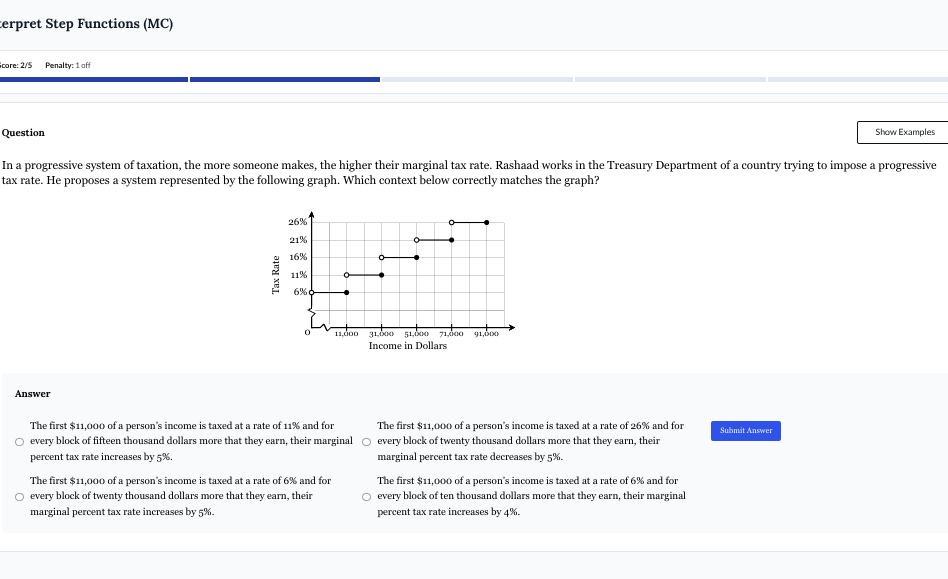

In a progressive system of taxation, the more someone makes, the higher their marginal tax rate. Rashaad works in the Treasury Department of a country trying to impose a progressiv... In a progressive system of taxation, the more someone makes, the higher their marginal tax rate. Rashaad works in the Treasury Department of a country trying to impose a progressive tax rate system represented by the following graph. Which context below correctly matches the graph?

Understand the Problem

The question is asking for the correct contextual interpretation of a graph representing a progressive tax system. It requires us to match the graph with the appropriate statements about how income is taxed at different levels.

Answer

The first $11,000 of a person's income is taxed at a rate of 6% and for every block of $10,000 more that they earn, their marginal percent tax rate increases by 4%.

Answer for screen readers

The first $11,000 of a person's income is taxed at a rate of 6% and for every block of $10,000 more that they earn, their marginal percent tax rate increases by 4%.

Steps to Solve

-

Examine the Graph Observe the tax rate represented in the graph, noting how it changes with increasing income. The graph indicates different segments represented by horizontal steps.

-

Identify Tax Brackets Determine the tax brackets by analyzing the income levels on the x-axis. For example, check where the tax rate changes (jumps) at specific income levels.

-

Interpret Tax Rates From the graph, the tax rates appear to start at 6% for incomes up to a certain level, then increase to 11%, and finally reach 26%.

-

Match Income Levels to Tax Rates Calculate the corresponding income levels for each tax rate to match them with the statements provided. For example, if the first $11,000 is taxed at 6%, this could be aligned with one of the options.

-

Match Statements to the Graph Read through the provided answer options, and identify which describes the tax rates at the specified income levels that align with the graph's tax rate segments.

The first $11,000 of a person's income is taxed at a rate of 6% and for every block of $10,000 more that they earn, their marginal percent tax rate increases by 4%.

More Information

In progressive tax systems, individuals pay higher rates on higher income levels. This method effectively redistributes wealth while ensuring those with greater ability to pay contribute a fairer share.

Tips

- Confusing income levels with tax rates; ensure to read both axes carefully.

- Misinterpreting the increases in tax rates; ensure the relationship between income blocks and tax increases is correctly understood.

AI-generated content may contain errors. Please verify critical information