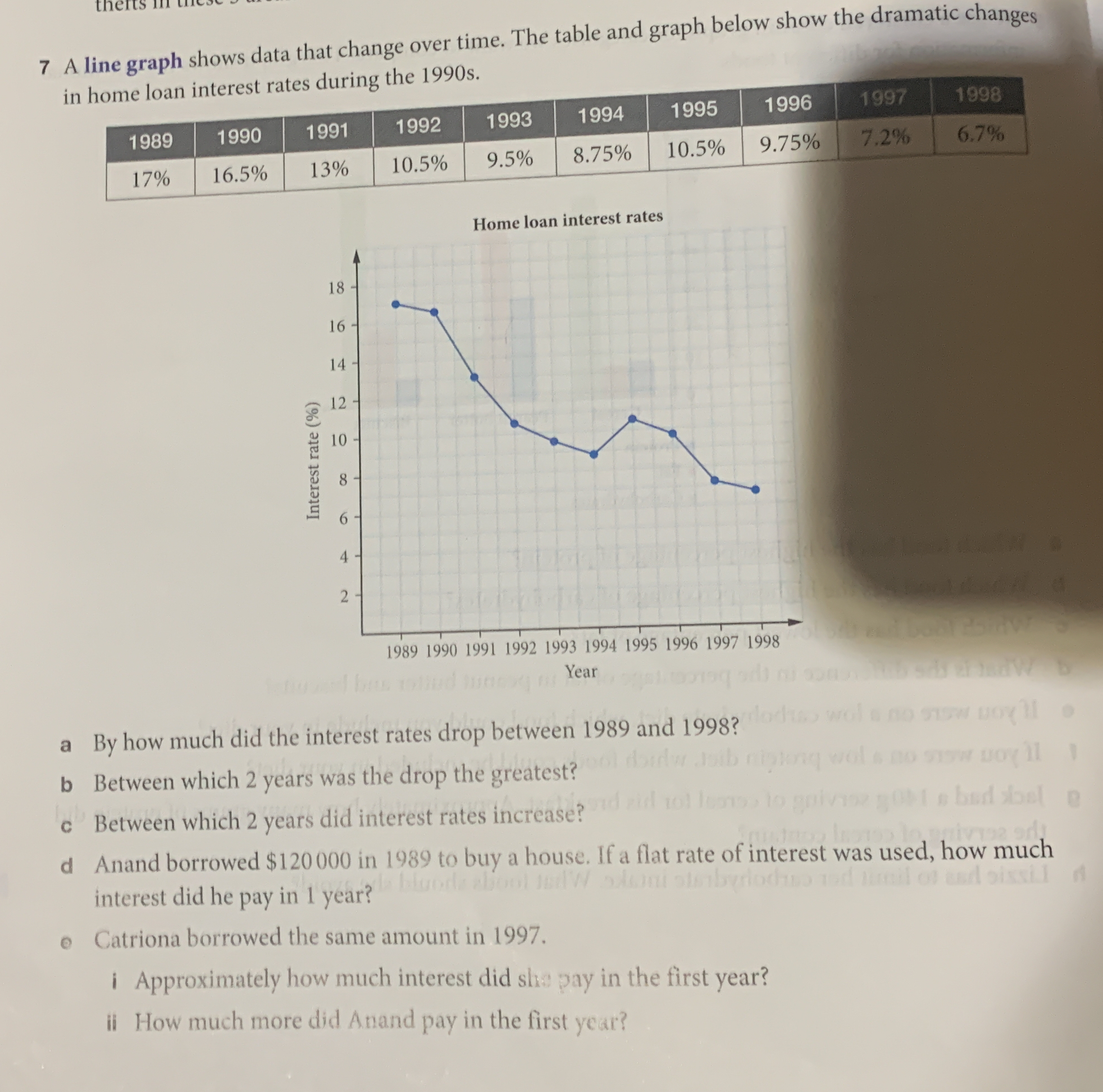

Based on the line graph and table provided: a. By how much did the interest rates drop between 1989 and 1998? b. Between which 2 years was the drop the greatest? c. Between which... Based on the line graph and table provided: a. By how much did the interest rates drop between 1989 and 1998? b. Between which 2 years was the drop the greatest? c. Between which 2 years did interest rates increase? d. Anand borrowed $120,000 in 1989 to buy a house. If a flat rate of interest was used, how much interest did he pay in 1 year? e. Catriona borrowed the same amount in 1997. i. Approximately how much interest did she pay in the first year? ii. How much more did Anand pay in the first year?

