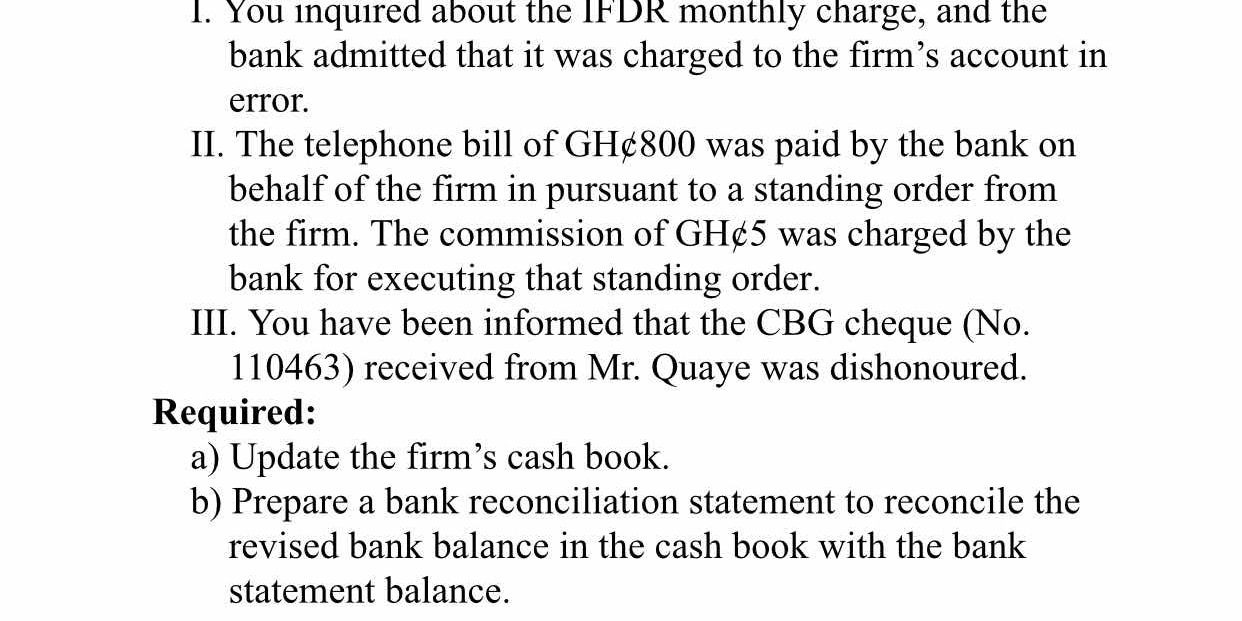

1. You inquired about the IFDR monthly charge, and the bank admitted that it was charged to the firm's account in error. 2. The telephone bill of GH¢800 was paid by the bank on beh... 1. You inquired about the IFDR monthly charge, and the bank admitted that it was charged to the firm's account in error. 2. The telephone bill of GH¢800 was paid by the bank on behalf of the firm pursuant to a standing order from the firm. The commission of GH¢5 was charged by the bank for executing that standing order. 3. You have been informed that the CBG cheque (No. 110463) received from Mr. Quaye was dishonoured. Required: a) Update the firm's cash book. b) Prepare a bank reconciliation statement to reconcile the revised bank balance in the cash book with the bank statement balance.

Understand the Problem

The question is an accounting exercise involving rectifying errors in a firm's cash book and preparing a bank reconciliation statement. It requires you to update the cash book based on information provided about a wrongly charged fee, a telephone bill payment, and a dishonored check. You then need to prepare a statement that reconciles the adjusted cash book balance with the bank statement balance.

Answer

* Update cash book for IFDR charge, telephone bill, commission and dishonored cheque. * Prepare bank reconciliation statement.

a) To update the firm's cash book:

- Add the IFDR monthly charge to the cash book, as it was charged in error and the bank admitted it.

- Deduct the telephone bill (GH¢800) and commission (GH¢5) from the cash book, as these were paid by the bank on behalf of the firm.

- Deduct the dishonoured cheque from Mr. Quaye from the cash book, as it was previously added upon receipt but now needs to be reversed.

b) To prepare a bank reconciliation statement: this will reconcile the revised cash book balance with the bank statement balance, accounting for any timing differences such as outstanding lodgements, unpresented cheques, or other items not yet reflected on both the bank statement and the cash book.

Answer for screen readers

a) To update the firm's cash book:

- Add the IFDR monthly charge to the cash book, as it was charged in error and the bank admitted it.

- Deduct the telephone bill (GH¢800) and commission (GH¢5) from the cash book, as these were paid by the bank on behalf of the firm.

- Deduct the dishonoured cheque from Mr. Quaye from the cash book, as it was previously added upon receipt but now needs to be reversed.

b) To prepare a bank reconciliation statement: this will reconcile the revised cash book balance with the bank statement balance, accounting for any timing differences such as outstanding lodgements, unpresented cheques, or other items not yet reflected on both the bank statement and the cash book.

More Information

A bank reconciliation is important to identify errors, fraud, and timing differences.

Tips

Students may forget that errors need to be corrected in the cashbook first.

AI-generated content may contain errors. Please verify critical information