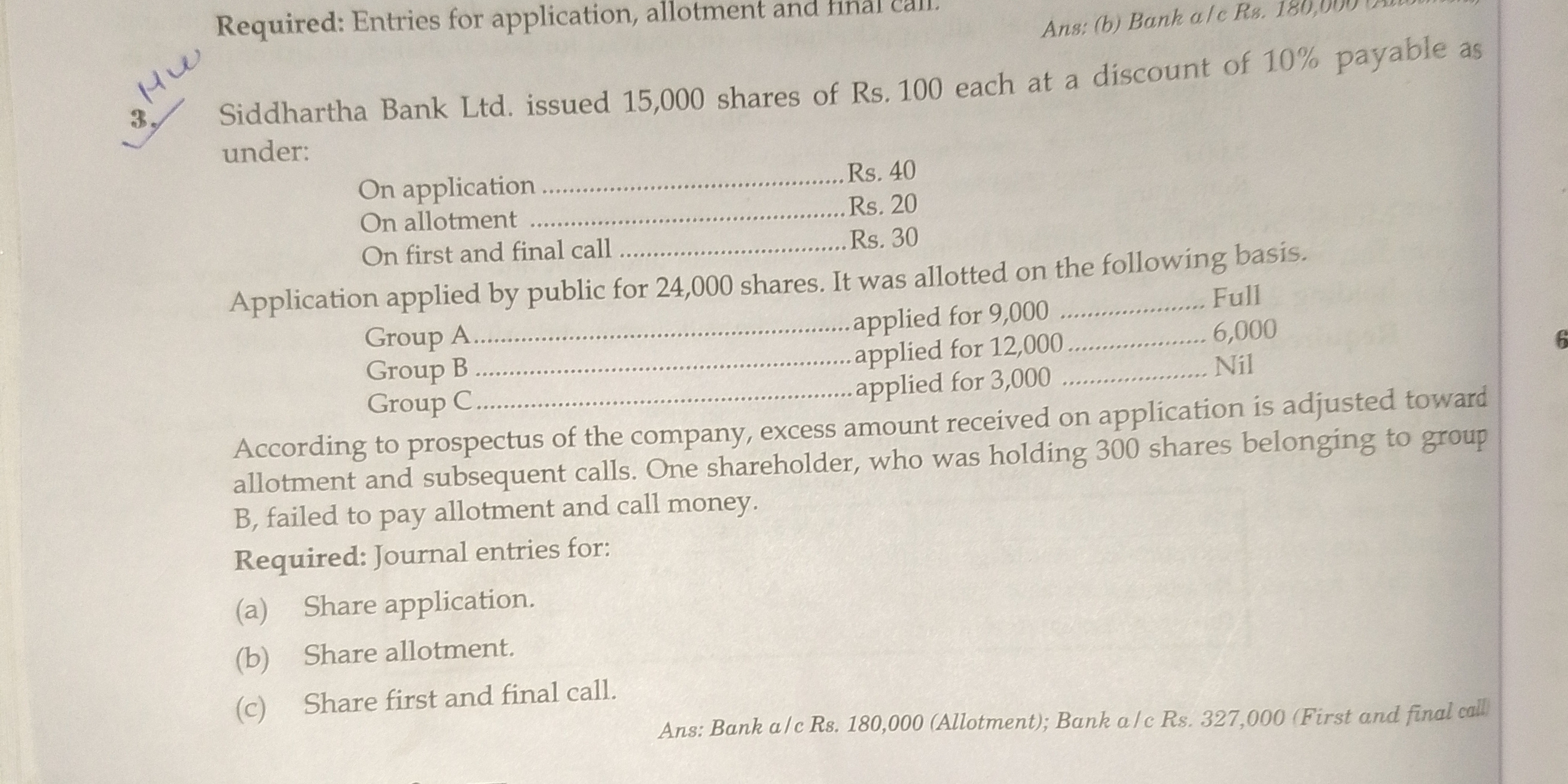

Required: Journal entries for: (a) Share application. (b) Share allotment. (c) Share first and final call.

Understand the Problem

The question is asking for journal entries related to the application, allotment, and final call for shares issued by Siddhartha Bank Ltd. It involves calculations based on the number of shares applied for by different groups and the amounts payable at each stage.

