4.2.1 Calculate Katlego's annual tax payable for the 2021/2022 tax year. 4.2.2 Define the term tax rebate. 4.2.3 Show that the tax threshold for age 65 to age 74 in the table is CO... 4.2.1 Calculate Katlego's annual tax payable for the 2021/2022 tax year. 4.2.2 Define the term tax rebate. 4.2.3 Show that the tax threshold for age 65 to age 74 in the table is CORRECT.

Understand the Problem

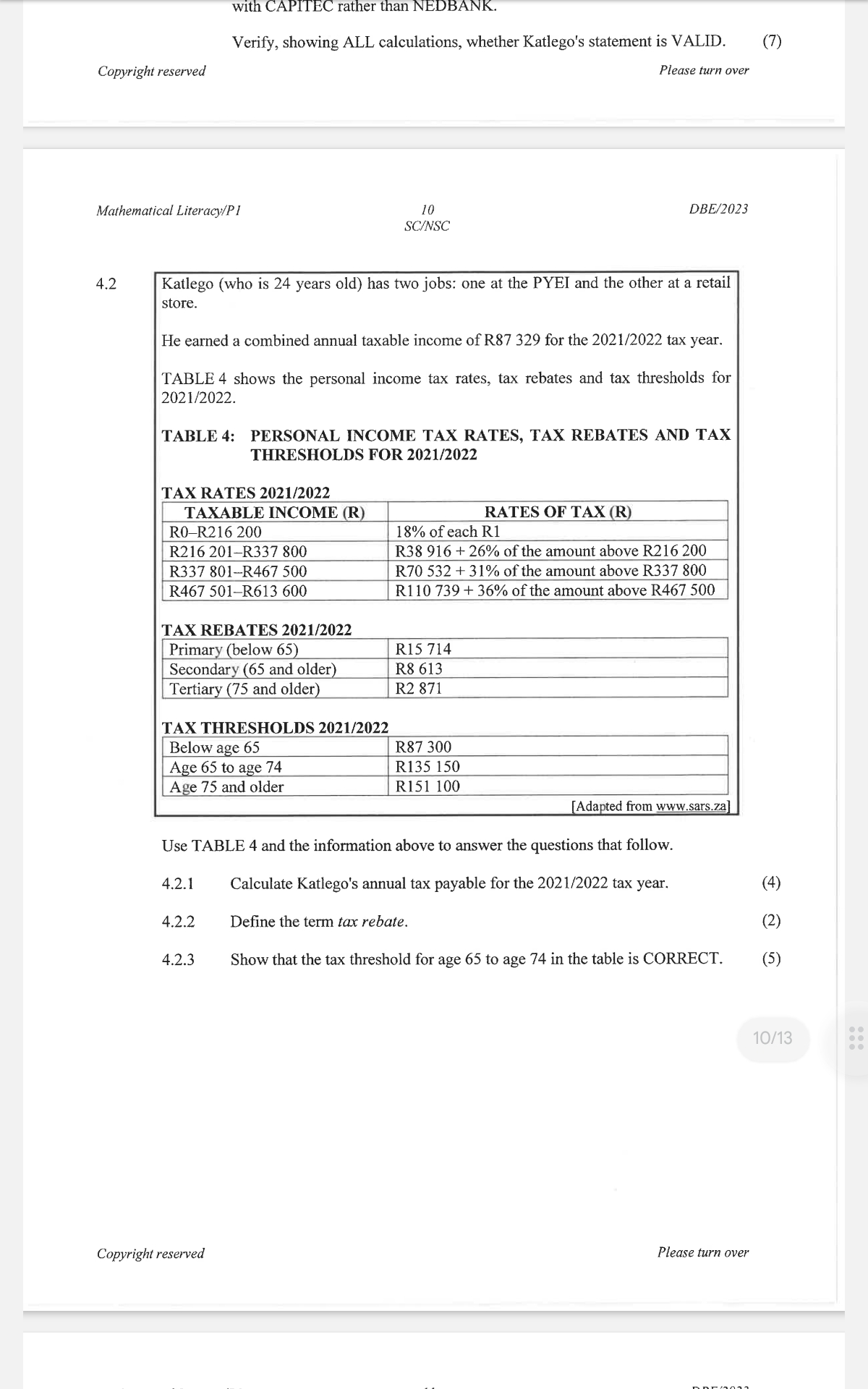

This is a math question from a Mathematical Literacy exam. We are given a scenario about Katlego's income and tax information, and we are asked to (1) calculate Katlego's annual tax payable, (2) define the term "tax rebate", and (3) verify the tax threshold for the age group 65-74 using the provided table.

