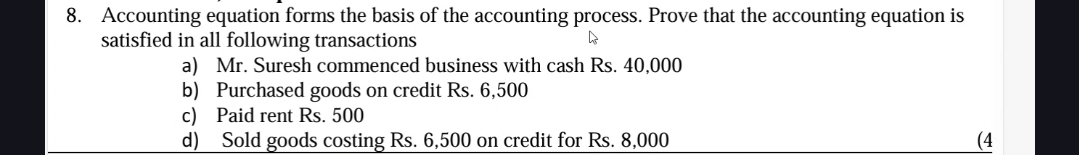

Prove that the accounting equation is satisfied in all following transactions: a) Mr. Suresh commenced business with cash Rs. 40,000 b) Purchased goods on credit Rs. 6,500 c) Paid... Prove that the accounting equation is satisfied in all following transactions: a) Mr. Suresh commenced business with cash Rs. 40,000 b) Purchased goods on credit Rs. 6,500 c) Paid rent Rs. 500 d) Sold goods costing Rs. 6,500 on credit for Rs. 8,000

Understand the Problem

The question requires demonstrating that the fundamental accounting equation (Assets = Liabilities + Equity) holds true after each of the given transactions. This involves analyzing how each transaction affects the assets, liabilities, and equity of the business and showing that the equation remains balanced.

Answer

The accounting equation (Assets = Liabilities + Equity) holds true after each transaction by adjusting the appropriate accounts.

The accounting equation (Assets = Liabilities + Equity) remains satisfied after each transaction: a) Cash (Asset) increases and Capital (Equity) increases by Rs. 40,000. b) Inventory (Asset) and Accounts Payable (Liability) increase by Rs. 6,500. c) Cash (Asset) decreases, and Retained Earnings (Equity) decreases by Rs. 500. d) Accounts Receivable (Asset) increases by Rs 8,000, Inventory (Asset) decreases by Rs 6,500, and Retained Earnings (Equity) increases by Rs 1,500 (8,000 - 6,500).

Answer for screen readers

The accounting equation (Assets = Liabilities + Equity) remains satisfied after each transaction: a) Cash (Asset) increases and Capital (Equity) increases by Rs. 40,000. b) Inventory (Asset) and Accounts Payable (Liability) increase by Rs. 6,500. c) Cash (Asset) decreases, and Retained Earnings (Equity) decreases by Rs. 500. d) Accounts Receivable (Asset) increases by Rs 8,000, Inventory (Asset) decreases by Rs 6,500, and Retained Earnings (Equity) increases by Rs 1,500 (8,000 - 6,500).

More Information

The basic accounting equation is the foundation for the double-entry accounting system. Even complex transactions can be recorded, as long as the accounting equation remains intact.

Tips

A common mistake is not understanding the dual aspect of each transaction. For example, when goods are sold on credit, both accounts receivable (asset) and retained earnings (equity) are affected.

Sources

AI-generated content may contain errors. Please verify critical information