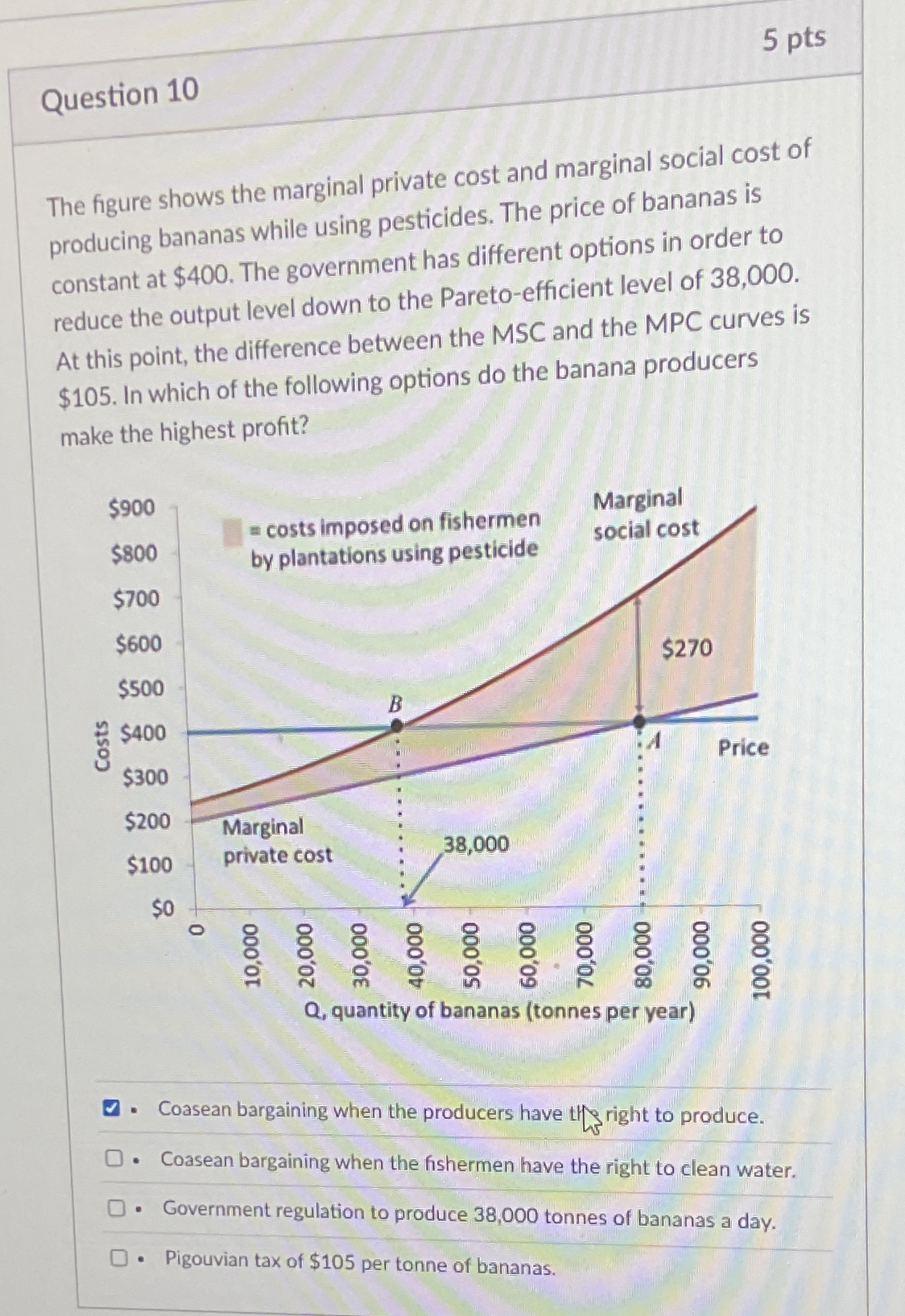

The figure shows the marginal private cost and marginal social cost of producing bananas while using pesticides. The price of bananas is constant at $400. The government has differ... The figure shows the marginal private cost and marginal social cost of producing bananas while using pesticides. The price of bananas is constant at $400. The government has different options in order to reduce the output level down to the Pareto-efficient level of 38,000. At this point, the difference between the MSC and the MPC curves is $105. In which of the following options do the banana producers make the highest profit?

Understand the Problem

The question is asking about how different economic policies affect the profits of banana producers, given a scenario with externalities (pesticide use). It provides a graph showing marginal private cost (MPC), marginal social cost (MSC), and the fixed price of bananas. You need to determine which of the listed options (Coasean bargaining or Pigouvian tax, etc.) would lead to the highest profit for the banana producers.

Answer

Coasean bargaining when the producers have the right to produce.

The banana producers make the highest profit when Coasean bargaining is used and the producers have the right to produce.

Answer for screen readers

The banana producers make the highest profit when Coasean bargaining is used and the producers have the right to produce.

More Information

Coasean bargaining allows parties to negotiate and reach an efficient solution. When producers have the right to produce, they can bargain with fishermen for compensation, potentially allowing them to maintain higher production levels and profits compared to other options like taxes or regulations.

Tips

A common mistake is to not understand the implications of each option on the producer's profit. Coasean bargaining, especially when producers have the right to produce, often leads to higher profits because it allows for negotiation and potentially less restrictive outcomes compared to taxes or direct regulations.

Sources

AI-generated content may contain errors. Please verify critical information