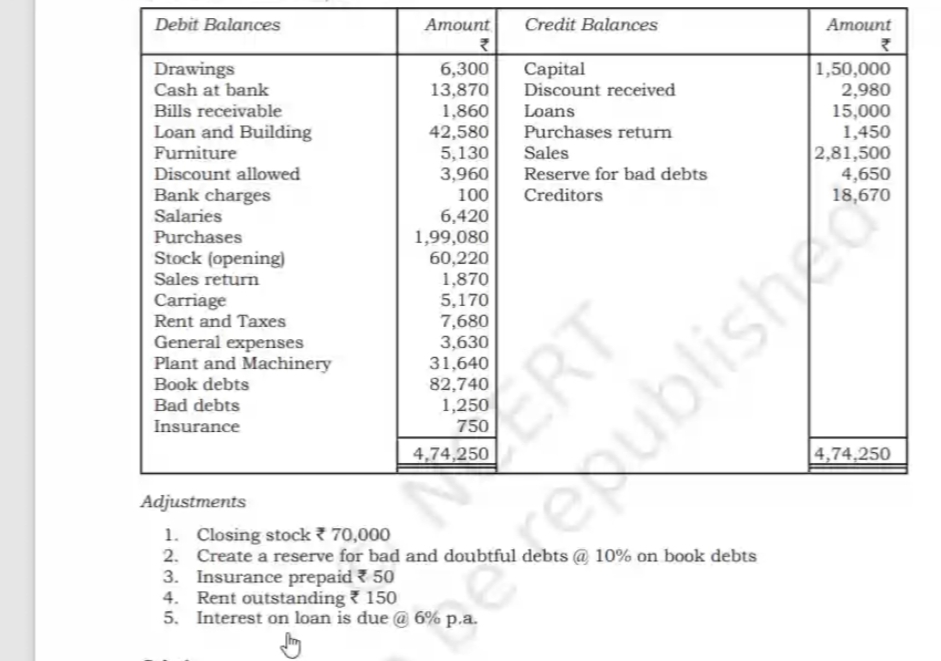

Prepare financial statements based on the provided debit and credit balances and adjustments.

Understand the Problem

The question provides debit and credit balances, along with some adjustments. It seems to require the preparation of financial statements like a trial balance, trading and profit & loss account, or a balance sheet. More context is needed to determine the exact requirement.

Answer

New Reserve for Bad Debts: ₹8,274 Additional Bad Debts Expense: ₹3,624 Prepaid Insurance: ₹50 Outstanding Rent: ₹150 Outstanding Interest on Loan: ₹900

Answer for screen readers

The adjusted values from the provided information are:

New Reserve for Bad Debts: ₹8,274 Additional Bad Debts Expense: ₹3,624 Prepaid Insurance: ₹50 Outstanding Rent: ₹150 Outstanding Interest on Loan: ₹900

Steps to Solve

-

Calculate the new reserve for bad debts. Calculate 10% of book debts: $82,740 \times 0.10 = ₹8,274$

-

Calculate additional bad debts expense. Determine the increase in reserve: $₹8,274 - ₹4,650 = ₹3,624$. This is an additional expense.

-

Calculate prepaid insurance. The adjustment states prepaid insurance is ₹50

-

Calculate outstanding rent. The adjustment states outstanding rent is ₹150

-

Calculate outstanding interest on loan. Calculate 6% interest on the ₹15,000 loan: $₹15,000 \times 0.06 = ₹900$

The adjusted values from the provided information are:

New Reserve for Bad Debts: ₹8,274 Additional Bad Debts Expense: ₹3,624 Prepaid Insurance: ₹50 Outstanding Rent: ₹150 Outstanding Interest on Loan: ₹900

More Information

These adjustments are crucial for preparing accurate financial statements. They ensure that revenues and expenses are recognized in the correct accounting period and that assets and liabilities are fairly stated.

Tips

- Failing to calculate the additional bad debts expense. Many students calculate the new reserve correctly but forget to account for the existing reserve when determining the expense.

- Forgetting to adjust for prepaid expenses or outstanding expenses/liabilities.

- Incorrectly calculating percentages.

AI-generated content may contain errors. Please verify critical information