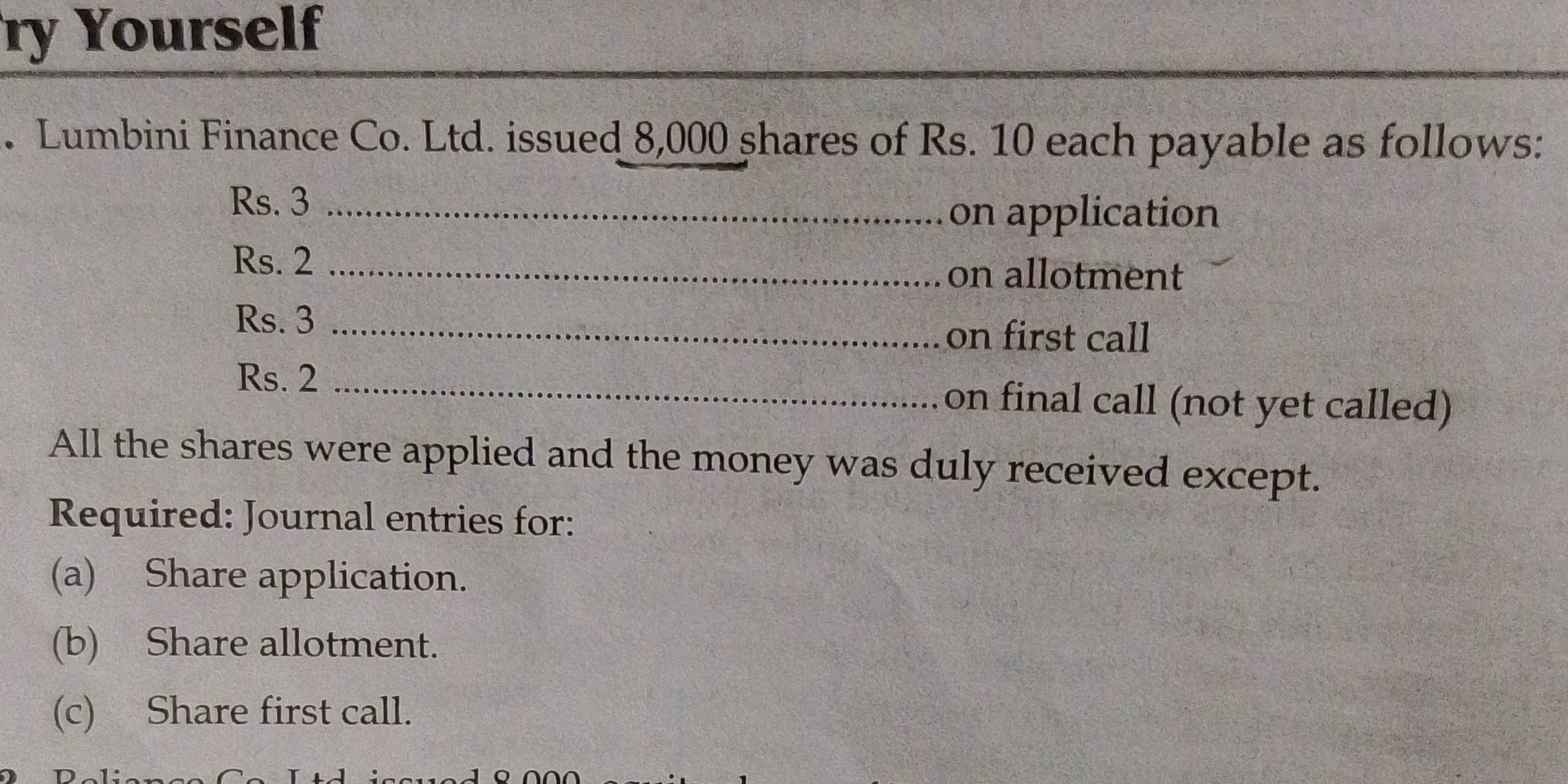

Lumbini Finance Co. Ltd. issued 8,000 shares of Rs. 10 each payable as follows: Rs. 3 on application, Rs. 2 on allotment, Rs. 3 on first call, and Rs. 2 on final call (not yet call... Lumbini Finance Co. Ltd. issued 8,000 shares of Rs. 10 each payable as follows: Rs. 3 on application, Rs. 2 on allotment, Rs. 3 on first call, and Rs. 2 on final call (not yet called). Required: Journal entries for: (a) Share application. (b) Share allotment. (c) Share first call.

Understand the Problem

The question is asking for the journal entries related to the issuance of shares by Lumbini Finance Co. Ltd., specifically for share application, share allotment, and share first call.

Answer

The journal entries record cash inflows for share applications, allotments, and calls, demonstrating how the funds are allocated across different accounts.

Answer for screen readers

The journal entries are:

-

For Share Application:

Bank Account Dr. 24,000 To Share Application Account 24,000 -

For Share Allotment:

Share Application Account Dr. 24,000 To Share Capital Account 16,000 To Share Allotment Account 8,000 -

For Share First Call:

Share Allotment Account Dr. 24,000 To Share First Call Account 24,000

Steps to Solve

- Calculate Total for Each Share Transaction

First, determine the total amount for each share transaction based on the number of shares and the amount payable at each stage:

- Application: $8,000 \text{ shares} \times Rs.3 = Rs. 24,000$

- Allotment: $8,000 \text{ shares} \times Rs.2 = Rs. 16,000$

- First Call: $8,000 \text{ shares} \times Rs.3 = Rs. 24,000$

- Journal Entry for Share Application

Record the journal entry for the share application:

-

Debit: Bank Account $Rs. 24,000$

-

Credit: Share Application Account $Rs. 24,000$

The entry would be:

Bank Account Dr. 24,000 To Share Application Account 24,000

- Journal Entry for Share Allotment

Next, record the journal entry for share allotment:

-

Debit: Share Application Account $Rs. 24,000$

-

Credit: Share Capital Account $Rs. 16,000$

-

Credit: Share Allotment Account $Rs. 16,000$

The entry would be:

Share Application Account Dr. 24,000 To Share Capital Account 16,000 To Share Allotment Account 8,000

- Journal Entry for Share First Call

Finally, record the journal entry for the share first call:

-

Debit: Share Allotment Account $Rs. 16,000$

-

Credit: Share First Call Account $Rs. 24,000$

The entry would be:

Share Allotment Account Dr. 24,000 To Share First Call Account 24,000

The journal entries are:

-

For Share Application:

Bank Account Dr. 24,000 To Share Application Account 24,000 -

For Share Allotment:

Share Application Account Dr. 24,000 To Share Capital Account 16,000 To Share Allotment Account 8,000 -

For Share First Call:

Share Allotment Account Dr. 24,000 To Share First Call Account 24,000

More Information

These journal entries represent the financial transactions for the issuance of shares, showing the inflow of cash into the Bank Account and how it is allocated between the Share Application, Share Allotment, and Share First Call accounts.

Tips

- Incorrectly Applying the Amounts: Ensure the correct amounts are used for each transaction based on the share pricing.

- Missing Accounts: Make sure to include all necessary accounts in each entry.

AI-generated content may contain errors. Please verify critical information