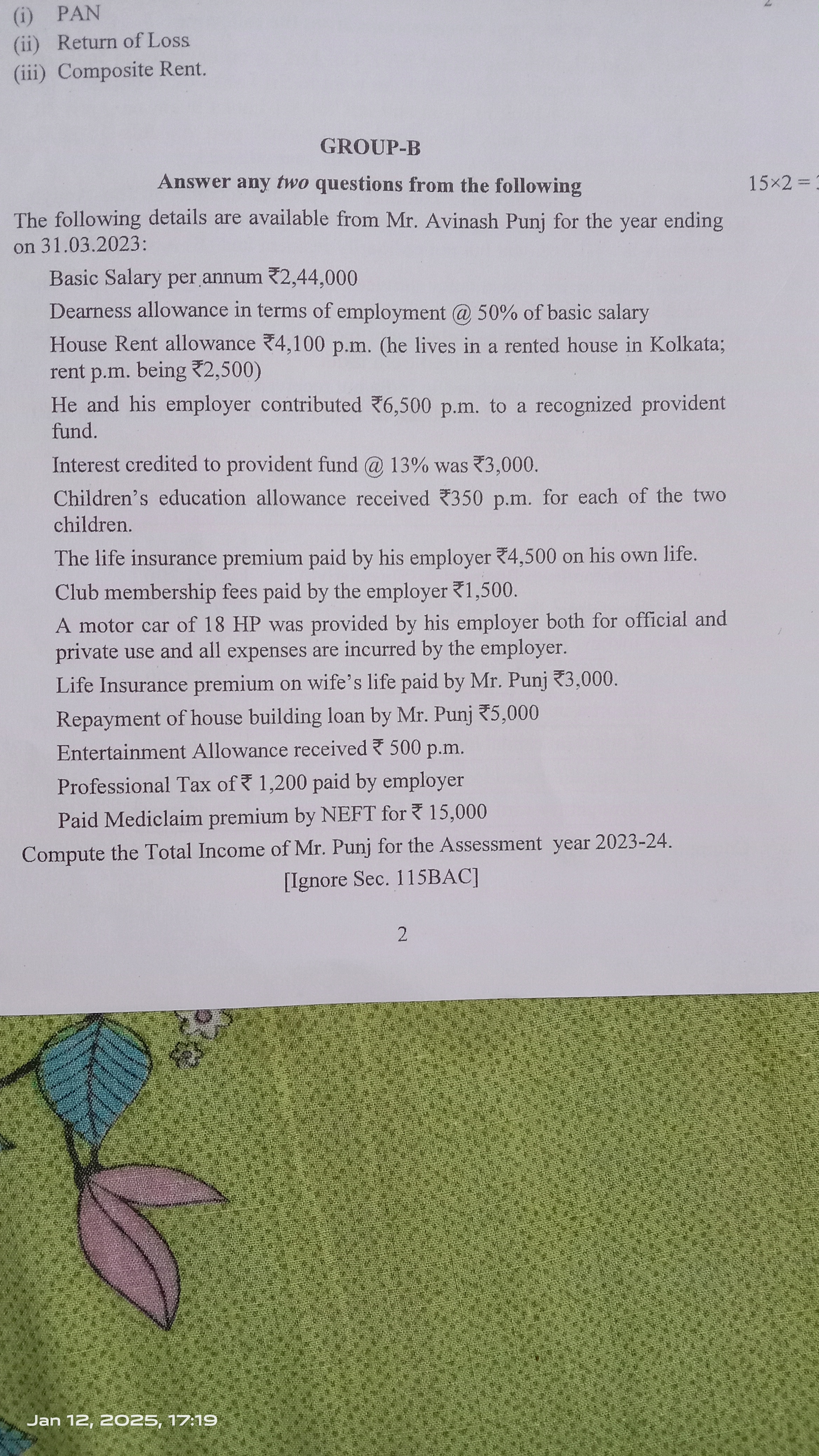

Compute the Total Income of Mr. Punj for the Assessment year 2023-24.

Understand the Problem

The question requires calculating the total income of Mr. Avinash Punj for the assessment year 2023-24 based on the financial details provided.

Answer

₹4,19,800

Answer for screen readers

The total income of Mr. Avinash Punj for the assessment year 2023-24 is ₹4,19,800.

Steps to Solve

-

Calculate Basic Salary and Dearness Allowance

- Basic Salary: ₹2,44,000

- Dearness Allowance (DA) = 50% of Basic Salary

- DA = $0.5 \times 2,44,000 = ₹1,22,000$

-

Calculate House Rent Allowance (HRA) and its exemption

- HRA per month = ₹4,100

- Total HRA for the year = $4,100 \times 12 = ₹49,200$

- Since Mr. Punj pays ₹2,500 in rent, the exempt HRA is calculated as:

- Rent paid - 10% of Basic Salary = $2,500 \times 12 - 0.1 \times 2,44,000$

- HRA exemption = $₹30,000 - ₹24,400 = ₹5,600$

-

Determine Total Income from Salary

- Total Salary before exemptions = Basic Salary + DA + HRA - HRA exemption

- Total Salary = $2,44,000 + 1,22,000 + 49,200 - 5,600 = ₹4,09,600$

-

Add Other Allowances and Contributions

- Children's Education Allowance = $350 \times 2 \times 12 = ₹8,400$

- Entertainment Allowance = $500 \times 12 = ₹6,000$

- Total before other deductions = $4,09,600 + 8,400 + 6,000 = ₹4,24,000$

-

Identify Deductions

- Life Insurance premium on wife’s life = ₹3,000

- Professional Tax = ₹1,200

- Total Deductions = ₹3,000 + ₹1,200 = ₹4,200

-

Calculate Total Income

- Total Income = Total Salary - Total Deductions

- Total Income = $4,24,000 - 4,200 = ₹4,19,800$

The total income of Mr. Avinash Punj for the assessment year 2023-24 is ₹4,19,800.

More Information

This calculation considers basic salary, allowances, exemptions, and deductions as per income tax norms in India. Mr. Punj’s total income reflects a comprehensive overview of his earnings and allowable expenses.

Tips

- Ignoring HRA exemption calculations: Make sure to calculate the exemption properly based on rent paid and salary.

- Forgetting to account for all deductions: Ensure all applicable deductions are considered to avoid overestimating income.

- Miscalculation of periods: Remember to multiply monthly allowances by 12 for annual totals.

AI-generated content may contain errors. Please verify critical information