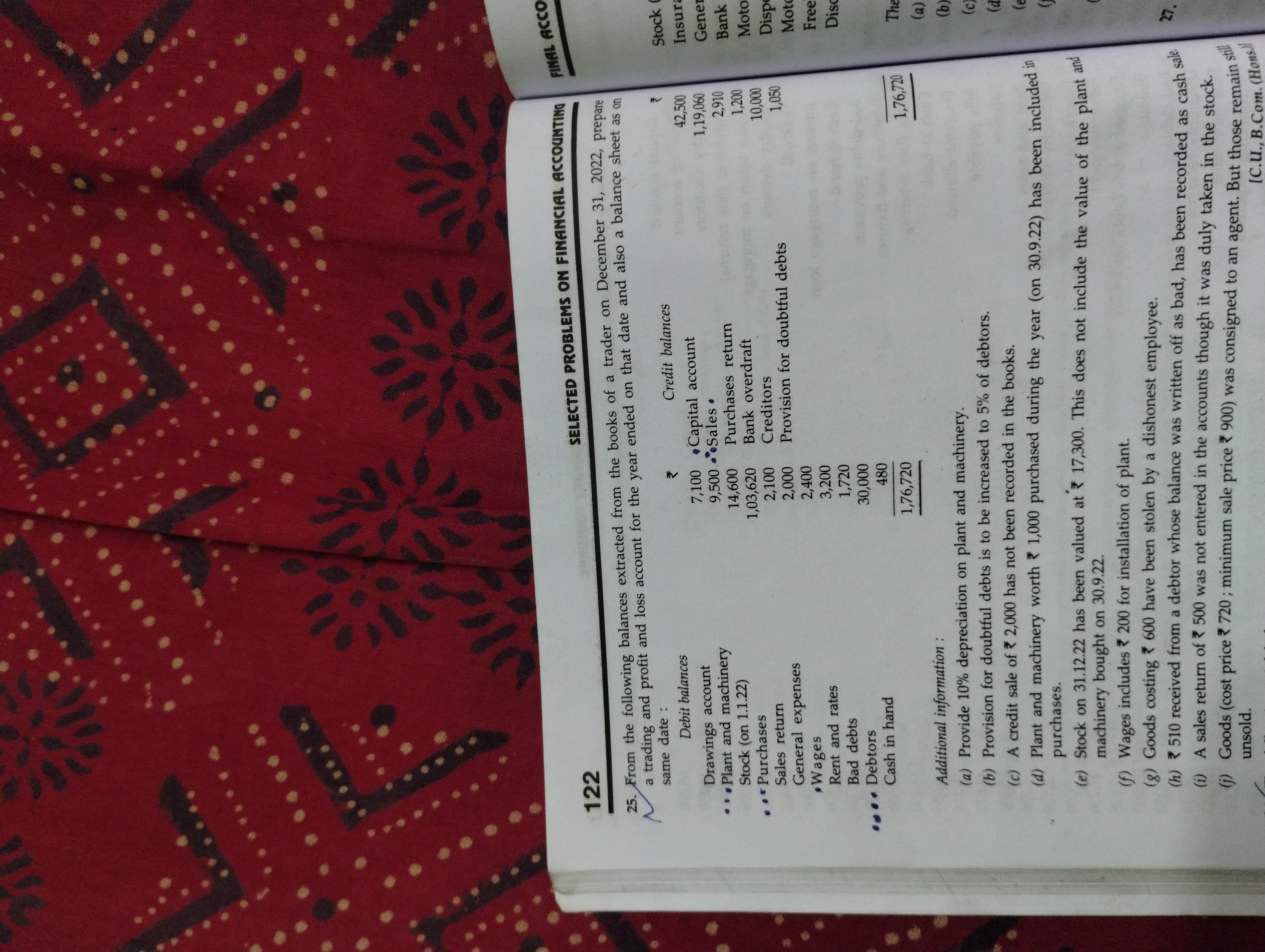

From the following balances extracted from the books of a trader on December 31, 2022, prepare a trading and profit and loss account for the year ended on that date and also a bala... From the following balances extracted from the books of a trader on December 31, 2022, prepare a trading and profit and loss account for the year ended on that date and also a balance sheet as on the same date.

Understand the Problem

The question is asking to prepare a trading and profit and loss account as well as a balance sheet based on the given balances extracted from the books of a trader for the year ended December 31, 2022.

Answer

The trader's financial records indicate a Net Loss of ₹1,022,000 with Total Assets at ₹28,330 and Total Liabilities at ₹13,960.

Answer for screen readers

The Trading and Profit & Loss Account shows a Net Loss of ₹1,022,000. The Balance Sheet with Total Assets of ₹28,330, Total Liabilities of ₹13,960, and Capital of ₹14,370 balances correctly.

Steps to Solve

-

Identify the Components Extract the necessary balances from the given information including assets, liabilities, income, and expenses.

-

Prepare the Trading Account Calculate the Gross Profit or Loss by determining the cost of goods sold and comparing it with sales.

-

Sales Calculation: Sales = Sales + Sales Returns = 19,960 - 1,460 = ₹18,500

-

Cost of goods sold (COGS): COGS = Opening Stock + Purchases - Closing Stock $$ \text{COGS} = 14,160 + 1,036,320 - 17,300 = ₹1,033,180 $$

-

Gross Profit: $$ \text{Gross Profit} = \text{Sales} - \text{COGS} = 18,500 - 1,033,180 = ₹(1,014,680) $$ (Indicating a Gross Loss)

- Prepare the Profit and Loss Account Include other incomes and expenses to derive the Net Profit or Loss.

-

Net Expenses: Total Expenses = General Expenses + Wages + Rent and Rates + Bad Debts = 2,400 + 2,000 + 3,720 + 200 = ₹8,320

-

Net Profit/Loss Calculation: $$ \text{Net Profit} = \text{Gross Profit} - \text{Total Expenses} = (1,014,680) - 8,320 = ₹(1,022,000) $$

- Prepare the Balance Sheet List all the assets and liabilities while ensuring that the accounting equation balances.

-

Assets:

- Plant and Machinery: 9,500 - (10% depreciation on 9,500)

- Stock: 17,300

- Debtors: 480

- Cash in Hand: 2,000 (Cash after adjustments)

-

Total Assets: $$ \text{Total Assets} = (9,500 - 950) + 17,300 + 480 + 2,000 = ₹28,330 $$

-

Liabilities:

- Creditors: 10,000

- Bank Overdraft: 2,910

- Provision for Doubtful Debts: 1,050

-

Total Liabilities: $$ \text{Total Liabilities} = 10,000 + 2,910 + 1,050 = ₹13,960 $$

- Final Figures for Balance Sheet Ensure that Total Assets = Total Liabilities + Equity: $$ 28,330 = 13,960 + 14,370 $$ (Equity from Capital Account)

The Trading and Profit & Loss Account shows a Net Loss of ₹1,022,000. The Balance Sheet with Total Assets of ₹28,330, Total Liabilities of ₹13,960, and Capital of ₹14,370 balances correctly.

More Information

This financial statement creation helps in understanding a trader's financial status over the year. A Trading Account indicates profitability, while the Balance Sheet presents the overall financial position.

Tips

- Forgetting to account for depreciation on fixed assets which can skew asset values.

- Miscalculating COGS which directly affects gross profit.

- Not adjusting for provisions on doubtful debts, impacting the profit and loss.

AI-generated content may contain errors. Please verify critical information