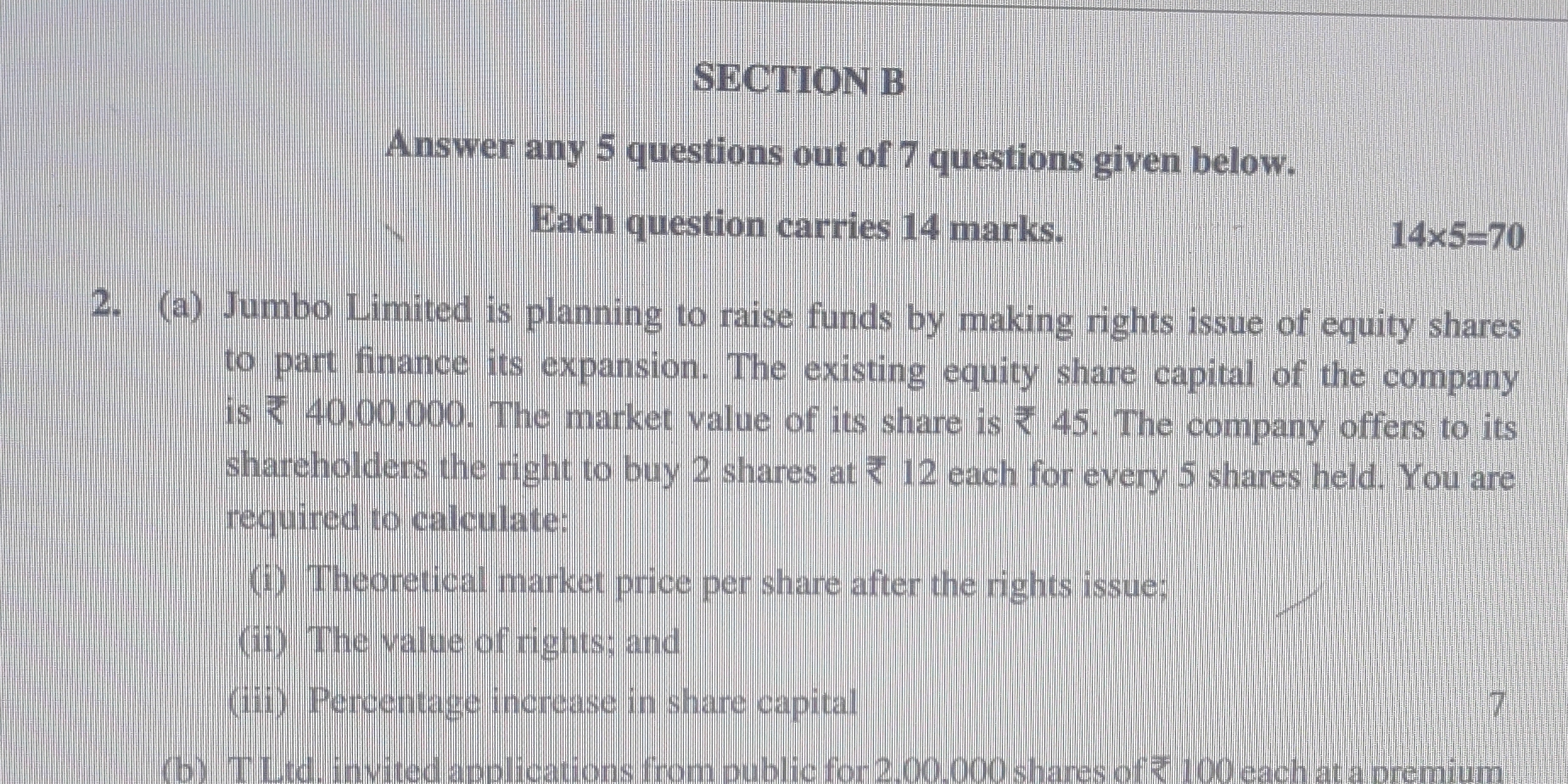

Jumbo Limited is planning to raise funds by making rights issue of equity shares to part finance its expansion. The existing equity share capital of the company is ₹ 40,00,000. The... Jumbo Limited is planning to raise funds by making rights issue of equity shares to part finance its expansion. The existing equity share capital of the company is ₹ 40,00,000. The market value of its share is ₹ 45. The company offers to its shareholders the right to buy 2 shares at ₹ 12 each for every 5 shares held. You are required to calculate: (i) Theoretical market price per share after the rights issue; (ii) The value of rights; and (iii) Percentage increase in share capital