Understand the Problem

The image shows a line graph and a table displaying home loan interest rates from 1989 to 1998. The questions require you to analyze the data presented in the graph and table to determine interest rate changes, identify periods of significant drops or increases, and calculate interest payments on loans for specific years.

Answer

a. 10.3% b. 1990 and 1991 c. 1994 and 1995 d. $20,400 e. i. $8,640 ii. $11,760

Answer for screen readers

a. The interest rates dropped by 10.3% between 1989 and 1998. b. The greatest drop was between 1990 and 1991. c. Interest rates increased between 1994 and 1995. d. Anand paid $20,400 in interest in 1989. e. i. Catriona paid approximately $8,640 in interest in 1997. ii. Anand paid $11,760 more than Catriona in the first year.

Steps to Solve

- Calculate the interest rate drop between 1989 and 1998

Subtract the 1998 interest rate from the 1989 interest rate. $ \text{Interest Rate Drop} = 17% - 6.7% = 10.3% $

- Identify the greatest drop in interest rates between two years

Examine the interest rate changes between consecutive years and find the largest decrease. 1989-1990: $17% - 16.5% = 0.5%$ 1990-1991: $16.5% - 13% = 3.5%$ 1991-1992: $13% - 10.5% = 2.5%$ 1992-1993: $10.5% - 9.5% = 1%$ 1993-1994: $9.5% - 8.75% = 0.75%$ 1994-1995: $8.75% - 10.5% = -1.75%$ (Increase) 1995-1996: $10.5% - 9.75% = 0.75%$ 1996-1997: $9.75% - 7.2% = 2.55%$ 1997-1998: $7.2% - 6.7% = 0.5%$ The greatest drop occurred between 1990 and 1991 (3.5%).

- Identify the years between which interest rates increased

Look for increases in interest rates between consecutive years. From the previous calculations, we found that interest rates increased between 1994 and 1995.

- Calculate Anand's interest payment in 1989

Calculate the interest paid on $120,000 at an interest rate of 17%. $\text{Interest} = \text{Principal} \times \text{Interest Rate} = $120,000 \times 0.17 = $20,400$

- Calculate Catriona's interest payment in 1997

Calculate the interest paid on $120,000 at an interest rate of 7.2%. $\text{Interest} = \text{Principal} \times \text{Interest Rate} = $120,000 \times 0.072 = $8,640$

- Calculate how much more Anand paid than Catriona

Subtract Catriona's interest payment from Anand's interest payment. Keep in mind that this is a question asking by how much more, meaning we want a positive value as an answer. $\text{Difference} = $20,400 - $8,640 = $11,760$

a. The interest rates dropped by 10.3% between 1989 and 1998. b. The greatest drop was between 1990 and 1991. c. Interest rates increased between 1994 and 1995. d. Anand paid $20,400 in interest in 1989. e. i. Catriona paid approximately $8,640 in interest in 1997. ii. Anand paid $11,760 more than Catriona in the first year.

More Information

Analyzing interest rate changes over time impacts financial decisions like home buying. Lower interest rates mean lower borrowing costs.

Tips

- Forgetting to convert percentages to decimals when calculating interest payments.

- Incorrectly identifying the years with the greatest drop or increase.

- Making calculation errors when computing interest or differences in interest payments.

- Confusing the order of subtraction when finding the difference in interest payments, resulting in a negative value.

AI-generated content may contain errors. Please verify critical information