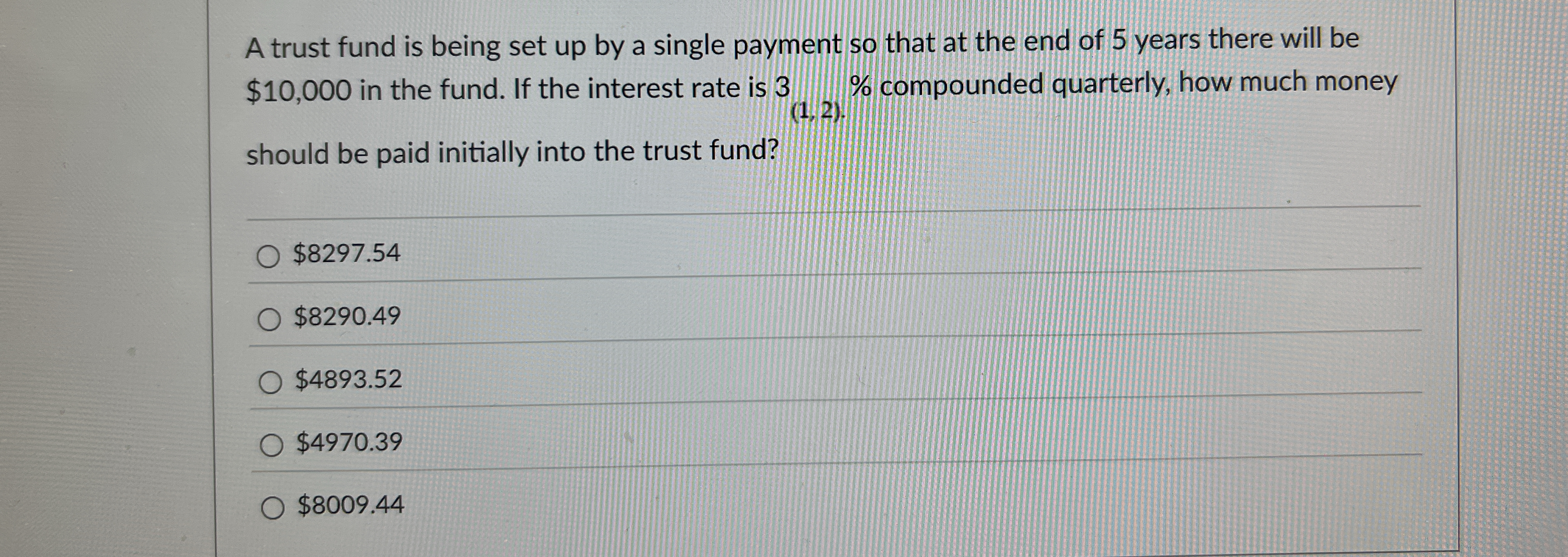

A trust fund is being set up by a single payment so that at the end of 5 years there will be $10,000 in the fund. If the interest rate is 3% compounded quarterly, how much money sh... A trust fund is being set up by a single payment so that at the end of 5 years there will be $10,000 in the fund. If the interest rate is 3% compounded quarterly, how much money should be paid initially into the trust fund?

Understand the Problem

The question asks us to calculate the initial amount needed to be deposited into a trust fund such that it grows to $10,000 after 5 years, given an interest rate of 3% compounded quarterly. We must use the present value formula to find the principal.

Answer

$8611.07

Answer for screen readers

$8611.07

Steps to Solve

- Identify the Future Value

The future value (FV) is the amount we want to have in the trust fund after 5 years, which is $10,000.

- Identify the interest rate

The annual interest rate (r) is 3%, or 0.03 as a decimal. Since the interest is compounded quarterly, we need to find the quarterly interest rate by dividing the annual rate by 4:

$i = r/4 = 0.03/4 = 0.0075$

- Determine the number of compounding periods

The number of years (t) is 5. Since the interest is compounded quarterly, we need to find the total number of compounding periods (n) by multiplying the number of years by 4:

$n = t * 4 = 5 * 4 = 20$

- Apply the present value formula

The present value (PV) formula is: $PV = FV / (1 + i)^n$

Where: FV = Future Value i = interest rate per period n = number of periods

- Calculate the Present Value

Plug the values into the formula: $PV = 10000 / (1 + 0.0075)^{20}$ $PV = 10000 / (1.0075)^{20}$ $PV = 10000 / 1.161184$ $PV = 8611.07$

$8611.07

More Information

The initial amount to be deposited into the trust fund is $8611.07 to reach $10,000 in 5 years with a 3% interest rate compounded quarterly.

Tips

A common mistake is forgetting to adjust the interest rate and the number of periods to match the compounding frequency (quarterly in this case). Forgetting to convert the annual interest rate to a quarterly rate is a frequent error. Similarly, not calculating the correct number of compounding periods can also lead to an incorrect answer. For example, using the annual interest rate and the number of years instead of the quarterly interest rate and number of quarters.

AI-generated content may contain errors. Please verify critical information