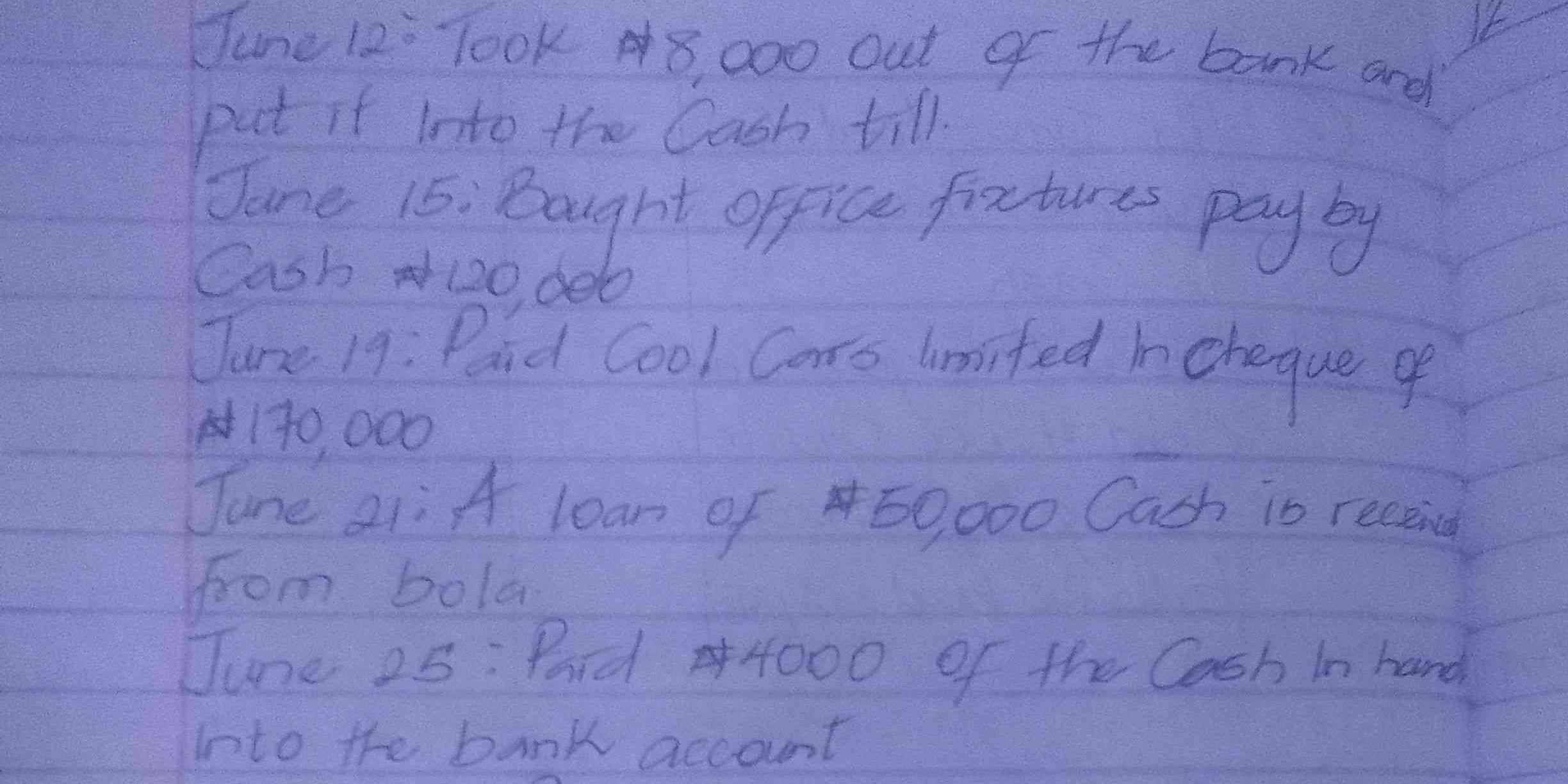

Record the following transactions: June 12: Took ₦8,000 out of the bank and put it into the cash till. June 15: Bought office fixtures pay by cash ₦120,000. June 19: Paid Cool Cars... Record the following transactions: June 12: Took ₦8,000 out of the bank and put it into the cash till. June 15: Bought office fixtures pay by cash ₦120,000. June 19: Paid Cool Cars limited in cheque of ₦170,000. June 21: A loan of ₦50,000 cash is received from Bola. June 25: Paid ₦4000 of the cash in hand into the bank account.

Understand the Problem

The image contains a list of financial transactions for a business or individual. It appears to be a record of cash inflows and outflows over a period in June. The currency appears to be the Nigerian Naira (₦). The question likely requires setting up a cash flow statement, or determining the closing cash balance.

Answer

-₦236,000

Answer for screen readers

The net cash flow is -₦236,000.

Steps to Solve

-

Identify cash inflows Cash inflows are the cash coming into the business. Based on the provided transactions, identify the cash inflows:

- June 12: Took ₦8,000 out of the bank and put it into the Cash till. This is a cash inflow of ₦8,000.

- June 21: A loan of ₦50,000 Cash is received from Bola. This is a cash inflow of ₦50,000.

-

Identify cash outflows Cash outflows are the cash leaving the business. Based on the provided transactions, identify the cash outflows:

- June 15: Bought office fixtures, pay by Cash ₦120,000. This is a cash outflow of ₦120,000.

- June 19: Paid Cool Cars limited in Cheque of ₦170,000. Note that although this is paid by cheque, for the purpose of this calculation we will assume this affects the cash balance as the question did not specify beginning bank or cash balance to reconcile for the day to day transactions. This is a cash outflow of ₦170,000.

- June 25: Paid ₦4,000 of the Cash in hand into the bank account. This affects the cash balance, meaning this is considered a decrease of cash balance. This is a cash outflow of ₦4,000.

-

Calculate total cash inflows Sum all the cash inflows identified in step 1: $$ \text{Total Cash Inflows} = ₦8,000 + ₦50,000 = ₦58,000 $$

-

Calculate total cash outflows Sum all the cash outflows identified in step 2: $$ \text{Total Cash Outflows} = ₦120,000 + ₦170,000 + ₦4,000 = ₦294,000 $$

-

Calculate the net cash flow Subtract the total cash outflows from the total cash inflows: $$ \text{Net Cash Flow} = \text{Total Cash Inflows} - \text{Total Cash Outflows} $$ $$ \text{Net Cash Flow} = ₦58,000 - ₦294,000 = -₦236,000 $$ This means there is a net cash outflow of ₦236,000.

The net cash flow is -₦236,000.

More Information

The negative sign indicates that the business spent more cash than it received during the period from June 12 to June 25. This implies a net cash outflow of ₦236,000.

Tips

A common mistake is to not keep track of whether transactions increase or decrease the cash balance when calculating total cash inflows vs total cash outflows. Another frequent mistake is missing a transaction when summing.

AI-generated content may contain errors. Please verify critical information