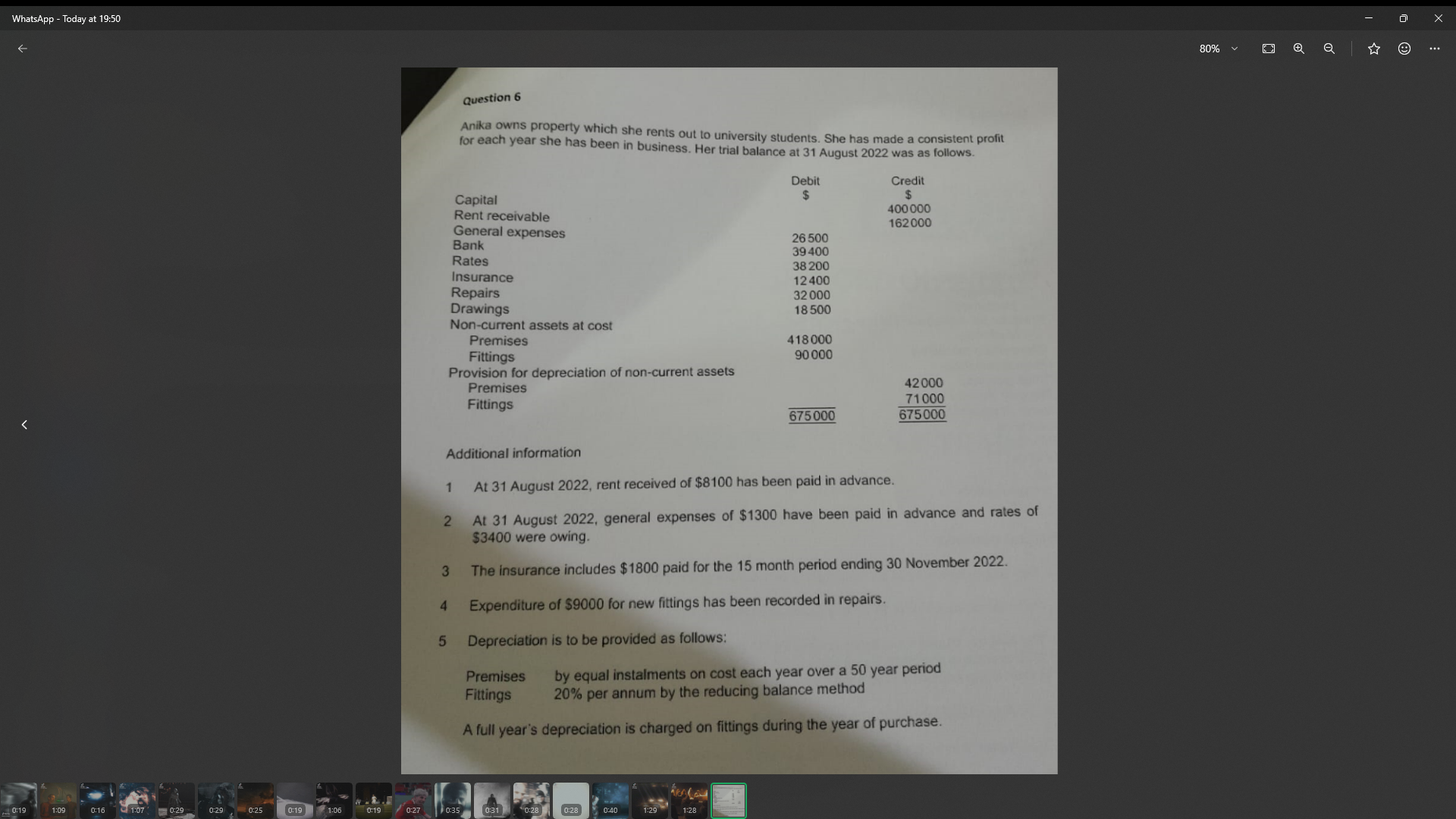

Anika owns property which she rents out. Prepare financial statements based on the trial balance and additional information provided.

Understand the Problem

The question is asking for help with preparing financial statements based on the trial balance and additional information provided. We need to address income from rent, expenses, depreciation, and the treatment of prepaid amounts to complete Anika's financial records for the specified date.

Answer

Total adjusted profit is calculated after adjusting for income and expenses based on the provided trial balance and additional information.

Answer for screen readers

Total adjusted profit for Anika for the year is calculated based on the adjustments in the financial statements.

Profit Calculation:

Total Income - Total Expenses = Adjusted Profit

Steps to Solve

-

Adjust Rent Receivable Anika has received $8100 in rent which has been paid in advance.

- Adjust for unearned rent income: Rent Receivable will decrease by $8100.

-

Adjust General Expenses General expenses include $1300 paid in advance, meaning these expenses should not be included in the current year’s expenses.

- Reduce General Expenses by $1300.

-

Adjust Rates Payable The rates of $3400 are owed, so we need to add this to current liabilities.

- Increase the Rates expense by $3400.

-

Adjust Insurance Expenses The prepaid insurance of $1800 should cover the 15 months ending November 2022. For this calculation:

- Monthly insurance expense = $1800 / 15 months = $120.

- For the 12 months until August 2022, total insurance expense = $120 * 12 = $1440.

- Adjust the insurance expense accordingly.

-

Record Repairs for New Fittings The expenditure of $9000 for new fittings wrongly recorded as repairs should be treated as an asset.

- Remove $9000 from Repairs and add it to Fittings.

-

Calculate Depreciation for Premises The premises depreciate by equal instalments over a 50-year period:

- Annual depreciation = Cost / Useful life = $418000 / 50 = $8360.

-

Calculate Depreciation for Fittings The fittings depreciate at 20% per annum using the reducing balance method:

- First, add the new fittings cost ($9000) to the existing fittings value: $90000 + $9000 = $99000.

- Calculate depreciation: $99000 * 20% = $19800.

-

Total Expenses and Profit Calculation Sum the adjusted expenses and subtract from the total income to calculate profit. Adjust for new expenses and income based on adjustments made above.

Total adjusted profit for Anika for the year is calculated based on the adjustments in the financial statements.

Profit Calculation:

Total Income - Total Expenses = Adjusted Profit

More Information

The adjustments for income and expenses reflect a more accurate picture of Anika's financial situation. The prepaid amounts ensure that income and expenses are recognized in the correct periods, adhering to the matching principle.

Tips

- Failing to account for prepaid expenses correctly.

- Misclassifying repairs as capital expenditures.

- Forgetting to include accrued expenses, leading to understated liabilities.

AI-generated content may contain errors. Please verify critical information