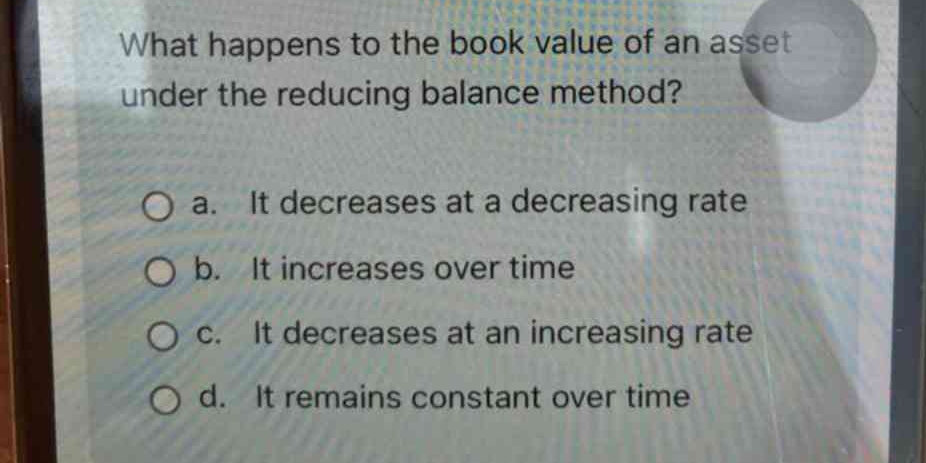

What happens to the book value of an asset under the reducing balance method?

Understand the Problem

The question is asking about the book value of an asset under the reducing balance method. The reducing balance method, also known as the diminishing balance method, is a type of depreciation method where the depreciation expense is highest in the early years of an asset's life and decreases over time. The question requires you to identify how the book value changes over time when this method is used.

Answer

A. It decreases at a decreasing rate

The book value of an asset decreases at a decreasing rate under the reducing balance method, so the answer is A.

Answer for screen readers

The book value of an asset decreases at a decreasing rate under the reducing balance method, so the answer is A.

More Information

The reducing balance method calculates depreciation as a percentage of an asset's book value. Since the book value decreases each year, the amount of depreciation also decreases, resulting in a decreasing rate of depreciation.

Tips

A common mistake is to confuse the reducing balance method with other depreciation methods, such as the straight-line method, where depreciation is constant. Remember that the reducing balance method results in higher depreciation expenses in the early years and lower expenses in later years.

Sources

- Reducing balance method: How to calculate depreciation? | Agicap - agicap.com

- Reducing Balance Depreciation Method: Explanation & Calculation - freshbooks.com

- Reducing Balance Method | Formula, Calculation, and Example - financestrategists.com

AI-generated content may contain errors. Please verify critical information