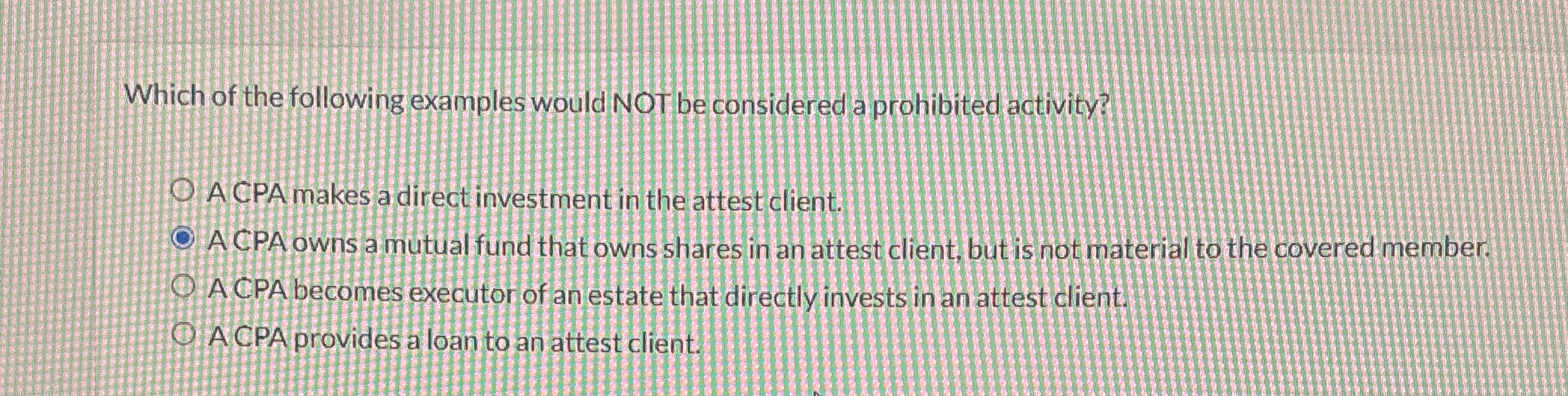

Which of the following examples would NOT be considered a prohibited activity?

Understand the Problem

The question is asking which example provided does not constitute a prohibited activity for a CPA in relation to attest clients. It requires an understanding of ethical guidelines and regulations that govern CPA practices.

Answer

A CPA owns a mutual fund that owns shares in an attest client but is not material to the covered member.

The final answer is: A CPA owns a mutual fund that owns shares in an attest client but is not material to the covered member.

Answer for screen readers

The final answer is: A CPA owns a mutual fund that owns shares in an attest client but is not material to the covered member.

More Information

Owning a mutual fund with shares in an attest client is typically allowed if the investment is not material to the CPA, as it is considered an indirect financial interest.

Tips

A common mistake is not understanding the difference between direct and indirect financial interests. Ensure the materiality of the investment is assessed.

AI-generated content may contain errors. Please verify critical information