Answer

1. Bank Account Rs. 960,000 2. Share Application Account Rs. 300,000 (Allotment) 3. Share First and Final Call Account Rs. 9,000 (Unpaid)

Answer for screen readers

Journal Entries:

-

Application Money:

- Debit: Bank Account Rs. 960,000

- Credit: Share Application Account Rs. 960,000

-

Allotment:

- Debit: Share Application Account Rs. 300,000

- Credit: Share Allotment Account Rs. 300,000

- Credit: Bank Account (for excess) Rs. 660,000

-

First and Final Call:

- Debit: Share Allotment Account Rs. 441,000

- Credit: Share First and Final Call Account Rs. 441,000

-

Adjust for Unpaid Calls:

- Debit: Share First and Final Call Account Rs. 9,000

- Credit: Calls in Arrears Account Rs. 9,000

Steps to Solve

- Determine Total Application Money Received

Calculate the total application money received based on shares applied for.

- Number of shares applied = 24,000

- Application money per share = Rs. 40

[ \text{Total application money} = 24,000 \times 40 = Rs. 960,000 ]

- Allotment of Shares

Shares are allotted as follows:

- Group A: Full allotment of 9,000 shares

- Group B: Allotted 6,000 shares out of 12,000 applied

- Group C: No allotment for 3,000 applied

Total shares allotted = 9,000 + 6,000 = 15,000 shares

The allotment money is calculated for all the allotted shares:

- Allotment money per share = Rs. 20

[ \text{Total allotment money} = 15,000 \times 20 = Rs. 300,000 ]

- Final Call Calculation

For the first and final call, calculate based on the shares allotted and include the adjustment:

- First and final call per share = Rs. 30

- Group B’s unpaid shares must be deducted: 300 shares

Total shares eligible for final call:

- Eligible shares = 15,000 - 300 = 14,700

[ \text{Total final call money} = 14,700 \times 30 = Rs. 441,000 ]

- Journal Entries

Now, create the journal entries for each stage:

-

Application Money Entry: [ \text{Bank Account} \quad \text{Debit} \quad Rs. 960,000 ] [ \text{To Share Application Account} \quad \text{Credit} \quad Rs. 960,000 ]

-

Allotment Entry (after adjusting for the excess on application): [ \text{Share Application Account} \quad \text{Debit} \quad Rs. 300,000 ] [ \text{To Share Allotment Account} \quad \text{Credit} \quad Rs. 300,000 ] [ \text{To Bank Account (for excess)} \quad \text{Credit} \quad Rs. 660,000 ]

-

First and Final Call Entry: [ \text{Share Allotment Account} \quad \text{Debit} \quad Rs. 441,000 ] [ \text{To Share First and Final Call Account} \quad \text{Credit} \quad Rs. 441,000 ]

- Adjust for Unpaid Calls

Since one shareholder from Group B with 300 shares didn’t pay: [ \text{Share First and Final Call Account} \quad \text{Debit} \quad Rs. 9,000 ] [ \text{To Calls in Arrears Account} \quad \text{Credit} \quad Rs. 9,000 ]

Journal Entries:

-

Application Money:

- Debit: Bank Account Rs. 960,000

- Credit: Share Application Account Rs. 960,000

-

Allotment:

- Debit: Share Application Account Rs. 300,000

- Credit: Share Allotment Account Rs. 300,000

- Credit: Bank Account (for excess) Rs. 660,000

-

First and Final Call:

- Debit: Share Allotment Account Rs. 441,000

- Credit: Share First and Final Call Account Rs. 441,000

-

Adjust for Unpaid Calls:

- Debit: Share First and Final Call Account Rs. 9,000

- Credit: Calls in Arrears Account Rs. 9,000

More Information

This question involves understanding share capital transactions and the process of journalizing amounts received at various stages of the share issuance process. The adjustment for unpaid amounts emphasizes the importance of accurate record-keeping in financial statements.

Tips

- Miscalculating Application Money: Always ensure to calculate the total application based on actual funds applied.

- Not Adjusting for Unpaid Calls: Remember to account for unpaid amounts to maintain accurate records in financial accounts.

AI-generated content may contain errors. Please verify critical information