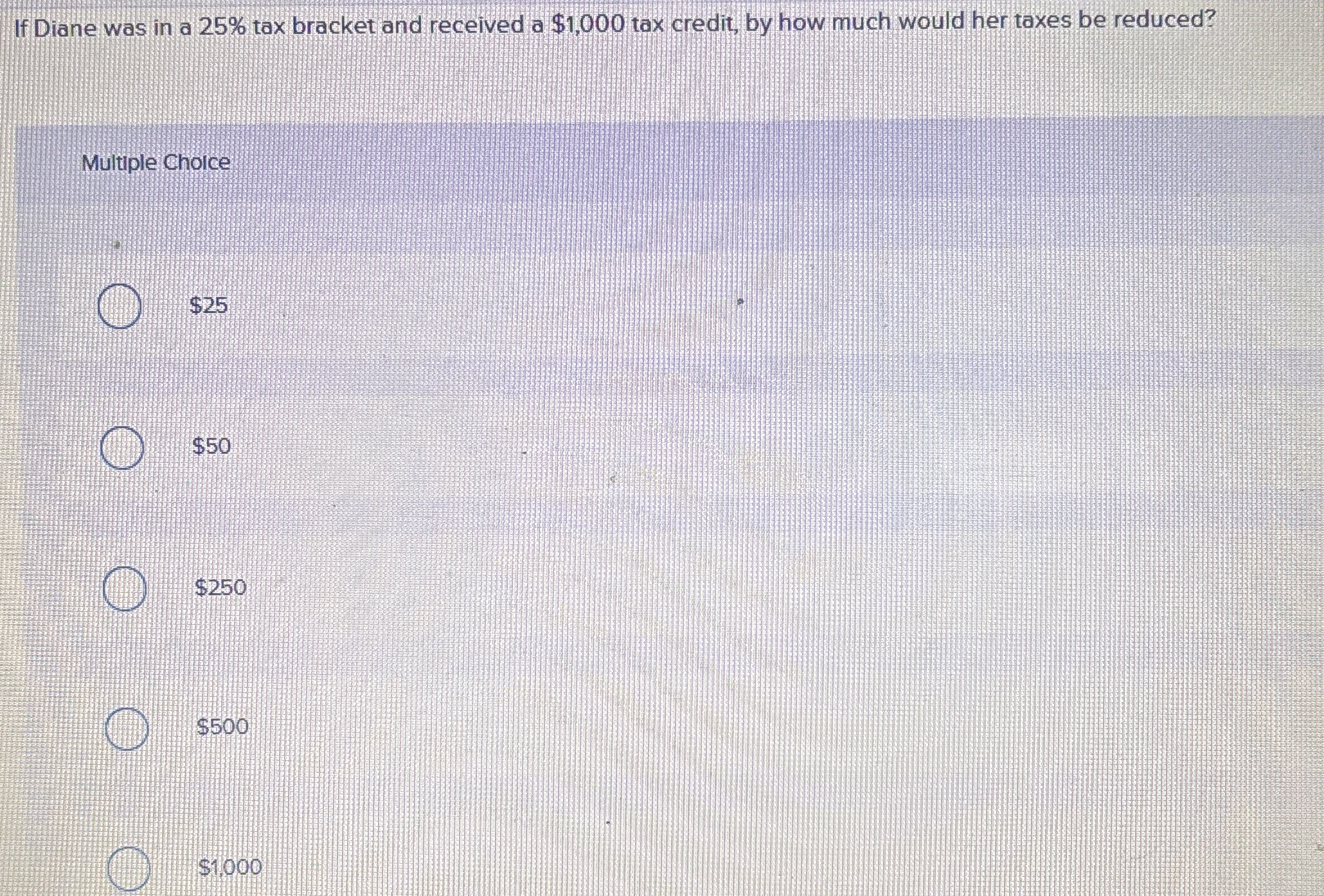

If Diane was in a 25% tax bracket and received a $1,000 tax credit, by how much would her taxes be reduced?

Understand the Problem

The question is asking for the amount by which Diane's taxes would be reduced based on a given tax credit and tax bracket. Since she is in a 25% tax bracket and receives a $1,000 tax credit, the goal is to determine the actual reduction in taxes. The calculation involves understanding how tax credits work in relation to tax brackets.

Answer

$1,000$

Answer for screen readers

$1,000$

Steps to Solve

-

Identify the impact of the tax credit

A tax credit directly reduces the amount of tax owed. Since Diane has a $1,000 tax credit, this amount will be deducted from her taxes. -

Determine the final reduction in taxes

The total reduction in Diane's taxes due to the tax credit is equal to the credit itself. Therefore, regardless of her tax bracket, a $1,000 credit reduces her taxes by $1,000. -

Final Calculation

Since tax credits reduce taxes dollar-for-dollar, the calculation for the tax reduction is:

$$ \text{Tax Reduction} = \text{Tax Credit} = 1000 $$

$1,000$

More Information

A tax credit is a benefit that reduces the amount of tax owed directly. Since Diane received a $1,000 tax credit, her taxes are reduced by the full $1,000, not influenced by her tax bracket.

Tips

- Confusing tax credits with tax deductions: A tax credit directly reduces taxes owed, while tax deductions reduce taxable income.

- Miscalculating the impact of a tax bracket on tax credits, which is unnecessary since credits are applied directly.

AI-generated content may contain errors. Please verify critical information