What are the financial formulas for Gross Profit, Operating Income, Net Income, Retained Earnings, EPS, and Price Earnings Ratio?

Understand the Problem

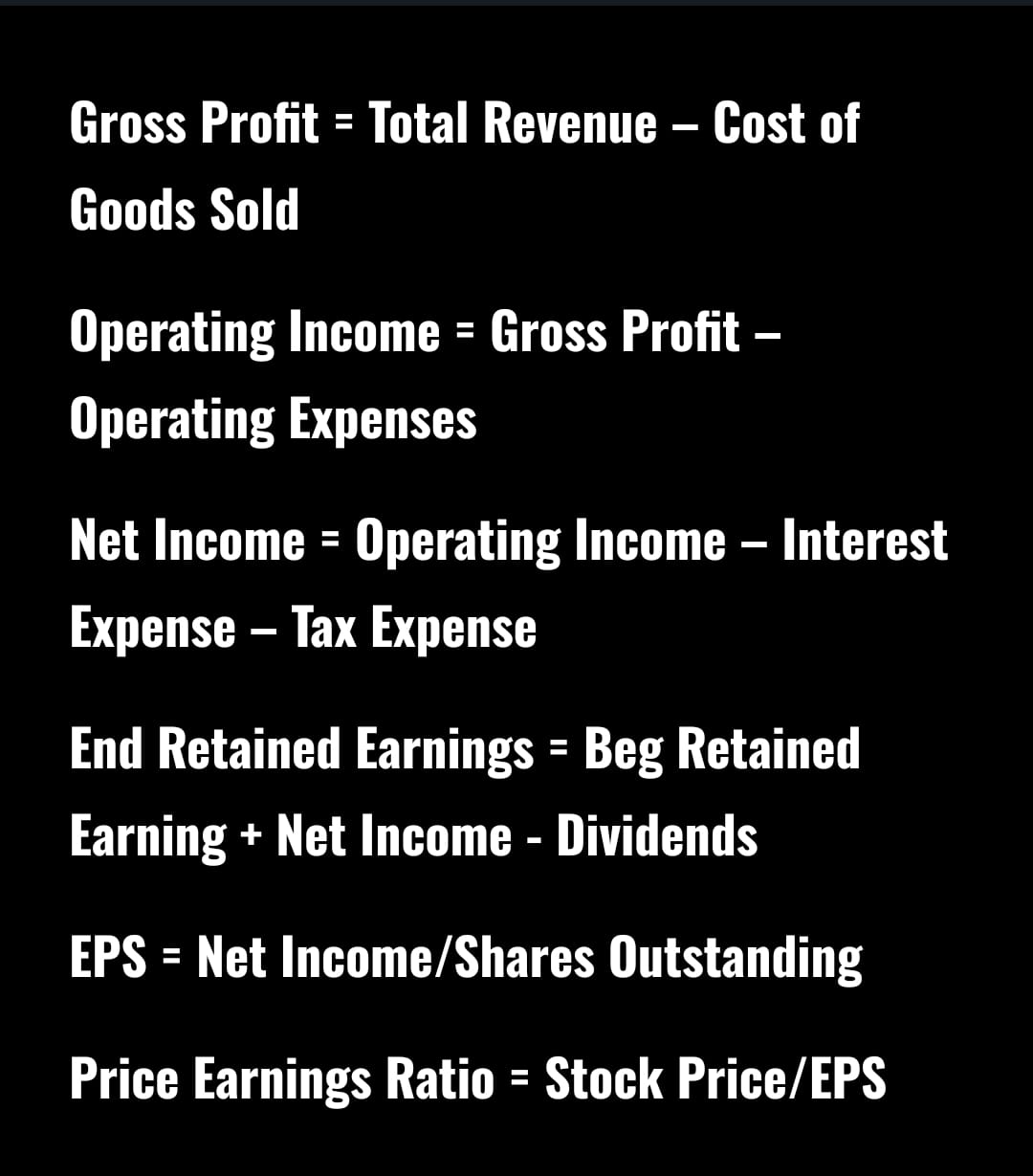

The question is providing a series of financial formulas related to profit, income, retained earnings, earnings per share, and the price-earnings ratio.

Answer

Gross Profit = Revenue - COGS; Operating Income = Gross Profit - Expenses; Net Income = Operating Income - Interest - Tax; Retained Earnings = Starting + Net Income - Dividends; EPS = Net Income/Shares; PE Ratio = Stock Price/EPS.

The financial formulas are: Gross Profit = Total Revenue - Cost of Goods Sold, Operating Income = Gross Profit - Operating Expenses, Net Income = Operating Income - Interest Expense - Tax Expense, Retained Earnings = Beginning Retained Earnings + Net Income - Dividends, EPS = Net Income / Shares Outstanding, Price Earnings Ratio = Stock Price / EPS.

Answer for screen readers

The financial formulas are: Gross Profit = Total Revenue - Cost of Goods Sold, Operating Income = Gross Profit - Operating Expenses, Net Income = Operating Income - Interest Expense - Tax Expense, Retained Earnings = Beginning Retained Earnings + Net Income - Dividends, EPS = Net Income / Shares Outstanding, Price Earnings Ratio = Stock Price / EPS.

More Information

These formulas are key for analyzing a company's financial performance. Gross profit and net income indicate profitability, while EPS and the PE ratio indicate value from an investment perspective.

Tips

Common mistakes include confusing gross profit with net income or miscalculating dividends when determining retained earnings.

Sources

- Earnings Per Share (EPS): What It Means and How to Calculate It - investopedia.com

- Net Income | Formula + Calculator - Wall Street Prep - wallstreetprep.com

- How to Calculate Retained Earnings: A Clear Guide for Businesses - finally.com

AI-generated content may contain errors. Please verify critical information