What are the key metrics to analyze for mutual funds as presented in the data set?

Understand the Problem

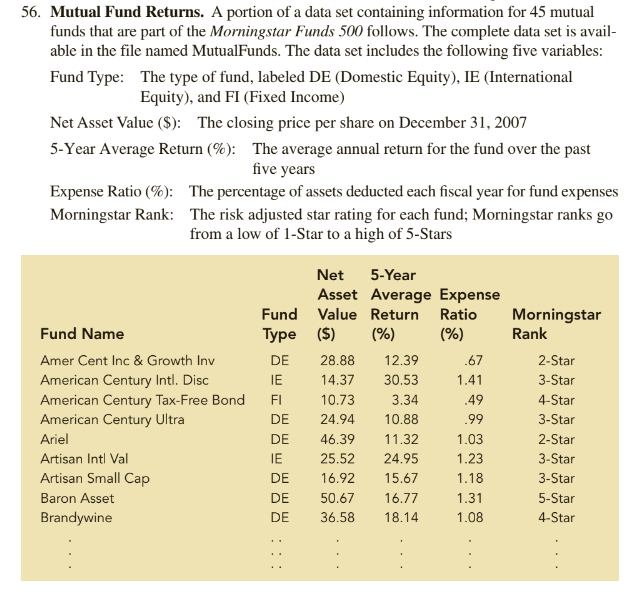

The question is asking for an analysis of the data provided in a table about various mutual funds, including metrics like net asset value, average return, expense ratio, and Morningstar rank.

Answer

Expense ratio, historical performance, Sharpe ratio, standard deviation, alpha, beta, turnover ratio.

The key metrics to analyze mutual funds are expense ratio, historical performance, risk-adjusted return (Sharpe ratio), standard deviation, alpha, beta, and turnover ratio.

Answer for screen readers

The key metrics to analyze mutual funds are expense ratio, historical performance, risk-adjusted return (Sharpe ratio), standard deviation, alpha, beta, and turnover ratio.

More Information

These metrics help investors assess the performance and risk associated with mutual funds, allowing for informed investment decisions.

Tips

A common mistake is overlooking the expense ratio, which can significantly impact returns over time.

Sources

- 7 Key Metrics for Analyzing Mutual Fund Performance - moneyfront.in

- Evaluating Mutual Fund Performance: Key Metrics - maxiomwealth.com

- Understanding Mutual Fund Performance - thriventfunds.com

AI-generated content may contain errors. Please verify critical information