Understand the Problem

The question presents a scenario where Jumbo Limited is raising funds through a rights issue of equity shares. We are asked to calculate: (i) the theoretical market price per share after the rights issue, (ii) the value of the rights, and (iii) the percentage increase in share capital. This requires understanding of financial concepts related to rights issues and their impact on share price and capital structure.

Answer

(i) $₹ 35.57$ (ii) $₹ 9.43$ (iii) $10.67\%$

Answer for screen readers

(i) Theoretical market price per share after the rights issue = $₹ 35.57$ (ii) The value of rights = $₹ 9.43$ (iii) Percentage increase in share capital = $10.67%$

Steps to Solve

- Calculate the number of existing shares

Divide the existing equity share capital by the market value per share to find the number of existing shares.

Number of existing shares = $\frac{40,00,000}{45} = 88,888.89 \approx 88,889$ shares

- Calculate the number of new shares issued

The company offers 2 shares for every 5 shares held.

Number of new shares = $\frac{2}{5} \times 88,889 = 35,555.6 \approx 35,556$ shares

- Calculate the total number of shares after the rights issue

Add the number of existing shares and the number of new shares.

Total number of shares = $88,889 + 35,556 = 124,445$ shares

- Calculate the total value of existing shares before the rights issue

Multiply the number of existing shares by the market value per share.

Total value of existing shares = $88,889 \times 45 = 40,00,005$

- Calculate the total value of new shares issued through the rights issue

Multiply the number of new shares by the issue price.

Total value of new shares = $35,556 \times 12 = 4,26,672$

- Calculate the aggregate value of shares after the rights issue

Add the total value of existing shares and the total value of new shares.

Aggregate value of shares = $40,00,005 + 4,26,672 = 44,26,677$

- Calculate the theoretical market price per share after the rights issue

Divide the aggregate value of shares by the total number of shares.

Theoretical market price per share = $\frac{44,26,677}{124,445} = 35.57$

- Calculate the value of the right

Value of right = $\frac{\text{Market price before right issue} - \text{Issue price}}{\text{Number of rights required to buy one share} + 1}$

Value of right = $\frac{45 - 12}{\frac{5}{2} + 1} = \frac{33}{3.5} = 9.43$

- Calculate the increase in share capital

Increase in share capital = Number of new shares $\times$ Issue price = $35,556 \times 12 = 4,26,672$

Existing share capital = $40,00,000$

Percentage increase in share capital = $\frac{\text{Increase in share capital}}{\text{Existing share capital}} \times 100$

Percentage increase in share capital = $\frac{4,26,672}{40,00,000} \times 100 = 10.67%$

(i) Theoretical market price per share after the rights issue = $₹ 35.57$ (ii) The value of rights = $₹ 9.43$ (iii) Percentage increase in share capital = $10.67%$

More Information

A rights issue is a way for companies to raise capital by offering existing shareholders the opportunity to buy new shares, usually at a discount to the current market price. This allows shareholders to maintain their proportional ownership in the company. The value of the right represents the theoretical benefit a shareholder receives from being able to purchase shares at a discounted price relative to the market price before the rights issue.

Tips

- Incorrectly calculating the number of new shares: Failing to correctly apply the ratio of new shares offered per existing share held.

- Using the wrong values in the formula for the value of the right: Confusing the market price before the rights issue with the issue price.

- Miscalculating the percentage increase in share capital: Incorrectly determining the increase in share capital or using the wrong base for percentage calculation.

- Rounding errors: Rounding off numbers at intermediate steps can lead to a significant difference in the final answer. It is best to avoid premature rounding or use more decimal places in calculations.

AI-generated content may contain errors. Please verify critical information