5$ rights are needed for one new share $$ \text{Value of right} = \frac{45 - 12}{2.5} $$ $$ \text{Value of right} = \frac{33}{2.5} = 13.2 \text{ ₹} $$

- Calculate the increase in share capital

The original share capital was $40,00,000$. The company issued $35,556$ new shares at $12$ ₹ each. $$ \text{Increase in share capital} = \text{Number of new shares} \times \text{Issue price per share} = 35,556 \times 12 = 4,26,672 \text{ ₹} $$

- Calculate the percentage increase in share capital

$$ \text{Percentage increase in share capital} = \frac{\text{Increase in share capital}}{\text{Existing equity share capital}} \times 100 $$ $$ \text{Percentage increase in share capital} = \frac{4,26,672}{40,00,000} \times 100 = 10.67% $$

(i) Theoretical market price per share after the rights issue: ₹35.57 (ii) The value of rights: ₹13.2 (iii) Percentage increase in share capital: 10.67%

More Information

The theoretical market price reflects the expected market price of the shares after the rights issue, assuming no other market factors influence the price. The value of the right represents the financial advantage a shareholder has by being offered the opportunity to buy new shares at a discounted price. The percentage increase in share capital shows how much additional capital has been raised relative to the original capital base.

Tips

- Incorrect calculation of number of new shares: Forgetting to calculate the correct number of new shares based on the rights issue terms.

- Miscalculation of aggregate market value: Incorrectly summing the total market value before the rights issue and the total amount from the rights issue.

- Incorrect value of right calculation: Errors in using the correct formula or misinterpreting the number of rights required to purchase a new share.

AI-generated content may contain errors. Please verify critical information