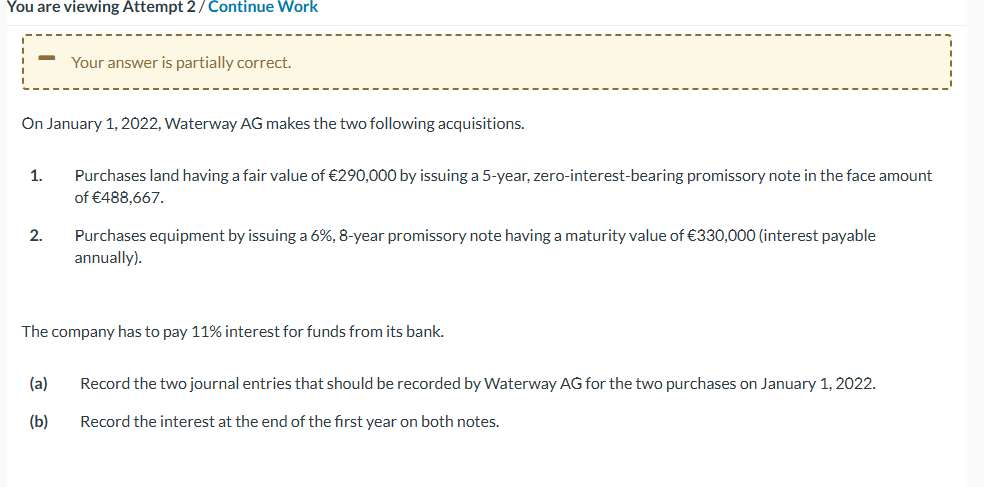

On January 1, 2022, Waterway AG makes two acquisitions. 1. Purchases land for €290,000 by issuing a 5-year, zero-interest-bearing promissory note with a face amount of €488,667. 2.... On January 1, 2022, Waterway AG makes two acquisitions. 1. Purchases land for €290,000 by issuing a 5-year, zero-interest-bearing promissory note with a face amount of €488,667. 2. Purchases equipment with a 6%, 8-year promissory note having a maturity value of €330,000 (interest payable annually). Record the two journal entries for both purchases on January 1, 2022, and the interest at the end of the first year on both notes.

Understand the Problem

The question requires journal entries for two acquisitions made by Waterway AG, a land purchase and an equipment purchase. Additionally, it asks for the interest calculation at the end of the first year for both promissory notes.

Answer

1. Land Purchase: - Debit Land €290,000 - Debit Discount on Notes Payable €198,667 - Credit Notes Payable €488,667 2. Equipment Purchase: - Debit Equipment €330,000 - Credit Notes Payable €330,000 3. Interest at Year-End: - Land Note: No interest - Equipment Note: €19,800

Answer for screen readers

-

Journal Entries:

- Land Purchase:

- Debit Land €290,000

- Debit Discount on Notes Payable €198,667

- Credit Notes Payable €488,667

- Equipment Purchase:

- Debit Equipment €330,000

- Credit Notes Payable €330,000

- Land Purchase:

-

Interest at Year-End:

- Land Note: No periodic interest; total amount due at maturity.

- Equipment Note: €19,800

Steps to Solve

- Journal Entry for Land Purchase

Waterway AG purchases land for €290,000 by issuing a zero-interest-bearing promissory note of €488,667.

The journal entry is:

- Debit Land €290,000

- Debit Discount on Notes Payable (difference) €198,667

- Credit Notes Payable €488,667

Calculation of Discount:

$$

\text{Discount} = \text{Face Value} - \text{Fair Value} = €488,667 - €290,000 = €198,667

$$

- Journal Entry for Equipment Purchase

Waterway AG purchases equipment for €330,000 with a 6% promissory note (interest payable annually).

The journal entry is:

- Debit Equipment €330,000

- Credit Notes Payable €330,000

- Calculate Interest at Year-End for Land Note

Since the land note is zero-interest-bearing, the interest is not calculated regularly; the total amount will be paid at maturity. However, for records:

$$ \text{Interest Expense} = \text{Discount} \times \text{Interest Rate}

$$

This note does not incur periodic interest payments, but we need to account for the discount amortization.

- Calculate Interest at Year-End for Equipment Note

For the equipment note, calculate annual interest:

$$ \text{Interest} = \text{Principal} \times \text{Interest Rate} = €330,000 \times 0.06 = €19,800 $$

-

Journal Entries:

- Land Purchase:

- Debit Land €290,000

- Debit Discount on Notes Payable €198,667

- Credit Notes Payable €488,667

- Equipment Purchase:

- Debit Equipment €330,000

- Credit Notes Payable €330,000

- Land Purchase:

-

Interest at Year-End:

- Land Note: No periodic interest; total amount due at maturity.

- Equipment Note: €19,800

More Information

The total amount due on the land note involves a significant discount that is amortized over its term. The equipment note incurs actual interest that affects annual cash flow.

Tips

- Not recognizing that zero-interest-bearing notes do not have annual interest payments.

- Miscalculating the interest on the equipment note by not using the correct interest rate.

AI-generated content may contain errors. Please verify critical information