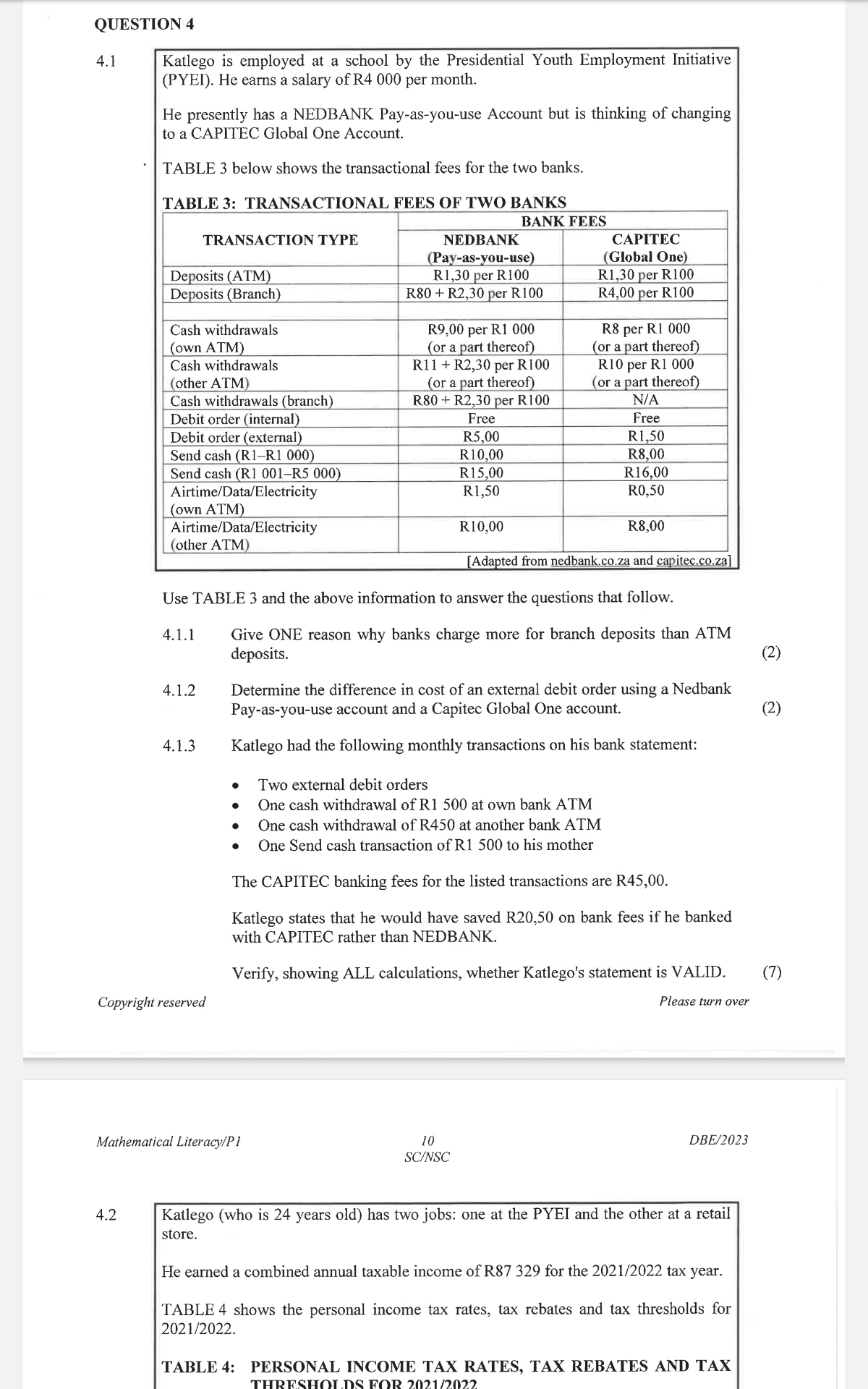

QUESTION 4 4.1 Katlego is employed at a school by the Presidential Youth Employment Initiative (PYEI). He earns a salary of R4 000 per month. He presently has a NEDBANK Pay-as-you-... QUESTION 4 4.1 Katlego is employed at a school by the Presidential Youth Employment Initiative (PYEI). He earns a salary of R4 000 per month. He presently has a NEDBANK Pay-as-you-use Account but is thinking of changing to a CAPITEC Global One Account. TABLE 3 below shows the transactional fees for the two banks. 4.1.1 Give ONE reason why banks charge more for branch deposits than ATM deposits. 4.1.2 Determine the difference in cost of an external debit order using a Nedbank Pay-as-you-use account and a Capitec Global One account. 4.1.3 Katlego had the following monthly transactions on his bank statement: Two external debit orders One cash withdrawal of R1 500 at own bank ATM One cash withdrawal of R450 at another bank ATM One Send cash transaction of R1 500 to his mother The CAPITEC banking fees for the listed transactions are R45,00. Katlego states that he would have saved R20,50 on bank fees if he banked with CAPITEC rather than NEDBANK. Verify, showing ALL calculations, whether Katlego's statement is VALID. 4.2 Katlego (who is 24 years old) has two jobs: one at the PYEI and the other at a retail store. He earned a combined annual taxable income of R87 329 for the 2021/2022 tax year. TABLE 4 shows the personal income tax rates, tax rebates and tax thresholds for 2021/2022.

Understand the Problem

This is a financial mathematics question. It involves analyzing bank transaction fees and income tax calculations to determine cost savings and tax liabilities. We need to use the provided tables to calculate and compare costs.

Answer

4. 1. 1 Higher operational costs 5. 2. 2 R3.50 6. 3. 3 Valid, savings = R20.50

Answer for screen readers

-

- 1 Banks charge more for branch deposits due to higher operational costs, such as staff salaries and infrastructure maintenance.

-

- 2 The difference in cost is R3.50.

-

- 3 Katlego's statement is valid.

Nedbank fees:

- Two external debit orders: $2 \times R5.00 = R10.00$

- One cash withdrawal of R1 500 at own bank ATM: $R9.00 \times 2 = R18.00$

- One cash withdrawal of R450 at another bank ATM: $R11 + (R2.30 \times 5) = R22.50$

- One Send cash transaction of R1 500: $R15.00$

Total Nedbank fees: $R10.00 + R18.00 + R22.50 + R15.00 = R65.50$

Difference in fees: $R65.50 - R45.00 = R20.50$

Steps to Solve

- Answer 4.1.1: Reason for higher branch deposit fees

