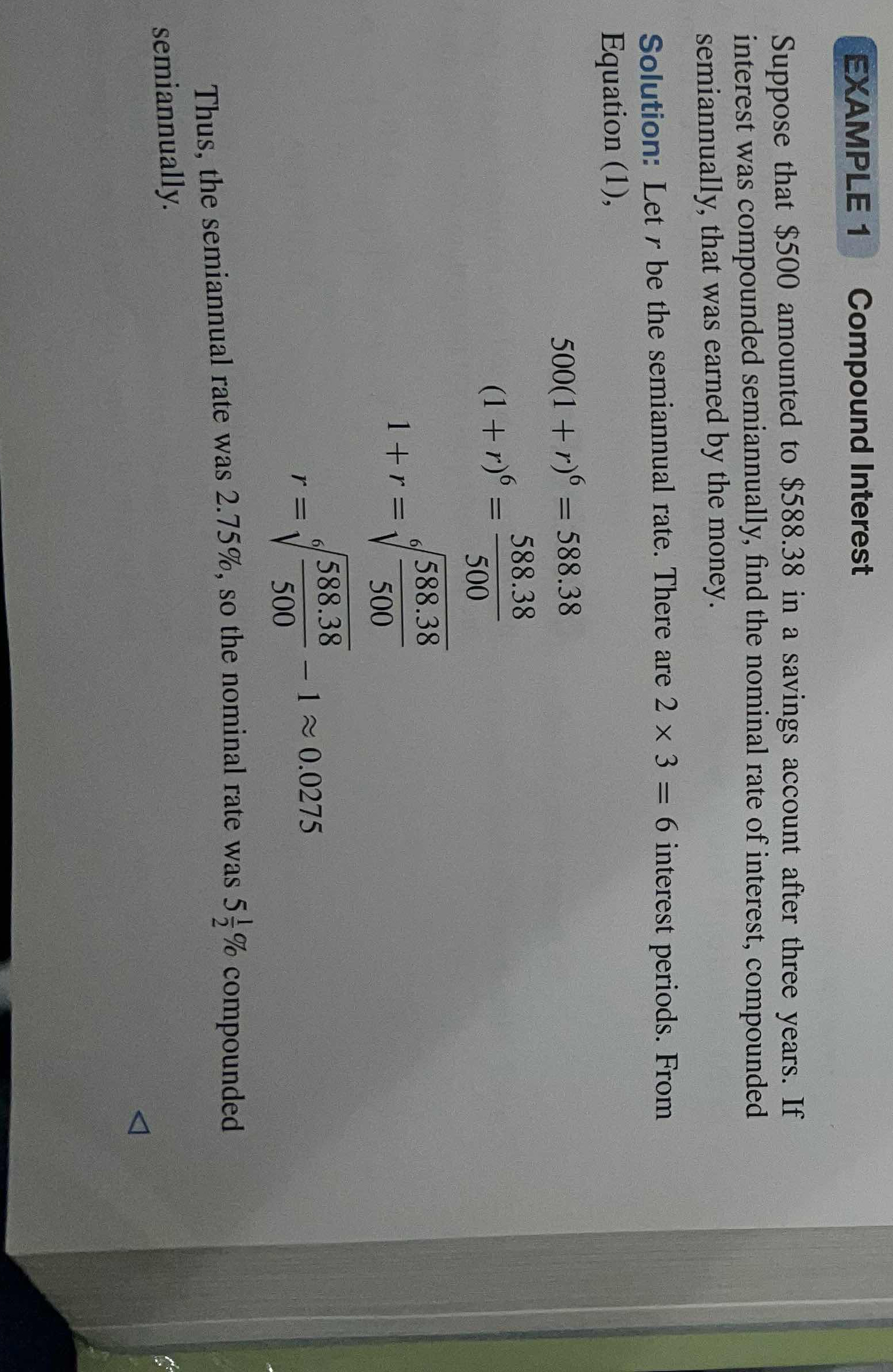

Suppose that $500 amounted to $588.38 in a savings account after three years. If interest was compounded semiannually, find the nominal rate of interest, compounded semiannually, t... Suppose that $500 amounted to $588.38 in a savings account after three years. If interest was compounded semiannually, find the nominal rate of interest, compounded semiannually, that was earned by the money.

Understand the Problem

The question asks to find the nominal interest rate when $500 amounts to $588.38 after three years with interest compounded semiannually. The solution demonstrates how to calculate the semiannual interest rate and then convert it to the nominal annual rate

Answer

The nominal rate of interest is $5.5\%$.

Answer for screen readers

The nominal rate of interest, compounded semiannually, is $5.5%$.

Steps to Solve

- Set up the compound interest formula

The formula for compound interest is:

$A = P(1 + r)^n$

Where: $A =$ the future value of the investment/loan, including interest $P =$ the principal investment amount (the initial deposit or loan amount) $r =$ the semiannual interest rate (as a decimal) $n =$ the number of compounding periods

In this case, $A = 588.38$, $P = 500$, and $n = 2 \times 3 = 6$ (since the interest is compounded semiannually for three years). We want to find $r$.

- Plug in the values and solve for $r$

Substitute the given values into the formula:

$588.38 = 500(1 + r)^6$

- Isolate $(1 + r)^6$

Divide both sides by 500:

$(1 + r)^6 = \frac{588.38}{500} = 1.17676$

- Solve for $1 + r$

Take the 6th root of both sides:

$1 + r = \sqrt[6]{1.17676}$

- Isolate $r$

Subtract 1 from both sides:

$r = \sqrt[6]{1.17676} - 1$

- Calculate $r$

$r \approx 1.0275 - 1 = 0.0275$

The semiannual interest rate is approximately 0.0275, or 2.75%.

- Calculate the nominal annual interest rate

Since the interest is compounded semiannually, the nominal annual interest rate is twice the semiannual rate:

Nominal rate $= 2 \times 0.0275 = 0.055$

- Express as a percentage

The nominal rate of interest is 5.5% or $5\frac{1}{2}%$.

The nominal rate of interest, compounded semiannually, is $5.5%$.

More Information

The nominal interest rate is the stated interest rate before taking into account the effects of compounding. In this example, although interest is applied twice a year, the annual rate is simply twice the semiannual rate. To find the effective annual rate, also known as the annual percentage yield (APY), we can use the formula:

$APY = (1 + \frac{r}{n})^{n} - 1$

Where $r$ is the nominal interest rate, and $n$ is the number of compounding periods per year. In this case:

$APY = (1 + \frac{0.055}{2})^{2} - 1 \approx 0.055756 \approx 5.58%$

Tips

A common mistake is forgetting to multiply the semiannual rate by 2 to get the nominal annual rate. Another mistake would be incorrectly calculating the 6th root.

AI-generated content may contain errors. Please verify critical information