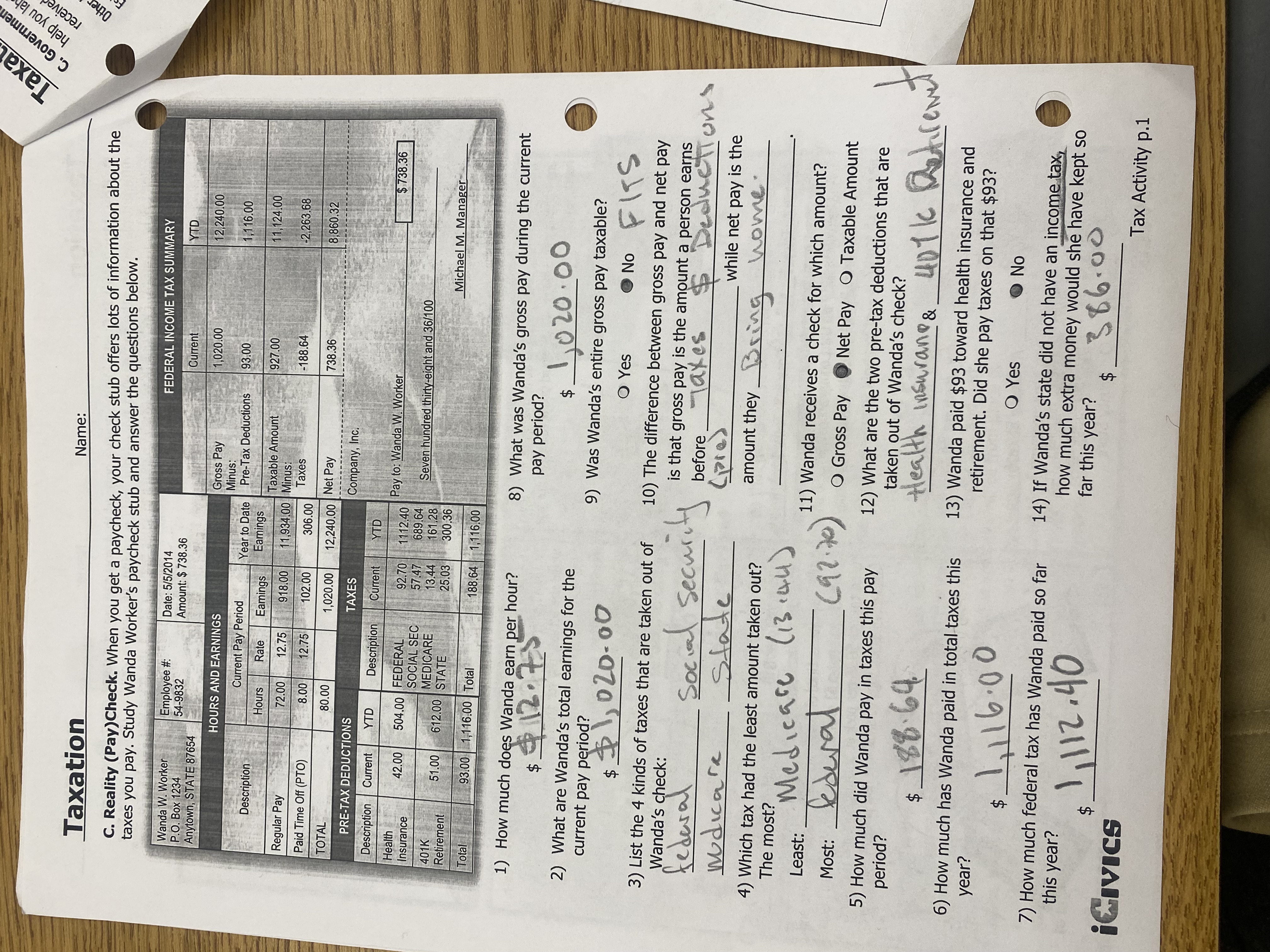

1) How much does Wanda earn per hour? 2) What are Wanda's total earnings for the current pay period? 3) List the 4 kinds of taxes that are taken out of Wanda's check. 4) Which tax... 1) How much does Wanda earn per hour? 2) What are Wanda's total earnings for the current pay period? 3) List the 4 kinds of taxes that are taken out of Wanda's check. 4) Which tax had the least amount taken out? 5) How much did Wanda pay in taxes this pay period? 6) How much has Wanda paid in total taxes this year? 7) How much federal tax has Wanda paid so far this year? 8) What was Wanda's gross pay during the current pay period? 9) Was Wanda’s entire gross pay taxable? 10) The difference between gross pay and net pay is that gross pay is the amount a person earns before taxes and deductions while net pay is the amount they bring home. 11) Wanda receives a check for which amount? 12) What are the two pre-tax deductions that are taken out of Wanda’s check? 13) Wanda paid $93 toward health insurance and retirement. Did she pay taxes on that $93? 14) If Wanda’s state did not have an income tax, how much extra money would she have kept so far this year?

Understand the Problem

The question set is asking students to analyze a paycheck stub for Wanda Worker and answer various questions related to her earnings, deductions, and taxes.

Answer

Wanda earns $12.75/hour. Her total pay is $1,020.00 with taxes deducted for federal, social security, Medicare, and state. Federal tax had the least withheld. Her check net is $738.36 with $93.00 in pre-tax deductions.

- Wanda earns $12.75 per hour. 2) Her total earnings for the current pay period are $1,020.00. 3) The 4 kinds of taxes taken out are federal, social security, Medicare, and state. 4) The tax with the least amount taken out is federal. 5) Wanda paid $188.64 in taxes this pay period. 6) She has paid $1,116.00 in total taxes this year. 7) She has paid $1,112.40 in federal tax so far this year. 8) Her gross pay during the current pay period was $1,020.00. 9) Not all of Wanda's gross pay was taxable as $93.00 was deducted pretax. 10) Gross pay is the total amount before deductions, while net pay is the amount after. 11) Wanda receives a check for the net pay of $738.36. 12) The two pre-tax deductions are health insurance and 401K retirement. 13) Wanda did not pay taxes on the $93 for health insurance and retirement. 14) If there was no state income tax, she would have kept an extra $366.00.

Answer for screen readers

- Wanda earns $12.75 per hour. 2) Her total earnings for the current pay period are $1,020.00. 3) The 4 kinds of taxes taken out are federal, social security, Medicare, and state. 4) The tax with the least amount taken out is federal. 5) Wanda paid $188.64 in taxes this pay period. 6) She has paid $1,116.00 in total taxes this year. 7) She has paid $1,112.40 in federal tax so far this year. 8) Her gross pay during the current pay period was $1,020.00. 9) Not all of Wanda's gross pay was taxable as $93.00 was deducted pretax. 10) Gross pay is the total amount before deductions, while net pay is the amount after. 11) Wanda receives a check for the net pay of $738.36. 12) The two pre-tax deductions are health insurance and 401K retirement. 13) Wanda did not pay taxes on the $93 for health insurance and retirement. 14) If there was no state income tax, she would have kept an extra $366.00.

More Information

Pre-tax deductions reduce the taxable income, allowing some earnings to be tax-free, which helps in saving on taxes.

Tips

Ensure to differentiate between pre-tax deductions and taxable income to calculate the correct net pay.

AI-generated content may contain errors. Please verify critical information