Podcast

Questions and Answers

What will be the net vehicle account value after two years of depreciation?

What will be the net vehicle account value after two years of depreciation?

- Rs 80,000 (correct)

- Rs 60,000

- Rs 90,000

- Rs 70,000

What is the total accumulated depreciation after the first two years of using the delivery van?

What is the total accumulated depreciation after the first two years of using the delivery van?

- Rs 10,000

- Rs 20,000 (correct)

- Rs 15,000

- Rs 25,000

How much will the depreciation expense appear as in the Profit and Loss Statement?

How much will the depreciation expense appear as in the Profit and Loss Statement?

- Rs 10,000 (correct)

- Rs 15,000

- Rs 20,000

- Rs 5,000

How is the delivery van depreciated over its useful life according to the method used?

How is the delivery van depreciated over its useful life according to the method used?

What will be the accounting entry for the purchase of the delivery van?

What will be the accounting entry for the purchase of the delivery van?

What will be the balance of the Net Vehicle account at the end of the first year?

What will be the balance of the Net Vehicle account at the end of the first year?

What is the total amount of Accumulated Depreciation at the end of the second year?

What is the total amount of Accumulated Depreciation at the end of the second year?

What is the Depreciation Expense reported in the Profit and Loss Statement for the first year?

What is the Depreciation Expense reported in the Profit and Loss Statement for the first year?

What would the Gross Fixed Assets value for the Vehicle account be after two years?

What would the Gross Fixed Assets value for the Vehicle account be after two years?

Which account would be credited in the journal entry for the second year's depreciation?

Which account would be credited in the journal entry for the second year's depreciation?

At the end of the second year, what will be the Net Fixed Assets value after accounting for depreciation?

At the end of the second year, what will be the Net Fixed Assets value after accounting for depreciation?

How much is the amount provisioned for depreciation in the journal entry at the end of the second year?

How much is the amount provisioned for depreciation in the journal entry at the end of the second year?

What would the total Non-Current Assets stand at after accounting for the vehicle and accumulated depreciation?

What would the total Non-Current Assets stand at after accounting for the vehicle and accumulated depreciation?

What is the gross fixed assets value for the vehicle as presented?

What is the gross fixed assets value for the vehicle as presented?

What is the total non-current assets amount after accounting for depreciation?

What is the total non-current assets amount after accounting for depreciation?

What entry is made for the depreciation expense at the end of the year?

What entry is made for the depreciation expense at the end of the year?

How much accumulated depreciation has been recorded for the vehicle before the year's depreciation entry?

How much accumulated depreciation has been recorded for the vehicle before the year's depreciation entry?

What is the net fixed assets value for the vehicle after accounting for depreciation?

What is the net fixed assets value for the vehicle after accounting for depreciation?

What is the value of the Net Fixed Assets: Vehicle after accounting for depreciation?

What is the value of the Net Fixed Assets: Vehicle after accounting for depreciation?

What is the total amount debited to the Depreciation Account at the end of the year?

What is the total amount debited to the Depreciation Account at the end of the year?

What is the total amount of Gross Fixed Assets for the vehicle recorded in the accounts?

What is the total amount of Gross Fixed Assets for the vehicle recorded in the accounts?

What amount is credited to the Accumulated Depreciation Account?

What amount is credited to the Accumulated Depreciation Account?

What will be the Gross Vehicle account balance in the balance sheet after accounting for accumulated depreciation?

What will be the Gross Vehicle account balance in the balance sheet after accounting for accumulated depreciation?

What is the primary purpose of reserves in a business?

What is the primary purpose of reserves in a business?

Where are reserves shown in a balance sheet?

Where are reserves shown in a balance sheet?

What is the total amount of current liabilities for XYZ Limited as of 31 March 2024?

What is the total amount of current liabilities for XYZ Limited as of 31 March 2024?

Which of the following is included in the current assets of XYZ Limited?

Which of the following is included in the current assets of XYZ Limited?

What is the total amount of shareholder's equity for XYZ Limited?

What is the total amount of shareholder's equity for XYZ Limited?

Which category did XYZ Limited report as long-term liabilities?

Which category did XYZ Limited report as long-term liabilities?

What is the total amount of fixed assets for XYZ Limited?

What is the total amount of fixed assets for XYZ Limited?

Which of the following accounts would be classified as an intangible asset for XYZ Limited?

Which of the following accounts would be classified as an intangible asset for XYZ Limited?

Flashcards are hidden until you start studying

Study Notes

Vehicle Depreciation: Straight-Line Method

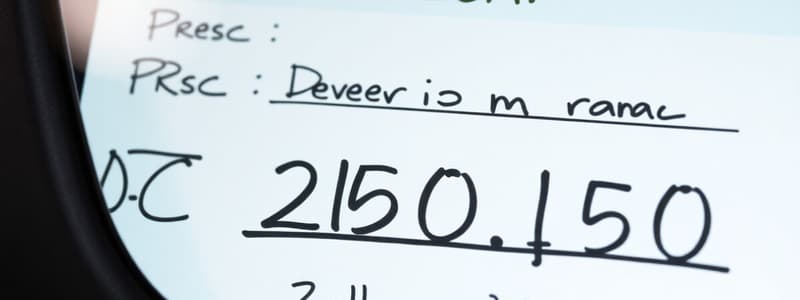

- A delivery van was purchased for Rs. 100,000.

- Depreciation is calculated using the straight-line method over 10 years.

- Annual depreciation expense is Rs. 10,000 (Rs. 100,000 / 10 years).

- After the first year:

- Accumulated depreciation is Rs. 10,000.

- Net vehicle value is Rs. 90,000 (Rs. 100,000 - Rs. 10,000).

- Depreciation expense on the Profit & Loss statement is Rs. 10,000.

- After the second year:

- Accumulated depreciation is Rs. 20,000.

- Net vehicle value is Rs. 80,000.

- Depreciation expense on the Profit & Loss statement remains Rs. 10,000.

Vehicle Depreciation: Written Down Value Method

- A delivery van was purchased for Rs. 100,000 on April 1st, 2023.

- The van has a useful life of 5 years with a zero salvage value.

- Depreciation is calculated using the written down value method at 20% per year.

- After the first year:

- Depreciation expense is Rs. 20,000 (20% of Rs. 100,000).

- Accumulated depreciation is Rs. 20,000.

- Net vehicle value is Rs. 80,000.

- Note that subsequent years' depreciation will be calculated on the reducing balance.

XYZ Limited Balance Sheet (March 31st, 2024)

- Assets: Total assets are Rs. 10,000,000. Includes current assets (Rs. 3,500,000), fixed assets (Rs. 4,000,000), and intangible assets (Rs. 2,500,000). Note that accumulated depreciation on buildings, plant, and machinery is Rs.1,000,000

- Liabilities & Shareholders’ Equity: Total liabilities and shareholders' equity are Rs. 10,000,000. Includes current liabilities (Rs. 3,000,000), long-term liabilities (Rs. 3,000,000), and shareholders' equity (Rs. 4,000,000). Shareholders' equity comprises ordinary share capital, capital reserves, and reserves & surplus.

Reserves versus Provisions

- Reserves are appropriations of profit to strengthen the financial position of a business; they are shown on the liabilities side of the balance sheet.

- Unlike reserves, provisions are allowances for anticipated losses or expenses.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.