Answer

4.2.1. R5.22 4.2.2. A reduction in tax liability. 4.2.3. Tax payable is R0 when income is R135 150 for ages 65-74.

Answer for screen readers

4.2.1. Katlego's annual tax payable for the 2021/2022 tax year is R5.22. 4.2.2. A tax rebate is a reduction in the amount of tax that a person or entity is liable to pay. 4.2.3. A person aged 65-74 earning R135 150 has a tax payable of R0, calculated as follows: $Tax,before,rebate = 0.18 \times 135150 = R24 327$ $Total,Rebate = R15 714 + R8 613 = R24 327$ $Annual,Tax,Payable = R24 327 - R24 327 = R0$

Steps to Solve

- Calculate Katlego's tax before rebate

Katlego's taxable income is R87 329, which falls in the first tax bracket (R0 - R216 200). The tax rate for this bracket is 18% of each R1.

Therefore, his tax before rebate is calculated as follows:

$Tax = 0.18 \times 87329 = 15719.22$

- Determine Katlego's tax rebate

Katlego is 24 years old, so he qualifies for the primary tax rebate, which is R15 714.

- Calculate Katlego's annual tax payable

Subtract the tax rebate from the tax before rebate to find the annual tax payable.

$Annual,Tax,Payable = Tax - Tax,Rebate$

$Annual,Tax,Payable = 15719.22 - 15714 = 5.22$

- Define tax rebate

A tax rebate is a reduction in the amount of tax that a person or entity is liable to pay. It is designed to reduce the tax burden on individuals, especially those in specific age groups.

- Verify the tax threshold for the age group 65-74

The tax threshold is the income level below which no income tax is payable. To verify the threshold for the age group 65-74, we need to understand that if a person in that age group earns less than or equal to the threshold, they don't need to pay income tax. This means their tax payable after the rebate is zero.

We need to calculate the tax payable for a 65-74 year old person earning R135 150 (the stated threshold) and show it equals zero after the rebate is applied.

Since R135 150 falls within the first tax bracket (R0 - R216 200), the tax rate is 18%.

$Tax,before,rebate = 0.18 \times 135150 = 24327$

- Calculate the tax rebate for a person aged 65-74

For a person aged 65-74, the tax rebates they can claim are the primary and secondary rebates: $Primary,rebate + Secondary,rebate = R15 714 + R8 613 = R24 327$

- Calculate annual tax payable for a person aged 65-74 earning R135 150

$Annual,Tax,Payable = Tax,before,rebate - Total,Rebate$

$Annual,Tax,Payable = 24327 - 24327 = 0$

This shows that a person aged 65-74 earning R135 150 will have a tax payable of R0. Therefore, the tax threshold of R135 150 for the age group 65-74 as given in the table is correct.

4.2.1. Katlego's annual tax payable for the 2021/2022 tax year is R5.22. 4.2.2. A tax rebate is a reduction in the amount of tax that a person or entity is liable to pay. 4.2.3. A person aged 65-74 earning R135 150 has a tax payable of R0, calculated as follows: $Tax,before,rebate = 0.18 \times 135150 = R24 327$ $Total,Rebate = R15 714 + R8 613 = R24 327$ $Annual,Tax,Payable = R24 327 - R24 327 = R0$

More Information

The tax system in South Africa uses a progressive tax system, meaning the more you earn, the higher the percentage of tax you pay. Tax rebates are used to reduce the tax burden, especially on vulnerable groups like the elderly

Tips

A common mistake is to forget to subtract the tax rebate when calculating the annual tax payable. Another mistake is using the wrong tax bracket or tax rebate amount. Also, when verifying the tax threshold, one might not calculate the combined primary and secondary rebates for someone aged 65-74.

AI-generated content may contain errors. Please verify critical information