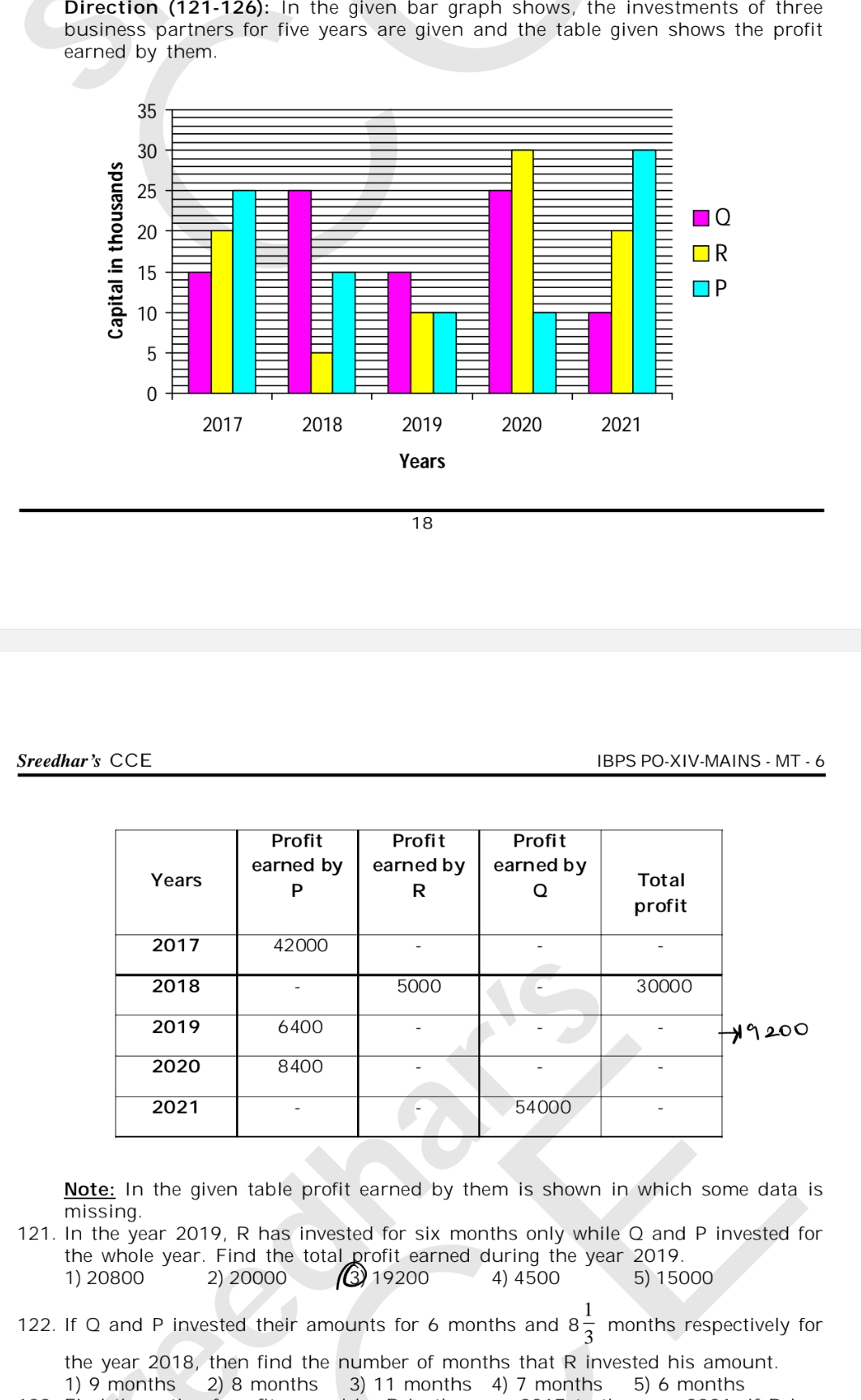

In the year 2019, R has invested for six months only while Q and P invested for the whole year. Find the total profit earned during the year 2019.

Understand the Problem

The question is asking us to calculate the total profit earned by business partner R in the year 2019, given that R invested for only six months while Q and P invested for the whole year. We also need to understand the data from the accompanying graph and table to derive the necessary figures.

Answer

$6400$

Answer for screen readers

The total profit earned by partner R in the year 2019 is $6400$.

Steps to Solve

-

Identify Profits and Shares in 2019 R's investment duration is 6 months, while P and Q invested for the entire year. We know Q's profit in 2019 is not given but needs to be derived.

-

Understanding the Total Profit in 2019 From the table, the total profit for 2019 is given as ( 19200 ). This total is the sum of profits earned by P, R, and Q: $$ P + R + Q = 19200 $$

-

Find Profit Earned by P From the table, it is clear that P's profit in 2019 is given as ( 6400 ).

-

Substitute Known Values into the Equation We substitute P's profit into the total profit equation: $$ 6400 + R + Q = 19200 $$

-

Rearranging the Equation Now, we can isolate R and Q: $$ R + Q = 19200 - 6400 $$ $$ R + Q = 12800 $$

-

Determine R's Profit Now we know that R, who invested for 6 months, will earn a proportion of the total profit. Since R invested for half of the year, R's profit can be expressed as: $$ R = \frac{6}{12} \times 12800 $$ $$ R = 0.5 \times 12800 $$

-

Calculate R's Profit Calculating this gives: $$ R = 6400 $$

The total profit earned by partner R in the year 2019 is $6400$.

More Information

In a partnership earnings scenario, when one partner invests for only part of the year, their profit needs to be adjusted based on the time they invested. This is an important aspect of shared profits among partners.

Tips

- Misunderstanding Investment Timeframes: Failing to account for the time periods of investments can lead to incorrect profit calculations.

- Arithmetic Errors: Simple arithmetic mistakes during calculations can alter the final profit amounts.

AI-generated content may contain errors. Please verify critical information