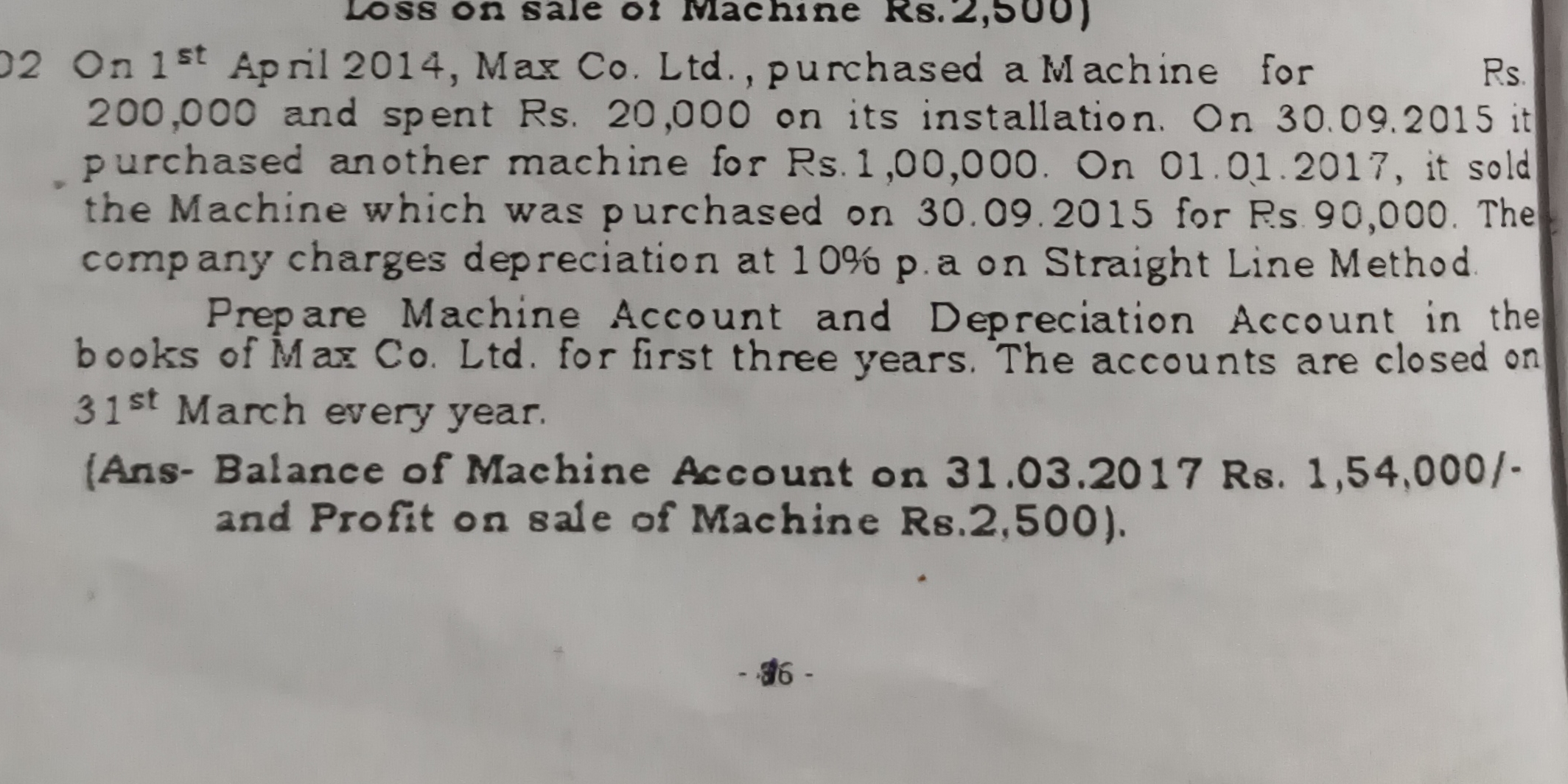

Prepare Machine Account and Depreciation Account in the books of Max Co. Ltd. for first three years. The accounts are closed on 31st March every year.

Understand the Problem

The question is asking to prepare the Machine Account and Depreciation Account for Max Co. Ltd. over the first three years based on given purchase and sale dates, costs, depreciation rates, and specific financial values.

Answer

Balance of Machine Account on 31.03.2017 is Rs. 154,000 and profit on sale of machine is Rs. 5,000.

Answer for screen readers

The balance of the Machine Account on 31.03.2017 is Rs. 154,000 and the profit on the sale of the machine is Rs. 5,000.

Steps to Solve

-

Calculate the total cost of the first machine The first machine was purchased for Rs. 200,000, with an installation cost of Rs. 20,000. Total cost = Rs. 200,000 + Rs. 20,000 = Rs. 220,000.

-

Determine depreciation for the first machine (2014-2016) Depreciation is charged at 10% p.a. on the total cost. For the first machine: Annual depreciation = (10% \times 220,000 = Rs. 22,000).

For three years (from 2014 to 2016): Total depreciation = (3 \times 22,000 = Rs. 66,000).

-

Calculate the book value of the first machine on 31.03.2017 Book value = Total cost - Total depreciation. Book value = Rs. 220,000 - Rs. 66,000 = Rs. 154,000.

-

Record the purchase of the second machine The second machine was purchased on 30.09.2015 for Rs. 100,000. Book value at time of purchase is Rs. 100,000, with no installation cost.

-

Determine depreciation for the second machine (2015-2017) For the second machine: Annual depreciation = (10% \times 100,000 = Rs. 10,000).

Depreciation for one and a half years (30.09.2015 to 31.03.2017): Total depreciation = (1.5 \times 10,000 = Rs. 15,000).

-

Calculate book value of the second machine on 31.03.2017 Book value = Total cost - Total depreciation. Book value = Rs. 100,000 - Rs. 15,000 = Rs. 85,000.

-

Determine the total book value of machines on 31.03.2017 Total book value = Book value of the first machine + Book value of the second machine. Total book value = Rs. 154,000 + Rs. 85,000 = Rs. 239,000.

-

Account for the sale of the second machine The second machine was sold on 01.01.2017 for Rs. 90,000.

-

Calculate gain/loss on sale of the second machine Find the book value of the second machine at the time of sale (30.09.2015 to 01.01.2017): Book value at sale = Rs. 100,000 - Rs. 15,000 = Rs. 85,000. Loss on sale = Book value - Sale price = Rs. 85,000 - Rs. 90,000 = Rs. 5,000 (profit).

The balance of the Machine Account on 31.03.2017 is Rs. 154,000 and the profit on the sale of the machine is Rs. 5,000.

More Information

The machine accounts reflect the impact of purchases, depreciation, and sales on the financial statements. Understanding these transactions is crucial for maintaining accurate financial records.

Tips

- Miscalculating total depreciation by not considering partial years correctly.

- Forgetting to include installation costs when calculating the initial cost of machines.

- Confusing profitable sales with loss on sales by failing to account for accumulated depreciation.

AI-generated content may contain errors. Please verify critical information