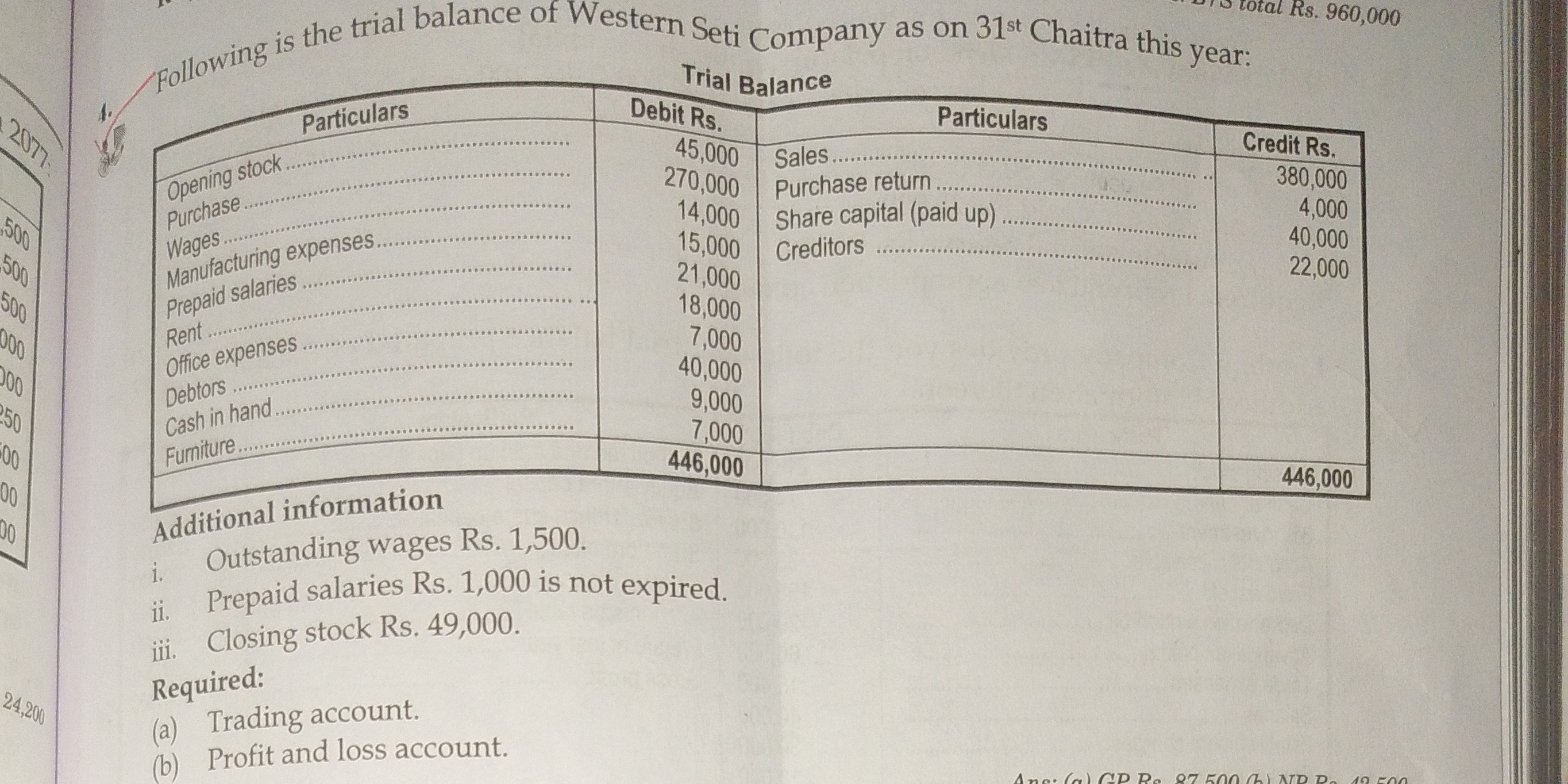

Prepare the trading account and profit and loss account for Western Seti Company based on the trial balance provided.

Understand the Problem

The question is asking for the preparation of a trading account and a profit and loss account based on the provided trial balance of Western Seti Company, including additional information about outstanding wages, prepaid salaries, and closing stock.

Answer

- Trading Account: Gross Profit is $62,500$; Profit and Loss Account: Net Profit is $61,500$.

Answer for screen readers

-

Trading Account:

- Sales: ( 380,000 )

- COGS: ( 317,500 )

- Gross Profit: ( 62,500 )

-

Profit and Loss Account:

- Gross Profit: ( 62,500 )

- Prepaid Salaries: ( 1,000 )

- Net Profit: ( 61,500 )

Steps to Solve

-

Calculate Total Purchases First, we calculate the total purchases by subtracting the purchase return from the purchases. [ \text{Total Purchases} = \text{Purchases} - \text{Purchase Returns} = 270,000 - 4,000 = 266,000 ]

-

Calculate Total Expenses We need to account for wages, manufacturing expenses, rent, and office expenses. We also need to include the outstanding wages. [ \text{Total Expenses} = \text{Wages} + \text{Manufacturing Expenses} + \text{Rent} + \text{Office Expenses} + \text{Outstanding Wages} ] [ \text{Total Expenses} = 14,000 + 15,000 + 18,000 + 7,000 + 1,500 = 55,500 ]

-

Calculate Cost of Goods Sold (COGS) The COGS is given by the formula: [ \text{COGS} = \text{Opening Stock} + \text{Total Purchases} + \text{Total Expenses} - \text{Closing Stock} ] [ \text{COGS} = 45,000 + 266,000 + 55,500 - 49,000 = 317,500 ]

-

Calculate Gross Profit Gross profit is calculated by subtracting COGS from sales. [ \text{Gross Profit} = \text{Sales} - \text{COGS} ] [ \text{Gross Profit} = 380,000 - 317,500 = 62,500 ]

-

Calculate Net Profit Now, we need to calculate the net profit by subtracting other expenses, which include prepaid salaries, from gross profit. [ \text{Net Profit} = \text{Gross Profit} - \text{Prepaid Salaries} ] [ \text{Net Profit} = 62,500 - 1,000 = 61,500 ]

-

Prepare Trading Account Finally, present the trading account: [ \text{Trading Account:} ] Sales: 380,000

Less: COGS: 317,500

Gross Profit: 62,500

-

Prepare Profit and Loss Account Present the profit and loss account: [ \text{Profit and Loss Account:} ] Gross Profit: 62,500

Less: Prepaid Salaries: 1,000

Net Profit: 61,500

-

Trading Account:

- Sales: ( 380,000 )

- COGS: ( 317,500 )

- Gross Profit: ( 62,500 )

-

Profit and Loss Account:

- Gross Profit: ( 62,500 )

- Prepaid Salaries: ( 1,000 )

- Net Profit: ( 61,500 )

More Information

The trading and profit and loss accounts provide insights into the performance of Western Seti Company. Gross profit reflects the company's efficiency in producing and selling its products, while net profit indicates overall financial health after accounting for all operating expenses.

Tips

- Ignoring outstanding or prepaid expenses: Always consider these adjustments as they affect profit calculations.

- Incorrectly calculating COGS: Ensure all components (opening stock, purchases, sales, and closing stock) are accurately included.

AI-generated content may contain errors. Please verify critical information