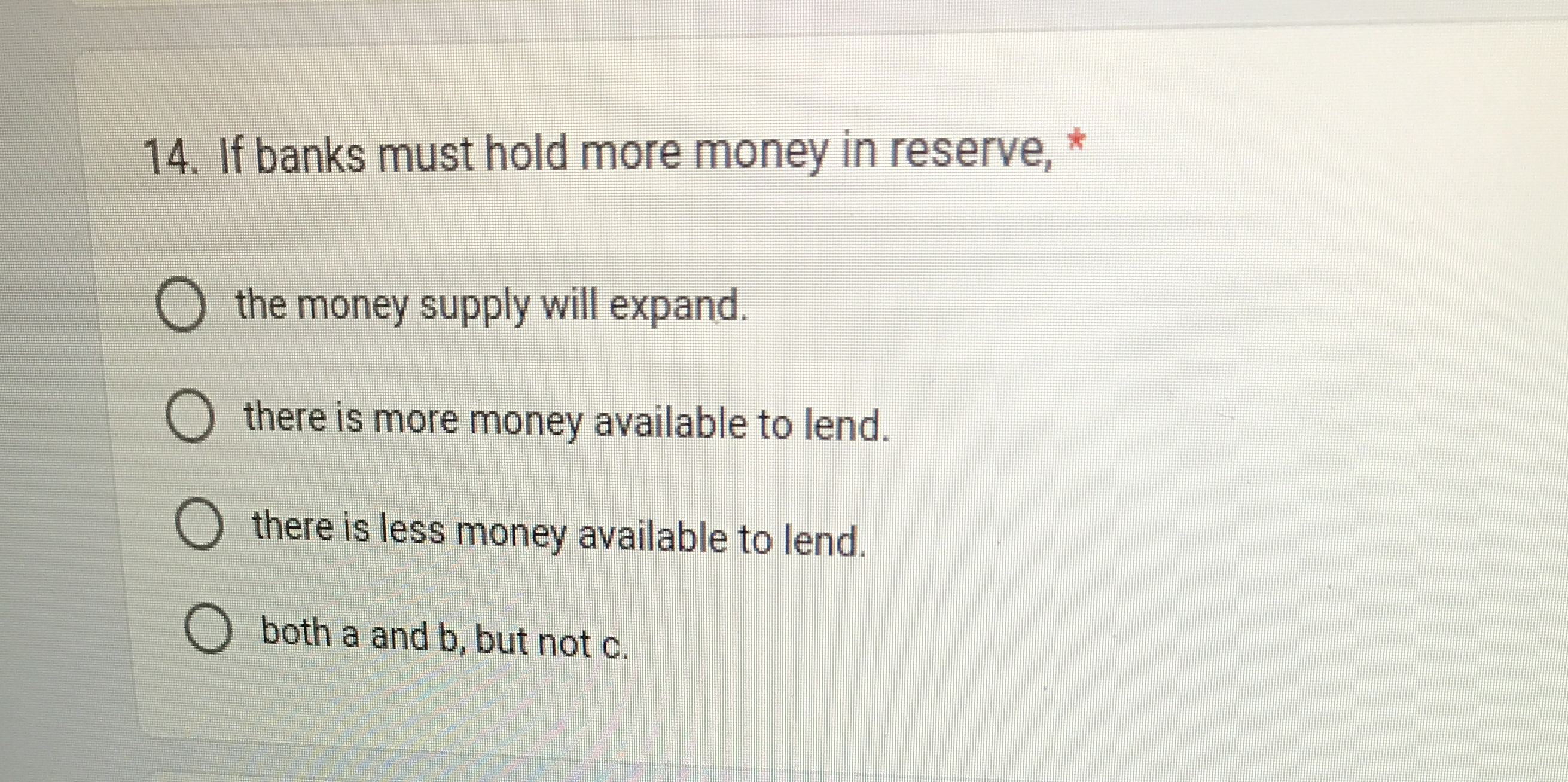

If banks must hold more money in reserve, what will happen?

Understand the Problem

The question is asking about the implications of banks needing to hold more money in reserve. Specifically, it seeks to understand the effects on the money supply and lending capacity of banks.

Answer

There is less money available to lend.

The correct answer is: there is less money available to lend.

Answer for screen readers

The correct answer is: there is less money available to lend.

More Information

Increasing reserve requirements means that banks have less money left over to lend, which reduces the overall money supply available in the economy.

Tips

One common mistake is thinking that increasing reserves increases available funds for lending. It's the opposite; more reserves mean less lending.

Sources

- Required Reserves - Investopedia - investopedia.com

AI-generated content may contain errors. Please verify critical information