Banks charge more for branch deposits than ATM deposits because branch deposits involve more staff and infrastructure costs (e.g., teller salaries, building maintenance).

- Answer 4.1.2: Difference in external debit order costs

The cost of an external debit order with Nedbank is R5.00, and with Capitec, it's R1.50. The difference in cost is $R5.00 - R1.50 = R3.50$.

- Answer 4.1.3: Calculate Nedbank fees

The transactions are:

- Two external debit orders: $2 \times R5.00 = R10.00$

- One cash withdrawal of R1 500 at own bank ATM: Since Nedbank charges $R9.00$ per R1 000 (or part thereof), for R1 500, the charge is $R9.00 \times 2 = R18.00$ because 1500 is between 1001 and 2000.

- One cash withdrawal of R450 at another bank ATM: Nedbank charges $R11 + R2.30$ per R100 (or part thereof). For R450, this is $R11 + (R2.30 \times 5) = R11 + R11.50 = R22.50$ (since R450 requires 5 lots of R100).

- One Send cash transaction of R1 500: The fee is R15.00. Total Nedbank fees $R10.00 + R18.00 + R22.50 + R15.00 = R65.50$

- Verify Katlego's statement

Katlego states that he would have saved R20.50 if he banked with Capitec. Capitec fees are R45.00. Nedbank fees are R65.50. The difference is : $R65.50 - R45.00 = R20.50$.

- Conclusion on Katlego's Statement.

Since the difference between Nedbank fees (R65.50) and Capitec fees (R45.00) is R20.50, Katlego's statement is valid.

-

- 1 Banks charge more for branch deposits due to higher operational costs, such as staff salaries and infrastructure maintenance.

-

- 2 The difference in cost is R3.50.

-

- 3 Katlego's statement is valid.

Nedbank fees:

- Two external debit orders: $2 \times R5.00 = R10.00$

- One cash withdrawal of R1 500 at own bank ATM: $R9.00 \times 2 = R18.00$

- One cash withdrawal of R450 at another bank ATM: $R11 + (R2.30 \times 5) = R22.50$

- One Send cash transaction of R1 500: $R15.00$

Total Nedbank fees: $R10.00 + R18.00 + R22.50 + R15.00 = R65.50$

Difference in fees: $R65.50 - R45.00 = R20.50$

More Information

Branch deposits are more expensive for banks due to the labor involved. A step-by-step breakdown is important to ensure the correctness of the answer, especially in the context of the question asking to verify the given answer.

Tips

- Incorrectly calculating the number of R100s in the ATM withdrawal at other banks.

- Misinterpreting the "per R1 000 or part thereof" condition for ATM withdrawals.

- Arithmetic errors in addition or subtraction.

AI-generated content may contain errors. Please verify critical information