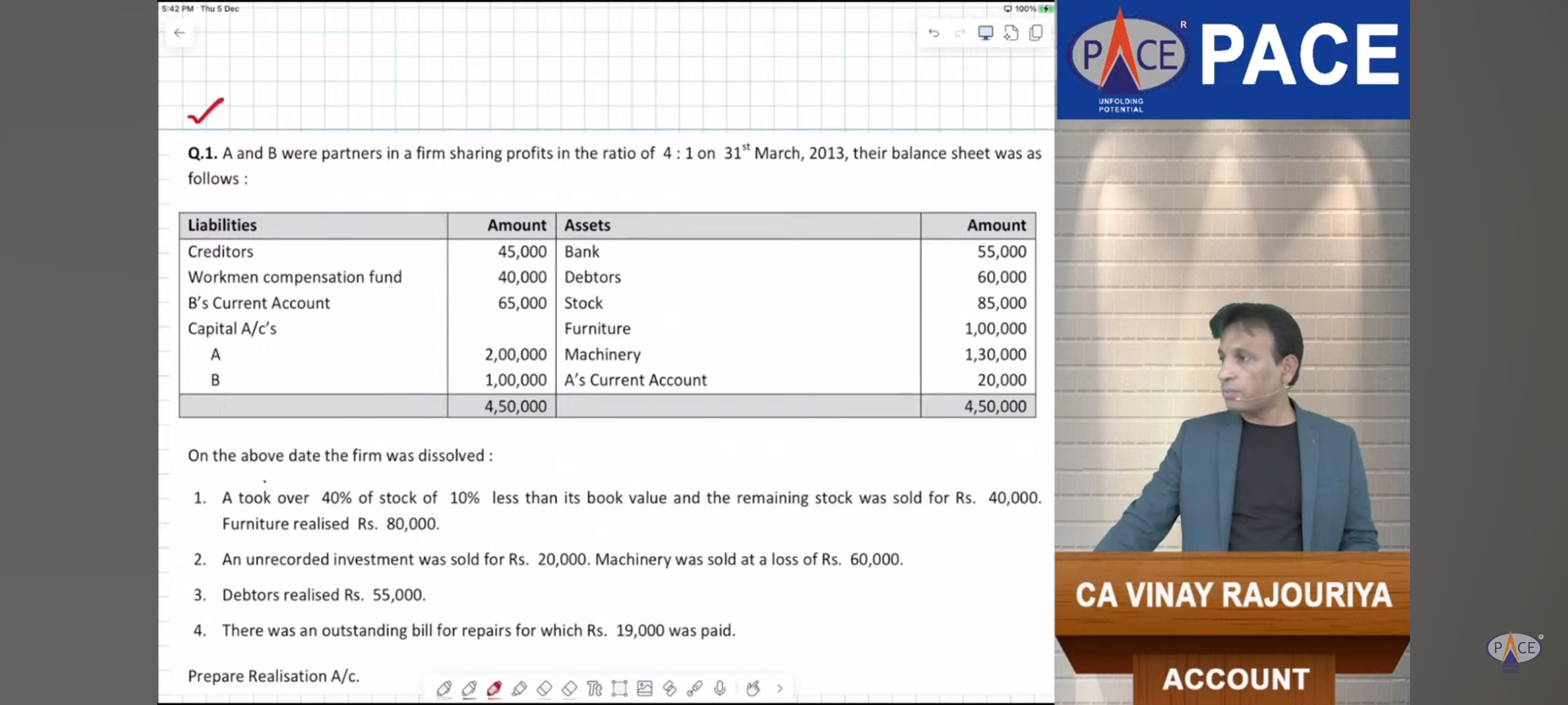

Prepare Realisation A/c.

Understand the Problem

The question is asking to prepare a Realisation Account based on the given financial information and conditions after the dissolution of a partnership firm, specifically detailing how assets were sold and liabilities settled.

Answer

The total surplus after realization is Rs. 191,600.

Answer for screen readers

The Realization Account will look like:

| Particulars | Amount (Rs) |

|---|---|

| To Stock (realized) | 30,600 |

| To Stock (remaining) | 40,000 |

| To Furniture | 80,000 |

| To Unrecorded Investment | 20,000 |

| To Debtors | 55,000 |

| To Machinery (realized) | 70,000 |

| Total Realizations | 295,600 |

| By Creditors | 45,000 |

| By Workmen Compensation Fund | 40,000 |

| By Outstanding Bill for Repairs | 19,000 |

| Total Liabilities | 104,000 |

| By Surplus | 191,600 |

Steps to Solve

-

List the assets and their realizations

- Calculate the realizations for each asset:

- For stock, A took over 40% at 10% less than book value:

- Book value of 40% of stock: $0.4 \times 85,000 = 34,000$

- Realization from A: $34,000 - 10% \times 34,000 = 30,600$

- Remaining stock realized: $40,000$

- Furniture realized: $80,000$

- Unrecorded investment realized: $20,000$

- Debtors realized: $55,000$

- Machinery was sold at a loss of $60,000:

- Book value of machinery: $130,000$

- Realization from machinery: $130,000 - 60,000 = 70,000$

- For stock, A took over 40% at 10% less than book value:

- Calculate the realizations for each asset:

-

Calculate total assets realized

- Add up the realizations:

- Total realizations = $30,600 + 40,000 + 80,000 + 20,000 + 55,000 + 70,000 = 295,600$

- Add up the realizations:

-

List the liabilities and payments

- The liabilities include:

- Creditors: $45,000$

- Workmen compensation fund: $40,000$

- Outstanding bill for repairs: $19,000$

- Total liabilities = $45,000 + 40,000 + 19,000 = $104,000$

- The liabilities include:

-

Calculate net surplus or deficit

- Determine the difference between total realizations and total liabilities:

- Net balance = $295,600 - 104,000 = 191,600$

- Determine the difference between total realizations and total liabilities:

-

Prepare the Realization Account

- Debit side: list realizations with totals.

- Credit side: list liabilities with totals and the net balance carried forward.

The Realization Account will look like:

| Particulars | Amount (Rs) |

|---|---|

| To Stock (realized) | 30,600 |

| To Stock (remaining) | 40,000 |

| To Furniture | 80,000 |

| To Unrecorded Investment | 20,000 |

| To Debtors | 55,000 |

| To Machinery (realized) | 70,000 |

| Total Realizations | 295,600 |

| By Creditors | 45,000 |

| By Workmen Compensation Fund | 40,000 |

| By Outstanding Bill for Repairs | 19,000 |

| Total Liabilities | 104,000 |

| By Surplus | 191,600 |

More Information

This Realization Account shows how the partnership's assets were liquidated and liabilities settled upon dissolution. The net surplus indicates the remaining amount after settling all obligations, which can then be distributed among the partners according to their profit-sharing ratio.

Tips

- Miscalculating the realizations or individual components of assets.

- Failing to account for all liabilities accurately.

- Forgetting to adjust for losses on the sale of assets like machinery.

AI-generated content may contain errors. Please verify critical information