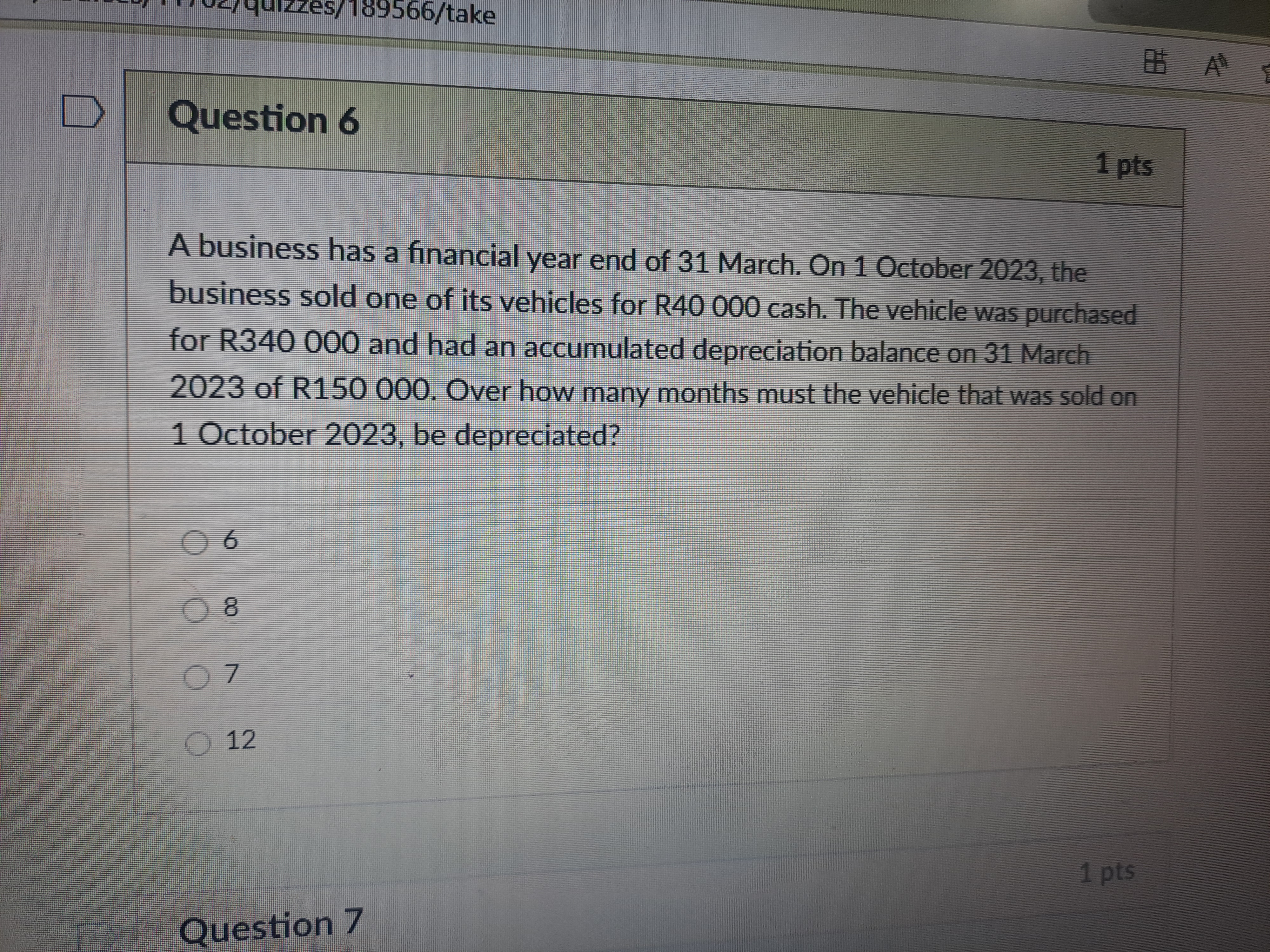

Over how many months must the vehicle that was sold on 1 October 2023, be depreciated?

Understand the Problem

The question is asking how many months the vehicle, sold on 1 October 2023, needs to be depreciated based on its purchase price and accumulated depreciation. This involves understanding depreciation and the timeline of the financial year.

Answer

6

Answer for screen readers

The vehicle must be depreciated for $6$ months.

Steps to Solve

- Identify financial year end and sale date

The financial year ends on 31 March. The vehicle is sold on 1 October 2023. We need to find out how many months are left in the financial year after the sale date.

- Calculate time until financial year end

From 1 October 2023 to 31 March 2024, we can calculate the number of months:

- October (remaining portion): 1 month

- November: 1 month

- December: 1 month

- January: 1 month

- February: 1 month

- March: 1 month

Summing these gives us: $$ \text{Total months} = 5 \text{ months} (full months) + 1 \text{ month (October)} = 6 \text{ months} $$

- Determine the final answer

The total number of months that the vehicle must be depreciated after it's sold is 6 months.

The vehicle must be depreciated for $6$ months.

More Information

A vehicle's depreciation period indicates the duration over which its value decreases due to wear and use. Since this vehicle's sale occurs at the end of the financial year, it's crucial to account for all months from the sale to the financial year-end.

Tips

- Miscalculating the months by not including the sale month correctly or by omitting the end month.

- Confusing the financial year-end with the calendar month-end.

AI-generated content may contain errors. Please verify critical information