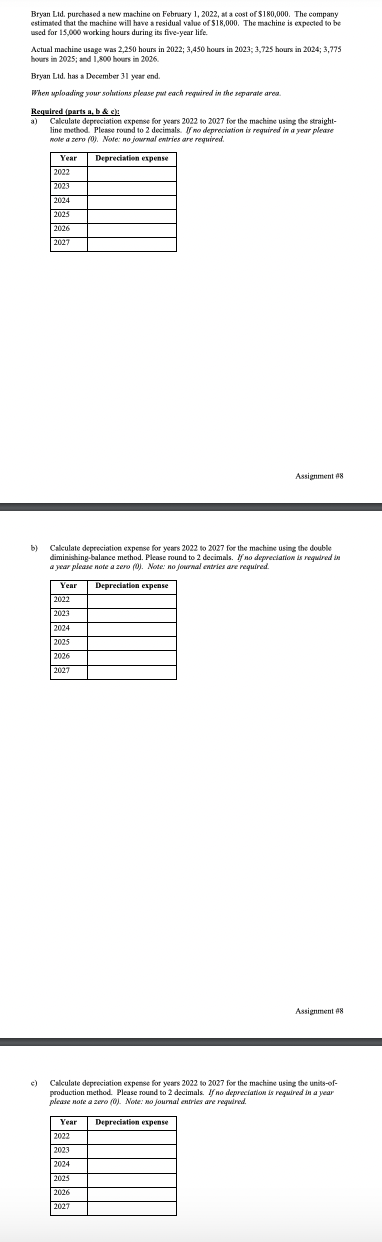

Calculate depreciation expense for years 2022 to 2027 for the machine using the straight-line method. Please round to 2 decimals. If no depreciation is required in a year please no... Calculate depreciation expense for years 2022 to 2027 for the machine using the straight-line method. Please round to 2 decimals. If no depreciation is required in a year please note a zero (0). Then calculate depreciation expense for years 2022 to 2027 using the double diminishing-balance method and finally using the units-of-production method.

Understand the Problem

The question is asking to calculate the depreciation expense for a machine over the years 2022 to 2027 using three different methods: straight-line, double diminishing-balance, and units-of-production. Each calculation will be provided in a table format for each year.

Answer

A) Straight-Line: $84,400; B) Double Diminishing: $232,000, $139,200, $83,520, $50,112, $30,067.20, $18,040.32; C) Units-of-Production: $12,417.68, $13,188.13, $18,383.46, $21,600.47, $23,603.65, $15,761.67.

Answer for screen readers

A) Straight-Line Method

- 2022: $84,400

- 2023: $84,400

- 2024: $84,400

- 2025: $84,400

- 2026: $84,400

- 2027: $84,400

B) Double Diminishing-Xbalance Method

- 2022: $232,000

- 2023: $139,200

- 2024: $83,520

- 2025: $50,112

- 2026: $30,067.20

- 2027: $18,040.32

C) Units-of-Production Method

- 2022: $12,417.68

- 2023: $13,188.13

- 2024: $18,383.46

- 2025: $21,600.47

- 2026: $23,603.65

- 2027: $15,761.67

Steps to Solve

- Calculate Straight-Line Depreciation

First, determine the annual depreciation expense using the straight-line method. The formula is:

$$ \text{Annual Depreciation} = \frac{\text{Cost} - \text{Residual Value}}{\text{Useful Life}} $$

For this problem:

- Cost = $580,000

- Residual Value = $158,000

- Useful Life = 5 years

So,

$$ \text{Annual Depreciation} = \frac{580,000 - 158,000}{5} = \frac{422,000}{5} = 84,400 $$

Each year from 2022 to 2027 will have a depreciation expense of $84,400.

- Calculate Double Diminishing Balance Depreciation

For the double diminishing balance method, the depreciation rate is twice the straight-line rate. First, find the straight-line rate:

$$ \text{Straight-Line Rate} = \frac{1}{\text{Useful Life}} = \frac{1}{5} = 0.20 $$

Thus, the double declining rate is:

$$ \text{Double Declining Rate} = 0.20 \times 2 = 0.40 $$

Calculate depreciation for each year:

-

Year 2022:

- Depreciation = $580,000 \times 0.40 = $232,000

- Book Value = $580,000 - $232,000 = $348,000

-

Year 2023:

- Depreciation = $348,000 \times 0.40 = $139,200

- Book Value = $348,000 - $139,200 = $208,800

-

Year 2024:

- Depreciation = $208,800 \times 0.40 = $83,520

- Book Value = $208,800 - $83,520 = $125,280

-

Year 2025:

- Depreciation = $125,280 \times 0.40 = $50,112

- Book Value = $125,280 - $50,112 = $75,168

-

Year 2026:

- Depreciation = $75,168 \times 0.40 = $30,067.20

- Book Value = $75,168 - $30,067.20 = $45,100.80

-

Year 2027:

- Depreciation = $45,100.80 \times 0.40 = $18,040.32

Round to two decimals for final totals.

- Calculate Units-of-Production Depreciation

Using the units-of-production method, calculate the depreciation based on actual usage. The total depreciation per hour can be calculated as:

$$ \text{Depreciation per Hour} = \frac{\text{Cost} - \text{Residual Value}}{\text{Total Useful Hours}} $$

Total hours = 75,000 hours over 5 years, resulting in:

$$ \text{Depreciation per Hour} = \frac{580,000 - 158,000}{75,000} = \frac{422,000}{75,000} \approx 5.62667 $$

Using the hours for each respective year from the problem statement, multiply the depreciation per hour by the hours used.

For 2022 to 2027, the calculations will be:

- 2022: $5.62667 \times 2205 \approx 12,417.68

- 2023: $5.62667 \times 2340 \approx 13,188.13

- 2024: $5.62667 \times 3375 \approx 18,383.46

- 2025: $5.62667 \times 3750 \approx 21,600.47

- 2026: $5.62667 \times 4200 \approx 23,603.65

- 2027: $5.62667 \times 2800 \approx 15,761.67

- Summarizing the Depreciation Expenses

Organize the calculated depreciation expenses by method and year into a table format for clarity.

A) Straight-Line Method

- 2022: $84,400

- 2023: $84,400

- 2024: $84,400

- 2025: $84,400

- 2026: $84,400

- 2027: $84,400

B) Double Diminishing-Xbalance Method

- 2022: $232,000

- 2023: $139,200

- 2024: $83,520

- 2025: $50,112

- 2026: $30,067.20

- 2027: $18,040.32

C) Units-of-Production Method

- 2022: $12,417.68

- 2023: $13,188.13

- 2024: $18,383.46

- 2025: $21,600.47

- 2026: $23,603.65

- 2027: $15,761.67

More Information

Depreciation methods differ widely, and the type used can significantly impact financial statements. The straight-line method provides consistent expenses annually, while the double diminishing balance accelerates expenses in earlier years. The units-of-production method varies according to actual usage, reflecting more accurately the wear and tear of the asset over time.

Tips

- Not properly accounting for the residual value when calculating straight-line depreciation.

- Failing to apply the correct depreciation rate in the double declining method.

- Miscalculating the depreciation per hour in the units-of-production method.

AI-generated content may contain errors. Please verify critical information