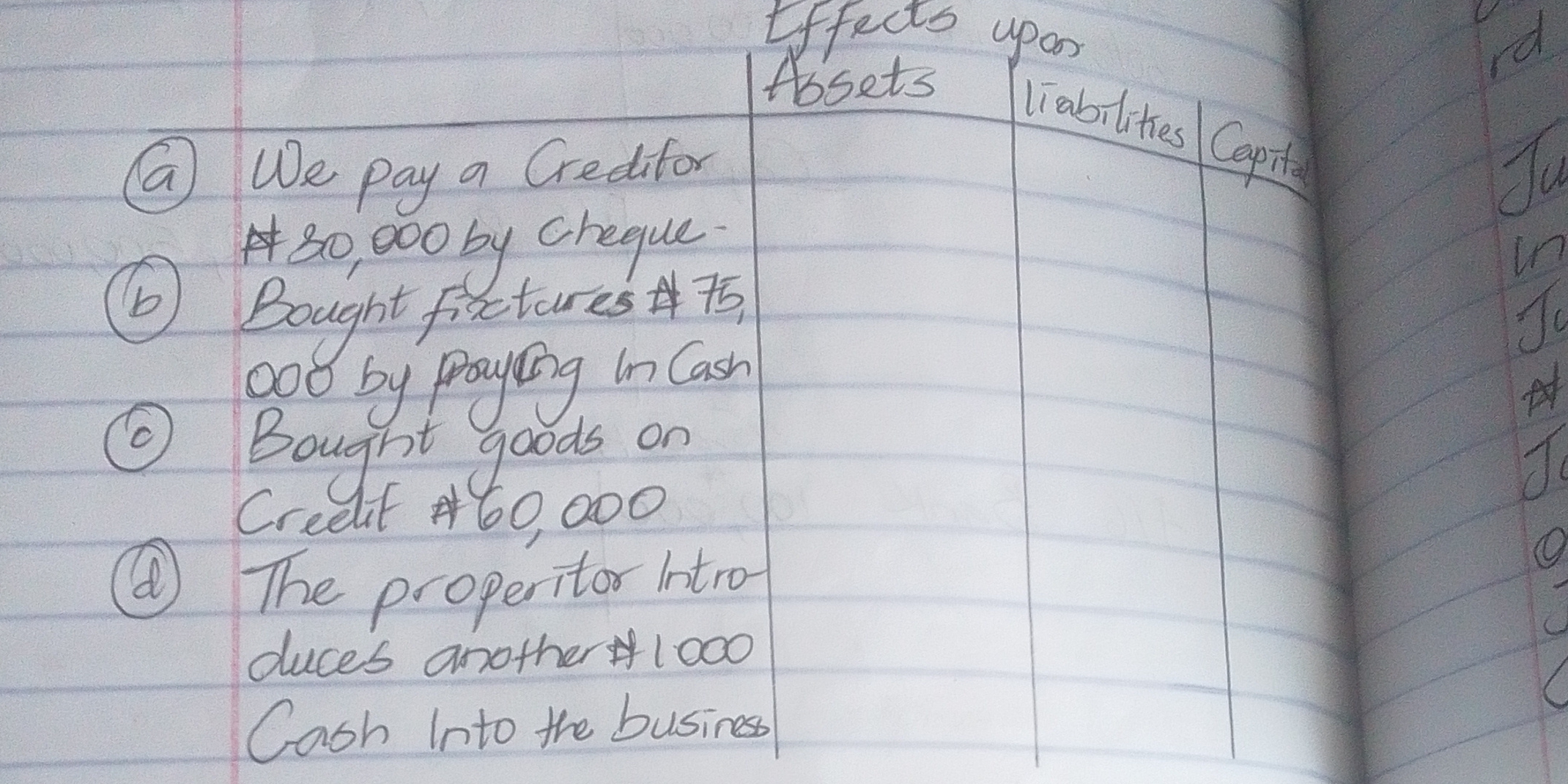

What are the effects on assets, liabilities, and capital for the following transactions: a) We pay a creditor #80,000 by cheque. b) Bought fixtures #75,000 by paying in cash. c) B... What are the effects on assets, liabilities, and capital for the following transactions: a) We pay a creditor #80,000 by cheque. b) Bought fixtures #75,000 by paying in cash. c) Bought goods on Credit #60,000. d) The proprietor introduces another #1,000 cash into the business.

Understand the Problem

The question describes four different financial transactions (paying a creditor, buying fixtures, buying goods on credit, and introducing cash into the business). We need to determine the impact to the assets, liabilities, and capital as a result of the transactions.

Answer

a) Assets decrease, Liabilities decrease, Capital no effect; b) Assets increase and decrease, Liabilities no effect, Capital no effect; c) Assets increase, Liabilities increase, Capital no effect; d) Assets increase, Liabilities no effect, Capital increase

Here's the breakdown of the effects on assets, liabilities, and capital for each transaction:

a) We pay a creditor ₦80,000 by cheque:

- Assets: Decrease (Cash/Bank decreases by ₦80,000)

- Liabilities: Decrease (Accounts Payable decreases by ₦80,000)

- Capital: No effect

b) Bought fixtures ₦75,000 by paying in cash:

- Assets: Increase (Fixtures increase by ₦75,000), Decrease (Cash decreases by ₦75,000)

- Liabilities: No effect

- Capital: No effect

c) Bought goods on credit ₦60,000:

- Assets: Increase (Inventory increases by ₦60,000)

- Liabilities: Increase (Accounts Payable increases by ₦60,000)

- Capital: No effect

d) The proprietor introduces another ₦1,000 cash into the business:

- Assets: Increase (Cash increases by ₦1,000)

- Liabilities: No effect

- Capital: Increase (Owner's Equity increases by ₦1,000)

Answer for screen readers

Here's the breakdown of the effects on assets, liabilities, and capital for each transaction:

a) We pay a creditor ₦80,000 by cheque:

- Assets: Decrease (Cash/Bank decreases by ₦80,000)

- Liabilities: Decrease (Accounts Payable decreases by ₦80,000)

- Capital: No effect

b) Bought fixtures ₦75,000 by paying in cash:

- Assets: Increase (Fixtures increase by ₦75,000), Decrease (Cash decreases by ₦75,000)

- Liabilities: No effect

- Capital: No effect

c) Bought goods on credit ₦60,000:

- Assets: Increase (Inventory increases by ₦60,000)

- Liabilities: Increase (Accounts Payable increases by ₦60,000)

- Capital: No effect

d) The proprietor introduces another ₦1,000 cash into the business:

- Assets: Increase (Cash increases by ₦1,000)

- Liabilities: No effect

- Capital: Increase (Owner's Equity increases by ₦1,000)

More Information

The basic accounting equation is Assets = Liabilities + Owner's Equity. Every transaction affects at least two accounts and maintains the balance of the accounting equation.

Tips

A common mistake is not recognizing the dual effect of each transaction. For example, when paying cash, both cash and either liabilities or expenses are affected.

Sources

AI-generated content may contain errors. Please verify critical information